US F&B report 2022

A trip to the supermarket is more expensive than ever. In this report, we analyze data from 2,000 working-age Americans to understand the impact that record-breaking inflation is having on grocery spend, alongside the changes in consumer behavior that brands will need to navigate in the coming months.

Get the freshest F&B insights!

Sign up to our newsletter

The findings at a glance

Chapter 1

Of all the categories affected by inflation, food has been the hardest hit. In the US, food inflation is rising at a rate of over 1% per month. This is putting very real pressure on consumers, 41.2% of whom were worried about affording food in our August Inflation Sentiment Tracker.

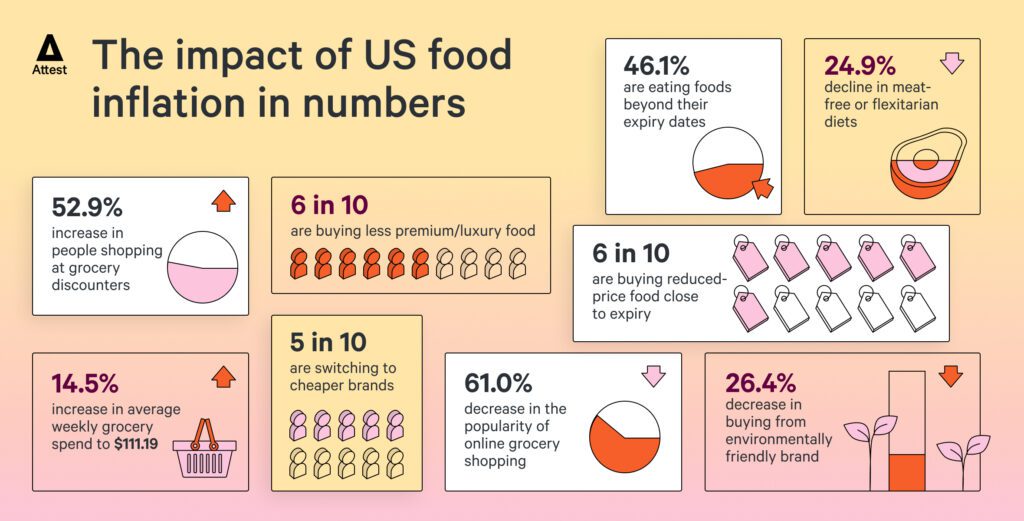

To find out how this is altering grocery shopping habits, we surveyed 2,000 nationally representative working age Americans. First off, we found that the average weekly grocery spend has increased by around $14 due to inflation. While Americans were spending an average of $97.09 per week on groceries six months ago, they’re now spending $111.19. It’s also worth noting that actual spend could be higher as the ceiling answer was ‘$200 or more’.

However, shoppers are keeping a tight rein on their spending, with 46.7% sticking to a budget when they go to the supermarket. They’re also taking other actions to bring down their grocery bills, with ramifications for F&B brands, retailers, and the health of the nation.

We’ll look at these now, but if you want to dig into the data for yourself and drill down into different demographics, you can do it in our interactive dashboard.

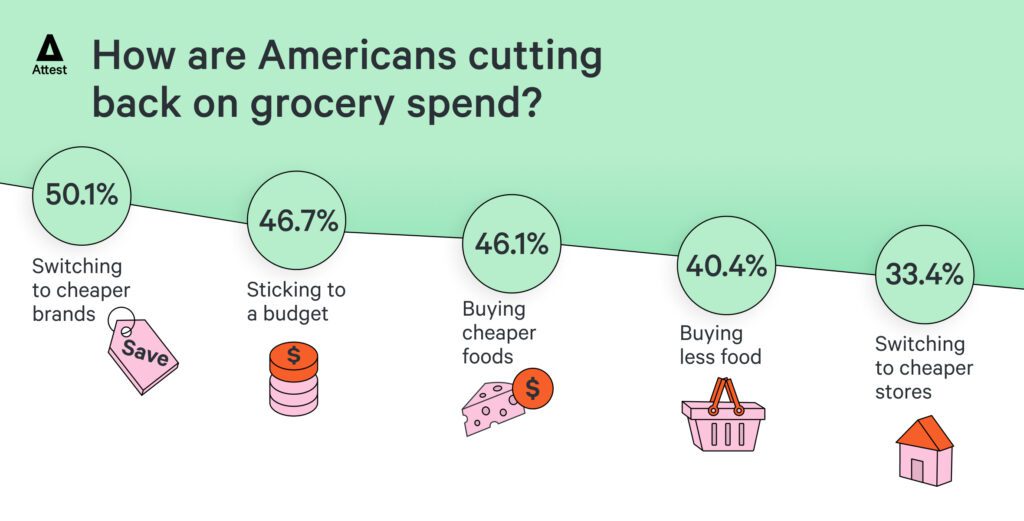

Buying cheaper, buying less

The primary behavior change? Switching to cheaper brands. It’s something 50.1% of Americans say they’re doing (and we’ll explore the categories most likely to be affected in a moment). But it’s not just like-for-like switches shoppers are making; they’re also switching to cheaper foods (46.1%). And with less healthy foods often being the cheapest, these dietary changes could be a blow for the war on obesity.

They could also put people at risk of malnutrition: 40.4% of our respondents are buying less food due to rising costs, with that figure jumping to 52% for those aged 55-64. This looks set to make a bad situation worse – in 2020, more than 38 million Americans were not getting enough food to live an active, healthy life, according to the Department of Agriculture.

Finally, we see that a third of shoppers are saving money by switching to cheaper stores. It’s the least likely action to take, which is surprising given that prices vary widely between retailers. The LA Times found that the cost of buying 15 popular grocery items could range from $48.88 to $79.65 depending on the grocery store. We’ll take a more detailed look at how inflation affects supermarket loyalty in the next chapter.

Premium foods bear the brunt

When it comes to buying less, Americans are cutting back across the board. We found that consumers have reduced their purchasing in eight out of nine categories. The hardest hit is the premium/luxury foods segment, which sees a huge 61.3% net reduction.

Alcohol also records a significant 48.9% net reduction, alongside convenience foods (36.9% net reduction). Could inflation present an unexpected health benefit? On the other hand, a net 22.1% of people are buying less fresh fruit and veg.

With their long shelf lives, canned and pantry goods record a lesser reduction at 8.3%, while a net 16.3% of people are buying less frozen food. Americans also say they are shopping less for non-food products: toiletries/cosmetics see a 29% net reduction, and cleaning/household products chalk up a 27.5% net reduction.

The only category to emerge unscathed is supermarket own-brand and value range products. This category records a small 0.4% net increase, but the overall downward trend in spending stops it from having any real time in the sun.

Chapter 2

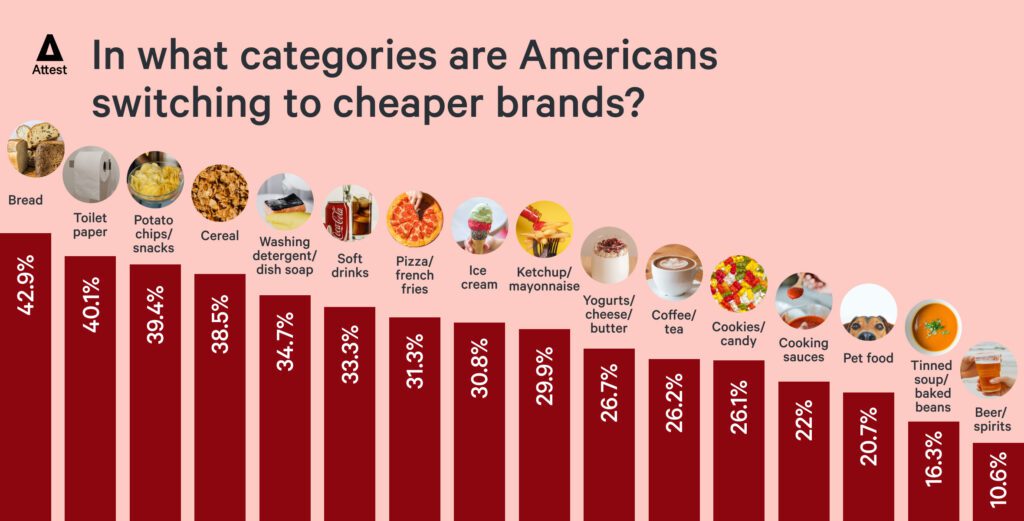

As we saw earlier, brand switching is the #1 way Americans are cutting back their grocery bills… but they’re more likely to consider switching in some categories than others.

The humble loaf is the biggest battle ground, with 42.9% of people saying they’ve switched to a cheaper brand of bread in the last six months. This is closely followed by toilet paper (40.1%), potato chips/snacks (39.4%), and cereal (38.5%).

At the other end of the scale, consumers are least likely to switch beer or spirit brands. Only 10.6% of people say they’ve started buying a cheaper brand in the last six months. Customers also have reasonably high loyalty to products like soup and baked beans (16.3% have switched).

Incidentally, brands won’t retain customers by putting up their prices. We found that US consumers would rather brands reduce product size than increase product price. A number of F&B brands have been called out for this practice – known as ‘shrinkflation’ – but our data shows Americans are marginally in favor; 55.5% voted for maintaining prices.

Beverage brands enjoy the most loyalty

A third of Americans told us they’d started buying a cheaper soft drink brand in the last six months. But despite this, respondents were most likely to name a beverage brand when asked if there was any F&B brand they intended to stay loyal to in the face of rising costs.

In fact, the top three brands named were all soft drink brands, with Coca-Cola/Coke in first place (named by 213 respondents), followed by Pepsi (named by 137), and Dr Pepper (named by 92). Other notable mentions include Kraft, which was named by 74 respondents, and Heinz, cited by 43 people (Americans still see them as separate brands despite the merger).

In a separate piece of research (covering brands in general, not just F&B brands), we found that the length of time a consumer has been buying a particular brand plays a role in their loyalty to it. So, it’s unsurprising that the brands named in our survey were all ones with considerable heritage. As inflation pushes more consumers to seek out cheaper alternatives, newer brands will have to try even harder to remain competitive.

Discount retailers take market share

We know that people are more likely to switch products than they are to swap retailers, but 33.4% of consumers have changed where they shop in the last six months. And, of course, it’s the discount grocery stores that benefited most from this shift. The number of Americans shopping at discounters like Aldi, Food 4 Less/Food Co, Grocery Outlet, Price Rite, Save A Lot, and WinCo has increased from 11.9% six months ago to 18.2% today.

Aldi is the retailer to win the most new customers, growing from 5.7% to 9.4%. At the other end of the scale, big box stores Walmart and Target have lost shoppers, although not to a massive degree. Walmart falls from 43.6% to 42%, while Target drops from 4.1% to 2.9%.

Another trend impacting retailers is the post-pandemic return to brick-and-mortar stores, and subsequent decline in online shopping. Our data shows a dramatic change in where people buy their groceries compared to last year. In January 2021, 25.6% of Americans shopped for groceries mostly or only online; today, that figure has dropped to 9.9%.

Meanwhile, the number of people who shop only in-store has almost doubled, rising from 26.4% to 50.6%. This means retailers may need to incentivize shoppers to go online, with special website-only deals and free delivery offers.

Get started with Attest

Start using consumer research to provide confidence in every decision with the right insight, at the right time.

Get started for freeChapter 3

Expiration dates lead to a lot of unnecessary food waste, with the Food Law and Policy Clinic reporting that 40% of all food waste happens at home. But the rising cost of food is causing Americans to reconsider the (often arbitrary) dates on food packaging.

Our data finds that 16.6% of people have only recently started eating foods after their expiration date. Added to the 29.5% of consumers who’ve done this for a while, this means 46.1% of Americans are now comfortable to make their own judgements about the ‘freshness’ of goods.

A further 18.1% have recently started eating opened foods beyond the advised time (in addition to the 35.2% of people who already do this). Meanwhile, 38.1% of people say they will remove ‘bad bits’ from food so it can still be eaten. This includes 15% who’ve made this change recently, suggesting that inflation is leading people to reassess what’s safe to eat.

Shoppers are also saving money by buying reduced price food that’s close to expiring; 33.5% have done this for a while, and a further 23.9% have just started. But while they might be happy to buy close-to-expiry products at a discount, when consumers are paying full price, they look for as long an expiry date as possible. A huge 88.6% of people say they check expiry dates prior to purchase to ensure a long life (including 20.1% who started doing this recently). This suggests removing expiration dates would help retailers reduce wastage of unsold products.

Dry foods are most trusted

The federal government doesn’t require dates on any food except baby formula, but they are often mandated at a state level – with massive variance. For example, in Idaho, milk can be sold for 21 days after it’s pasteurized, while in Montana, it’s just 12 days.

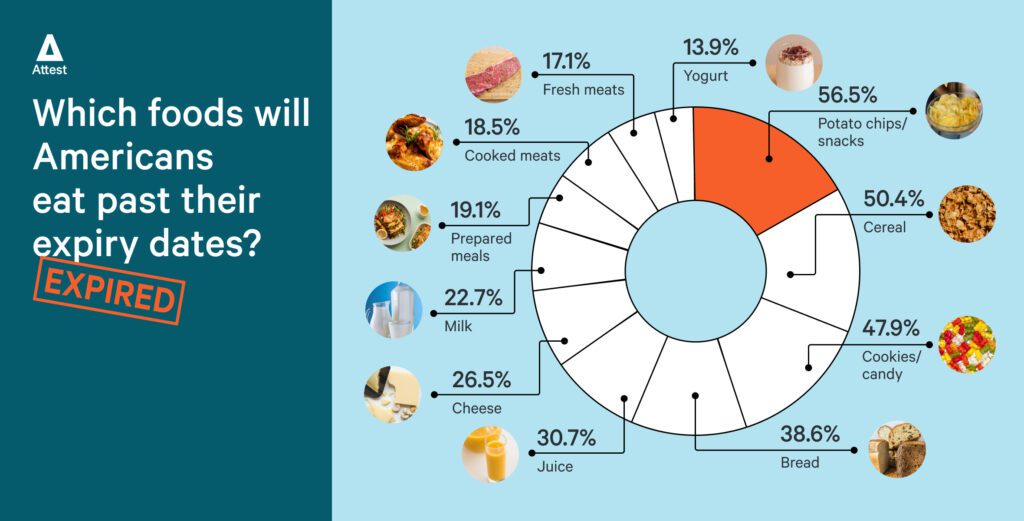

There’s little science behind expiration dates, yet our data shows we instinctively feel some foods are safer to eat beyond their expiration dates than others. We showed respondents a list of 11 foods and asked them which they would eat beyond their expiry date if they looked, smelled and tasted fine.

The food most likely to be eaten is potato chips/snacks (56.5%) followed by cereal (50.4%) and cookies/candy (47.9%). More than a third (38.6%) said they would eat bread after it had expired but only 22.7% would consume milk past its expiration date. Least likely to be eaten after expiry are yogurt (13.9%) and fresh meat (17.1%).

We’re still wasting food

Despite the belt-tightening happening across America, we’re still letting food go to waste. Our data shows that Americans throw away an average of three unconsumed/partially consumed groceries every week.

Younger consumers are the worst culprits for food waste, while those in the 55-64 age range are especially good at minimizing waste. Nearly 41% of people in this older age group say they throw away only one piece of edible waste per week (or none at all), in comparison to 20.5% of those aged 18-24.

Interestingly, Gen Z are significantly more likely than other demographics to value expiration dates: 72.6% don’t eat food after it has expired, 58.1% won’t eat opened food beyond the advised time, and 59.8% won’t buy food that’s close to expiry.

Perhaps we can conclude that those with more life experience, who understand how to identify what is and what isn’t safe to eat, are less likely to rely on expiration dates and subsequently waste less food.

Chapter 4

Clearly, reduced food waste is a great thing, but apart from that, how does inflation impact the environment? We wanted to find out whether consumers care less about ‘being green’ when they’re trying to save money. To get a handle on this, we benchmarked today’s landscape against Attest data from January 2021.

First, we asked respondents to rank six factors according to how much they’re influenced by them when choosing food or drink brands. While we see that sustainability/ethics remains in fifth place, just below convenience and above packaging attractiveness/advertising, we do see an interesting shift in priorities.

Quality/taste was ranked first in 2021, whereas this year, it has been replaced by price. The cost of food is now the most important factor influencing a consumer’s purchase, while quality comes second. This in itself is a clear message that times have changed, and, while consumers support environmental initiatives, they’re unlikely to pay more for them.

Buying from green brands is less important

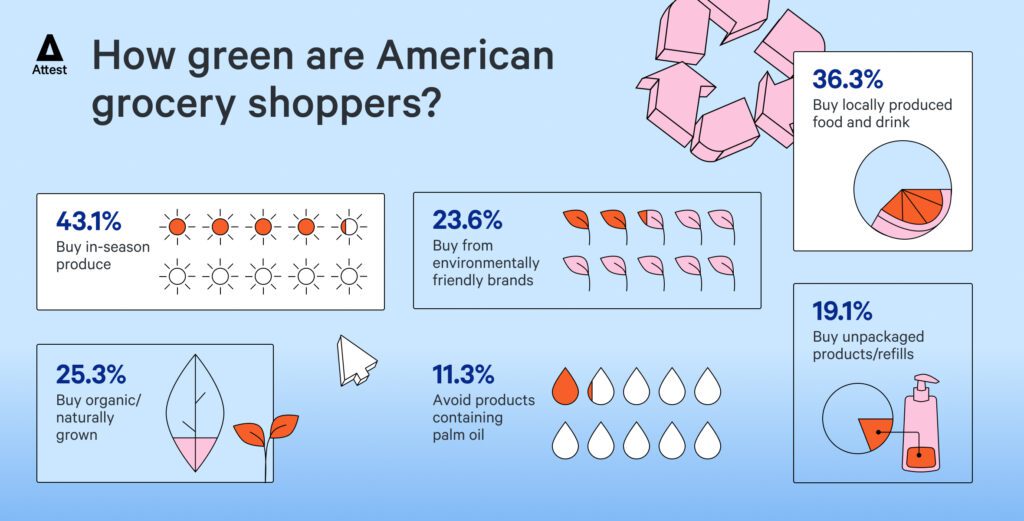

We find further evidence that Americans are becoming less environmentally-conscious when we compare data on their buying behaviors. Significantly fewer are trying to buy from environmentally-friendly brands when they go grocery shopping. While almost a third aimed to do this in 2021, that figure has fallen to 23.6%.

Organic food purchasing has also declined – down from 30% to 25.3% – which is no surprise, really, given organic tends to cost a premium. Cost is clearly a factor here, with consumers also less likely to try to buy locally produced products (down from 43.7% to 36.3%), which can also be more expensive than mass-produced commodity food.

The upside, however, is that shoppers are slightly more likely to buy seasonal products (up from 41% to 43.1%). Buying domestically grown, seasonal foods will always be cheaper than products imported from other countries. This is a strong message for retailers to push.

Veganism is losing traction

When consumers are strapped for cash, they can’t afford to be idealistic. So, it figures that they might swap an organic carrot for a cheaper industrially-farmed one. But what perhaps doesn’t make sense is the increased meat consumption our data uncovers. Meat is expensive, yet we see a decline in plant-based diets and a 9.1 percentage point increase in Americans describing themselves as ‘meateaters’ (rising from 63.5% in 2021 to 72.6% in 2022).

Veganism – which was always minimal in the US – is now minuscule; only 1.2% of people describe themselves as vegans (previously 4.3%). Meanwhile, the number of vegetarians has fallen from 6% to 4.2%, and pescetarians from 4.2% to 2.1%. This means that only 7.5% of Americans classify themselves as non-meat eaters.

The popularity of flexitarianism – where people mostly eat meat-free meals – has also gone down, from 22% to 19.9%. At the same time, retail sales data shows the market for plant-based food is now worth $7 billion in the US (up from $5.5bn in 2019). Since there hasn’t been huge growth in people adopting meat-free diets, we can only conclude that this boom is down to more meat-eating Americans integrating plant-based foods into their diets. Either way, it seems rising costs aren’t enough to wean people off meat.