Sample size calculator

Stuck on what sample size to use for your survey? We get this question a lot. So much, in fact, that we tasked our internal team of research experts with creating a sample size calculator for your use!

Fill in the fields below to see what sample size is the right fit for your upcoming research.

Sample size

385

Ready to go? Send a 5-question survey for free and gain immediate insights today.

Run your first survey for free or book a demoThe components of the Attest Sample Size Calculator

There is an art and a science to sample size calculation. The “art” is the context of your target audience and the type of research you’re running. And the “science” is the statistical calculation based on the level of robustness and accuracy you’re seeking from your sample. That’s why our calculator looks at survey type, population size, margin of error and confidence level.

Survey Type

Some survey types, like brand tracking, require large samples to reduce the natural flux in data over time. Whereas concept and creative testing, whether it’s monadic or sequential monadic, are specific enough that smaller sample sizes often help you achieve your goal of deciding which creative concept to launch.

Population Size

If you’re looking for a representative sample of a target population, it’s important to know what the total size of that population is. We’ve pre-programmed the populations of popular survey countries, but you can also select a custom audience to calculate your sample from. For example, if you know your target is 30 year old women who do yoga, so long as you know the size of that customer population, feel free to enter your own custom population size

Margin of Error

This is the level of potential variance you’re willing to tolerate in your results. The percentages here indicate the maximum amount you’re happy for your results to differ from the actual population by. Lower margins of error require higher sample sizes.

Confidence Level

This is the percentage of confidence you can have that the results you are seeing are how the entire population would respond. We’ve preprogrammed standard confidence intervals used in market research, which is 95%. The higher the confidence level you choose, the more sure you can be that the data is representative of the population.

The maths behind the calculator

For the detail-minded and inquisitive amongst you:

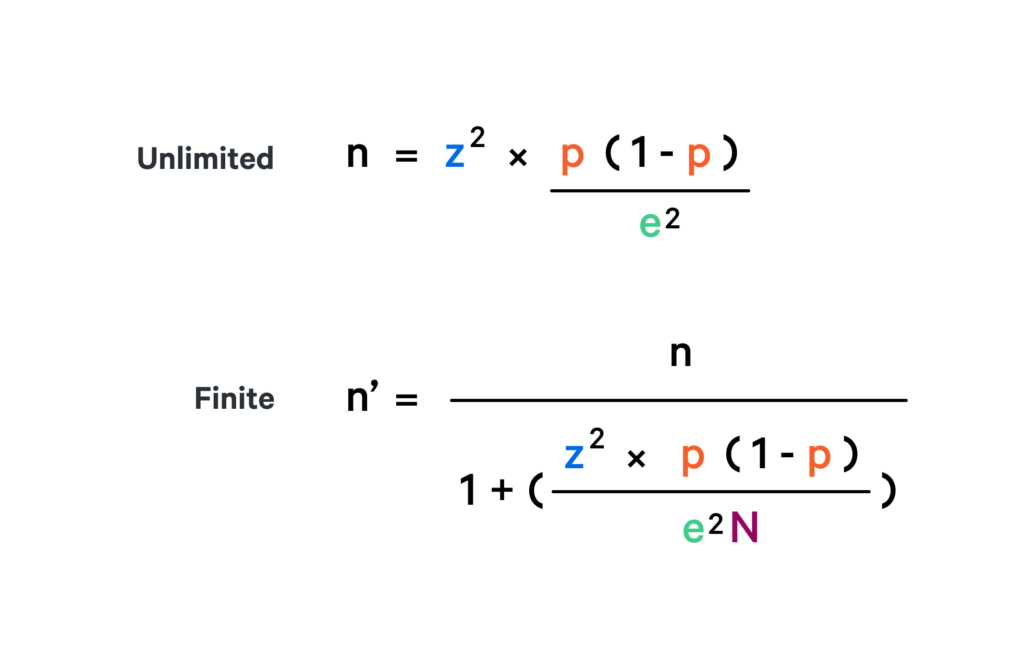

Following standard market research conventions, the formula used is as below. Note that the value in the calculator is the finite size, calculated with the equations below and rounded up to the nearest whole number which is typical for this statistical calculation.

A z-score is the number of standard deviations (e.g. the variation) the value is from the mean. To find the right z-score, you can use the below figures for inputting to the formula:

| Confidence level | Z-score |

|---|---|

| 80 | 1.28 |

| 90 | 1.65 |

| 95 | 1.96 |

| 99 | 2.58 |

These statistics form the basis of the calculator input behind the scenes, so you can easily see the output.

If you have any further questions or queries about the sample size calculator, or want a chat with the Customer Research Team on the best sample size to use, don’t hesitate to get in touch for more information.

Different Survey Types

Here are more detailed sample size considerations for typical market research purposes:

1. Brand tracking

Helps you answer: how is my brand doing?

Sample size considerations:

- Go large: We would typically recommend a minimum sample size of 1,000 (n=1,000) as brand trackers are typically based on bigger audiences to reduce the level of natural flux in data. This is why we recommend smaller margins of error in our calculator for brand tracking.

- Break it down: What subgroups are you interested in? For example, will your business want to know what target females aged 18-34 think about your brand? Make sure you account for how these might turn out given your key questions.

- Think long term: If you’re running a brand, tracker aim to keep your sample size consistent over time. Running brand trackers usually means applying some form of fresh sample each month/quarter and excluding anyone who has taken a recent previous survey which may impact the available audience size.

- Is it feasible: The more niche your audience is, the more likely you are to need a smaller, but as robust as possible, sample size.

2. Concept testing/creative testing

Helps you answer: which concept/creative should I launch and why?

Sample size considerations:

- Monadic or sequential monadic?: That is the question! Monadic testing, which is when you place each individual concept/creative in separate surveys (‘cells’), is on the whole a less biased and deeper way of understanding the performance of each concept. Sequential monadic is when multiple concepts/creatives are placed in the same cell – you might do this if you have more niche audiences which mean many tests are not possible. This method is less effective when concepts/creatives are similar, or when you are testing many (e.g. more than two) concepts in a single test. We recommend where possible to carry out monadic testing so you can get the most unbiased data on your concept/creative

- Quick tests: Traditional research agencies might only recommend a sample size of 100-150 (n=100-150). This is due to them taking much longer to fill surveys. At Attest, we recommend n=250 per cell because we can fill surveys much quicker which gives you robustness and confidence in the results you get back! How great is that?

3. Price testing

Helps you answer: what’s my ideal price point?

Sample size considerations:

- Analysis needed: The type of analysis you want to run will dictate the type of study you want to run. At Attest we have a Van Westendorp pricing template you can use here. This type of study typically needs a sample size of at least 300 (n=300) to give you confidence in the results.

- Is it feasible: Particularly where you are targeting a more niche audience, get in touch with the Customer Research Team with any queries.

4. Consumer profiling

Helps you answer: what are the attitudes and behaviours of my (potential) audience?

Sample size considerations

- Go large: You’ll want a larger sample size because a lot of the time you might not know what subgroups of interest (‘personas’) might fall out from this type of study. The aim is to have overall robustness so you can dig into the data and understand how certain groups behave or think.

- Is it feasible: Particularly where you are targeting a more niche audience, get in touch with the Customer Research Team for guidance on ideal sample sizes for your study.

We know there are a few considerations for choosing the right sample for your study. While this quick guide gives you key points to take into account, feel free to reach out to our Sales team and Research Managers to get some customised advice for your upcoming project.

We know there are a few considerations for choosing the right sample for your study. While this quick guide gives you key points to take into account, our Customer Research Team is always here to help.

Book a demo