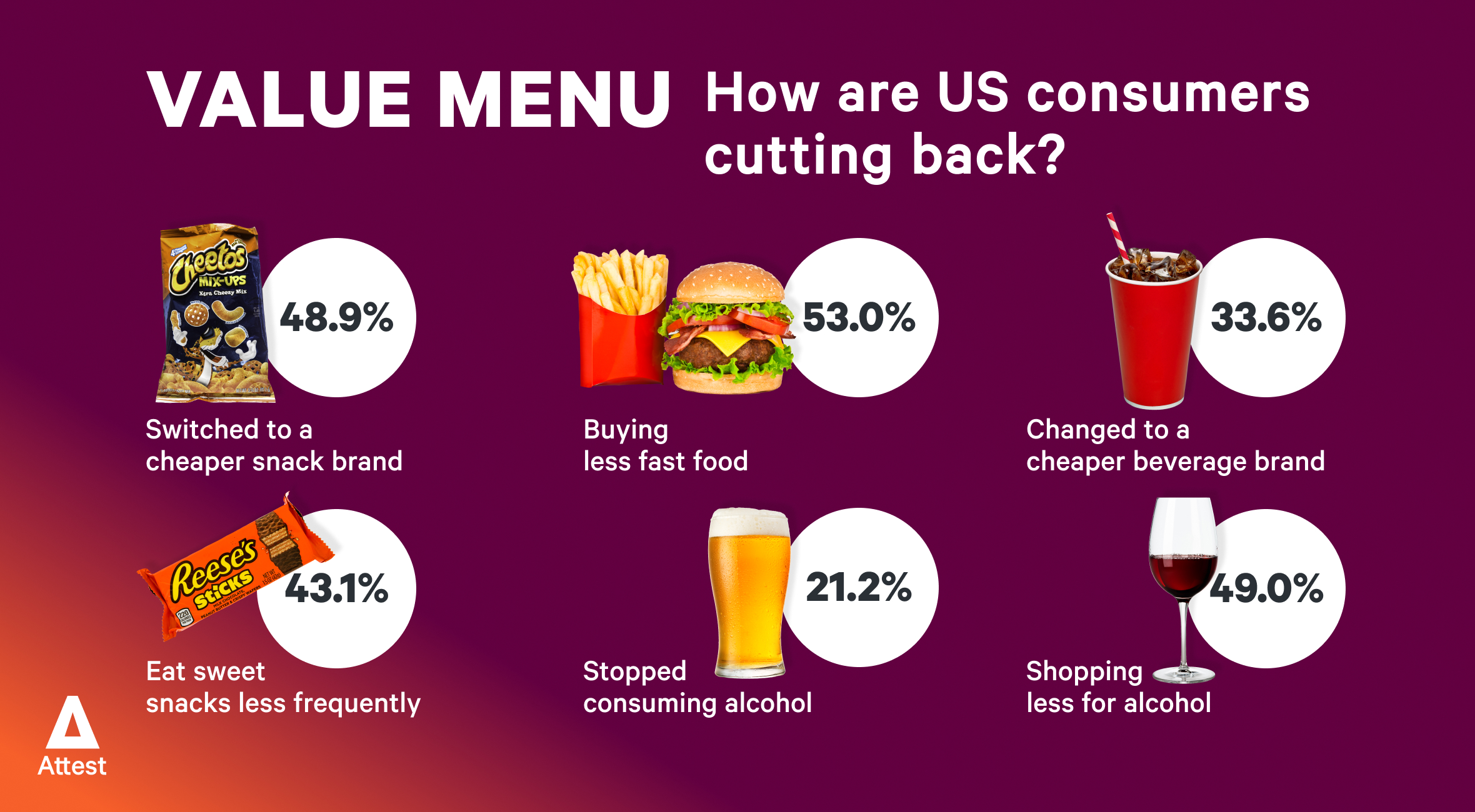

Cutbacks are on the menu for F&B brands

With consumers making sweeping changes to grocery spend, cutbacks are on the menu for every category. To learn how to navigate them, talk to us about consumer insights today.

Talk to us

What does Q4 have in store for your category?

From drinks to dessert, every course on the menu will experience challenges this quarter. To better understand the impact in different categories – as well as uncover the hidden opportunities for brands – we surveyed 2,000 working-age American consumers.

Alcohol

Alcohol is one of the hardest hit categories, with 49.0% of shoppers buying less than they did previously. Consumption has fallen dramatically; 32.6% are consuming alcohol less frequently, and 21.2% have stopped consuming it altogether because of inflation.

- 20.1% of shoppers have switched to a cheaper brand of alcohol

- Millennials are most likely to have switched

- Budweiser and Jack Daniels have the highest brand loyalty

Takeaway: Consider a social media promotion campaign.

Non-alcoholic beverages

Coca-Cola and Pepsi are the beverage brands that enjoy the most loyalty, but even these two giants aren’t safe from downtrading. Nearly 34% of consumers have already switched to a cheaper beverage brand; Gen Z are the demographic most likely to swap.

- 36.6% of shoppers are buying beverages less

- 32.2% are consuming beverages less frequently

- 24.3% are consuming smaller servings

Takeaway: Consider offering smaller drink sizes with a lower RRP.

Our retail sales team suggested there might be a shift in the coffee category; moving from foodservice back to the grocery store because of inflation. So we did a quick survey, and sure enough, there really does appear to be a shift.

Andrea Ramirez, Consumer & Customer Market Insight Manager, Torani

Savory snacks

Brand switching is highest in the savory snacks category: 48.9% of people have switched. But they’re not just trading down; 39% say they’re shopping less for snacks, too. There’s also rationing going on in the snacks category, with 28.7% of consumers eating smaller servings.

- 39.8% are consuming snacks less frequently because of inflation

- Boomers have reduced snack consumption the most

- People are least willing to give up Lays and Doritos

Takeaway: Consider individually portioned packs.

What’s the outlook for your brand? Speak to your customers today

Find out how

Fast food

Supersize me? Nope. Thanks to inflation, consumption of fast food is on the decrease. 48.4% of consumers say they are consuming it less frequently, and a further 20.3% are eating smaller servings. This trend is most pronounced for Gen Z: 30.5% visit fast food restaurants frequently, but they’re buying smaller and cheaper meals.

- 53.0% of people are buying less fast food

- 29.6% of shoppers have switched to a cheaper brand

- McDonald’s and Taco Bell have the highest brand loyalty

Takeaway: Consider introducing a dollar menu.

Sweet snacks

Nearly 37% of US shoppers have switched to a cheaper brand in the sweet snacks category, with Millennials most likely to have changed their allegiance. Of all sweet brands, Hershey’s and Reese’s Pieces have the most brand loyalty.

- 47.6% are shopping in the sweet snacks category less than before

- 43.1% are consuming sweet snacks less frequently because of inflation

- Women are most likely to have reduced their consumption

Takeaway: Consider in-store promotions.

Hungry for a deeper understanding?

✅ Learn about your brand awareness and loyalty

✅ Understand how to adapt pricing, pack sizes and distribution

✅ Know who your closest competitors are

✅ Test messaging and make your marketing dollars count

✅ Uncover hidden opportunities

Get a direct line to

inflation-squeezed consumers

Quick and easy to run surveys

Get going in minutes with our intuitive platform and get results quickly, our average survey closes in 1 day 19 hours.

High data quality

We use automated and human checks on your data, you can be sure you’re making the right business decisions.

Research guidance

You’ll be supported by a dedicated industry professional every step of the way to help you get the most from your research.

Find your target audience

Our audience lets you access 150+ million people across 59 countries, and use filters and quotas to make it as targeted as you need.