US F&B Digest – Wellness foods issue

Welcome to the latest edition of our F&B Digest, this time focused on functional foods and wellness products. We’ve digested data from 2,000 US consumers to discover trends and opportunities in this growing sector.

What’s inside

- Is the F&B industry doing enough to help shoppers make healthy choices?

- The ‘magic’ ingredients that can boost profits for F&B brands

- Better immune health is top of US consumers’ shopping list

- The core steps to success in wellness foods marketing

- How OTO discovered CBD’s most valuable consumers

- What consumers want from CBD products

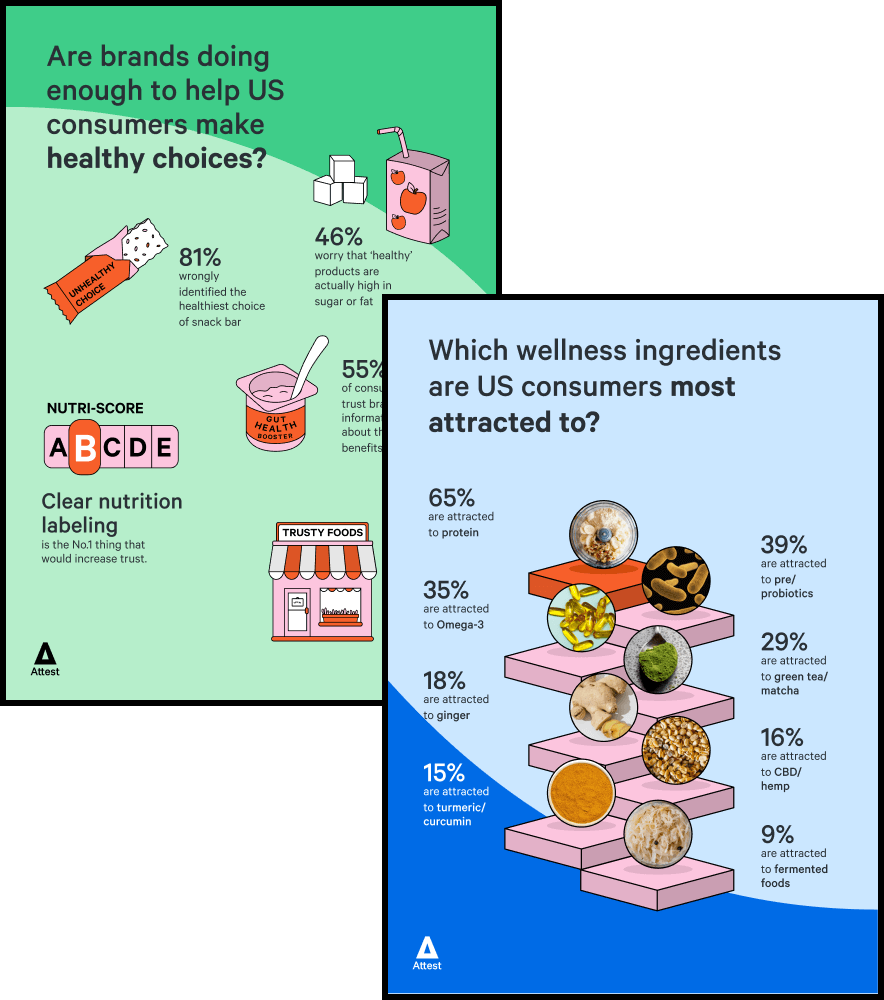

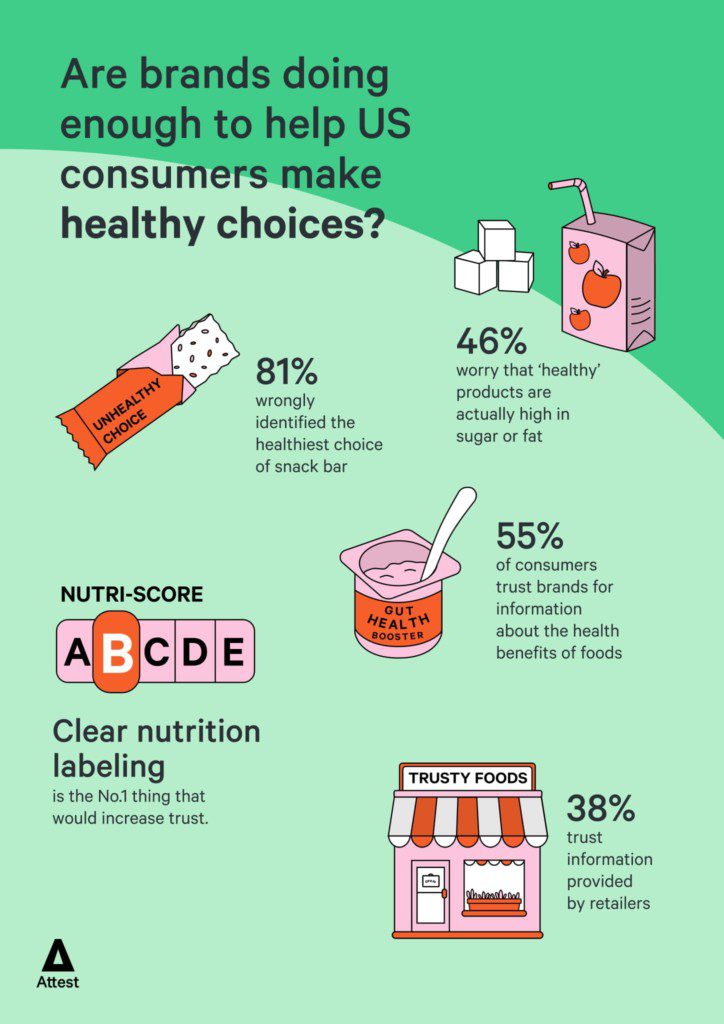

Consumers are still confused about what’s healthy, especially when it comes to food and drink products marketed as containing wellness ingredients.

A new bill calling for standardized front-of-pack nutrition labeling is under consideration by the US government – but how much difficulty do Americans have identifying healthy food?

The legislation, called the Food Labeling Modernization Act of 2021, proposes an easily recognizable symbol that rates foods on healthiness, such as a traffic light system or a star rating.

The current nutrition-fact label that can be found on the back of packaging has been in use since 1990, but its effectiveness is questionable given that roughly two out of three US adults are overweight or obese (Harvard). How many people actually have time to study how many calories, grams of sugar, or milligrams of sodium are contained within one serving?

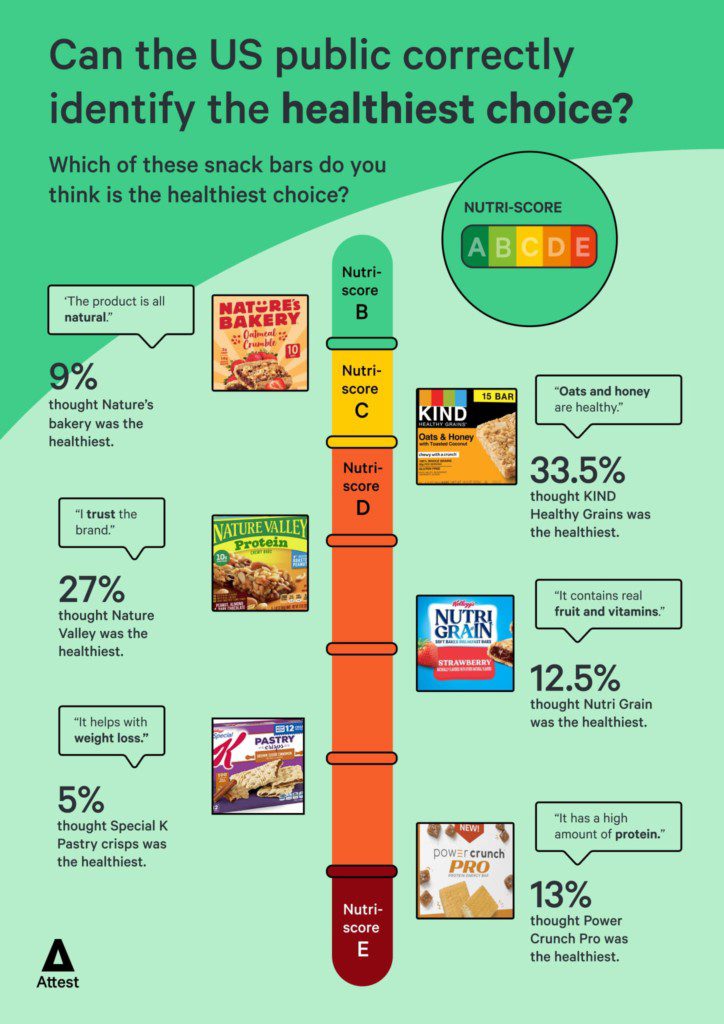

To make things easier for shoppers, the World Health Organization recommends the introduction of the Nutri-Score, a color-coding system that shows at-a-glance if a product is a healthy or unhealthy choice. Without this, most consumers are relying on other visual clues on the packaging – but how reliable are they?

To put this to the test, we showed six varieties of snack bars to 2,000 US consumers and asked them to tell us which was the healthiest choice (see the data here). We then asked them why they made that choice. These answers were particularly illuminating in showing how F&B brands mislead consumers – whether it’s intentional or not.

We used the Nutri-Score system to gauge the healthiness of the snack bars, inputting the nutritional information into this Nutri-Score calculator. It’s worth noting that most of the snack bars we tested got a score D (amber color), denoting that it’s a less healthy option. Only one snack bar had a Nutri-Score of B (green color).

Clear consumer confusion

Only 9% of our respondents were able to identify the snack bar with a Nutri-Score of B. Thanks to their low saturated fat and high fiber content, Nature’s Bakery Oatmeal Crumble Strawberry bars are the healthiest choice.

The largest single percentage of people (33.5%) selected Kind Oats and Honey Healthy Grains bars, which are not a bad choice, with a Nutri-Score of C. Behind this was Nature Valley Peanut, Almond & Dark Chocolate Chewy Bars (27%). These get a D rating due to a higher saturated fat content.

Third-most likely to be thought the healthiest are Power Crunch Pro Salted Caramel Protein Energy Bar, but they’re actually the worst of the bunch. With a saturated fat content that represents 60% of the recommended daily value (in a 58g bar), they chalked up a Nurti-Score of E. Yet with the protein claim, they were able to convince 13% of consumers they were the healthiest choice.

Only 9% of Americans could identify the healthiest cereal bar.

Other health-related messaging that swayed people’s choices were phrases like “whole grains”, “made with real fruit”, “naturally flavored” and “100 calories”. But some masked a high sugar content; Nutri-Grain Soft Baked Strawberry Breakfast Bars, for example, were thought to be the healthiest choice by 12.5% of respondents, but contain 24% of the recommended daily sugar intake in a single bar.

Brands can’t keep burying their heads

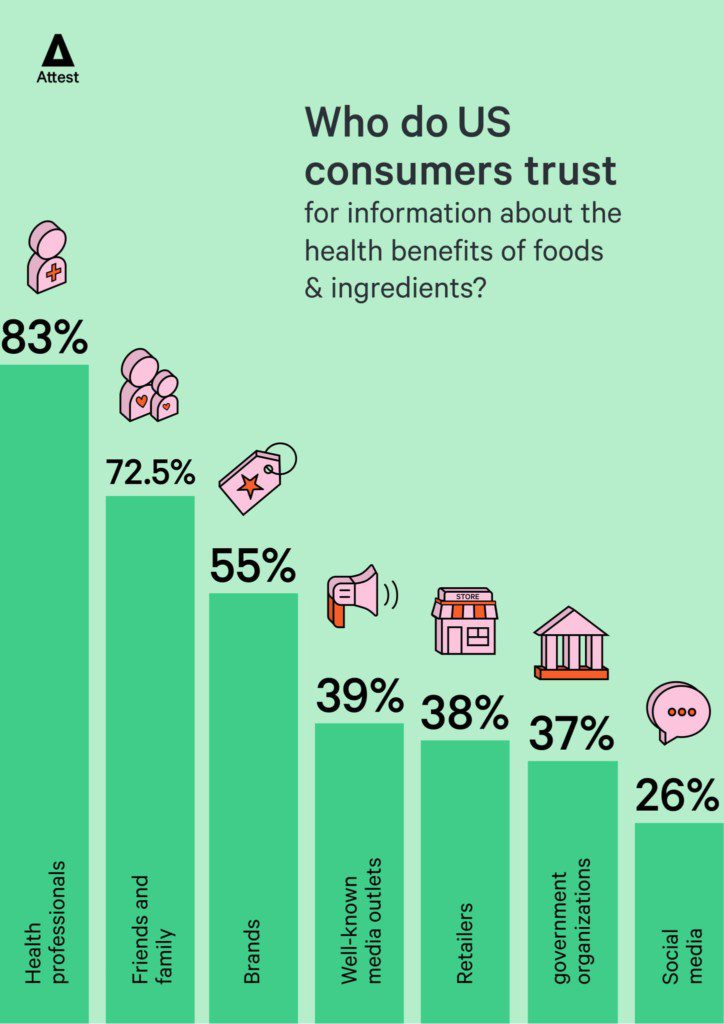

Our data shows that consumers look to brands to provide information about the health benefits of particular foods and ingredients; 55% of people trust them, which puts brands ahead of government organizations (who 37% trust for information). It means brands have a considerable duty of care, which should extend to clear nutritional labeling.

The beauty of color-coded nutrition labels for the consumer is their simplicity, but it’s this that can also deter brands from wanting to use them. They may argue that the nutritional benefits of nuts, for example, outweigh the negatives of their high fat content. Yet the arbitrary nature of the algorithms may result in a nut-based product receiving a poor score.

55% of consumers trust brands for information about the health benefits of foods.

It’s a valid argument but the fact is that America is facing an obesity crisis. Brands need to play their part in fighting it, even if that means reduced sales for products they can’t, or don’t want to, reformulate. As we see from the Nutri-Scores of this small sample of snack bars, there are too many products on supermarket shelves that appear healthy but might actually contribute to weight gain. And it’s something that is of real concern to consumers.

Just under half of our respondents (46%) stated that their top concern when shopping for food and drink products marketed as healthy is that they actually have high sugar, salt or fat content. But encouragingly for brands confident in the nutritional value of their products, clearly displaying it can help them win more sales; 51% of shoppers say this is the number one factor that would increase their trust.

Get started with Attest

Start using consumer research to provide confidence in every decision with the right insight, at the right time.

Get started for free

US consumers show strong demand for functional foods that promise to improve their health.

F&B brands that include wellness ingredients in their products can achieve higher RRPs, with US shoppers increasingly attracted to these ingredients – and willing to pay more for them.

Our latest F&B consumer data unpicks what ingredients enjoy the biggest health halos, the benefits shoppers believe those ingredients offer, and how much of a premium they’re prepared to pay.

Americans rank eating so-called ‘functional foods’ as the second-most likely factor to impact on their health (behind eating less sugar, salt and fat, and ahead of eating more fruits and vegetables). And more than half of US consumers (60%) say they are consciously looking out for food and drink products to support their overall health when they shop.

Creating products for this market will be a growth opportunity in 2022 and beyond, but where should brands start when it comes to NPD?

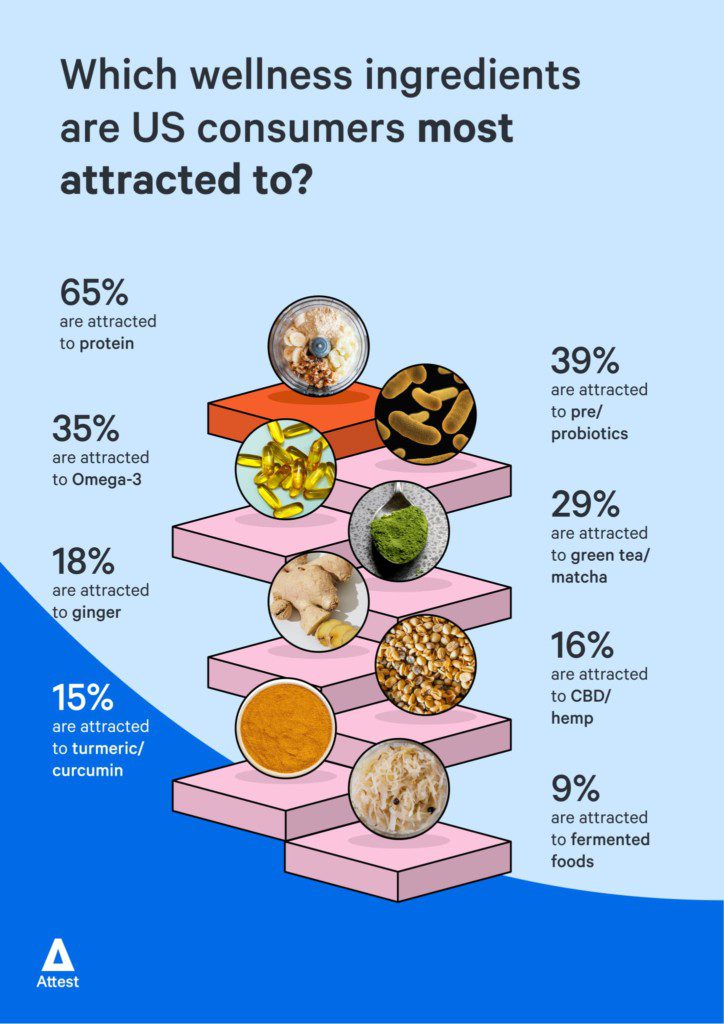

Ingredients with the most pulling power

We showed a list of wellness ingredients to 2,000 nationally representative US consumers and asked them to tell us the top three they were most attracted to. The clear winner was protein, chosen by 65% of respondents. It’s especially popular with people aged below 40, 68% of whom say they’re attracted to food and drink products containing it.

When we asked what health benefits respondents associate with protein, they were most likely to say ‘better overall well-being and energy’ (55%). It was also recognized for the role it can play in weight loss (28%).

Behind protein, the most desirable ingredient is pre/probiotics (39%), with Millennials (aged 26-40) showing the most interest overall (43%). People believe pre/probiotics support digestive health (60%) and immune health 37%.

The third-most attractive wellness ingredient is Omega-3; 35% of people selected it, but it’s the older demographic groups who desire it most (40% of Boomers versus 26% of Gen Z). Americans associate Omega-3 with heart health (45%) and brain health (35%).

68% of people under 40 are attracted to food and drink containing added protein.

The data also suggests opportunities for targeting different demographics with certain wellness ingredients. Boomers, for example, over-index for interest in turmeric/curcumin (18%). They associate this ingredient with immune health, as well as relief from pain.

Meanwhile, Gen Z (aged 18-25) show the most interest in green tea/matcha (38%), which is associated with digestive health and relief from stress, as well as fermented foods like kombucha and tempeh (13.5%).

Gen Z and Millennials both show elevated interest in food and drink products containing CBD/hemp (20% and 21% are attracted to them respectively). CBD is ascribed a wide variety of health benefits by respondents, including relief from pain, stress, anxiety, depression, and better sleep.

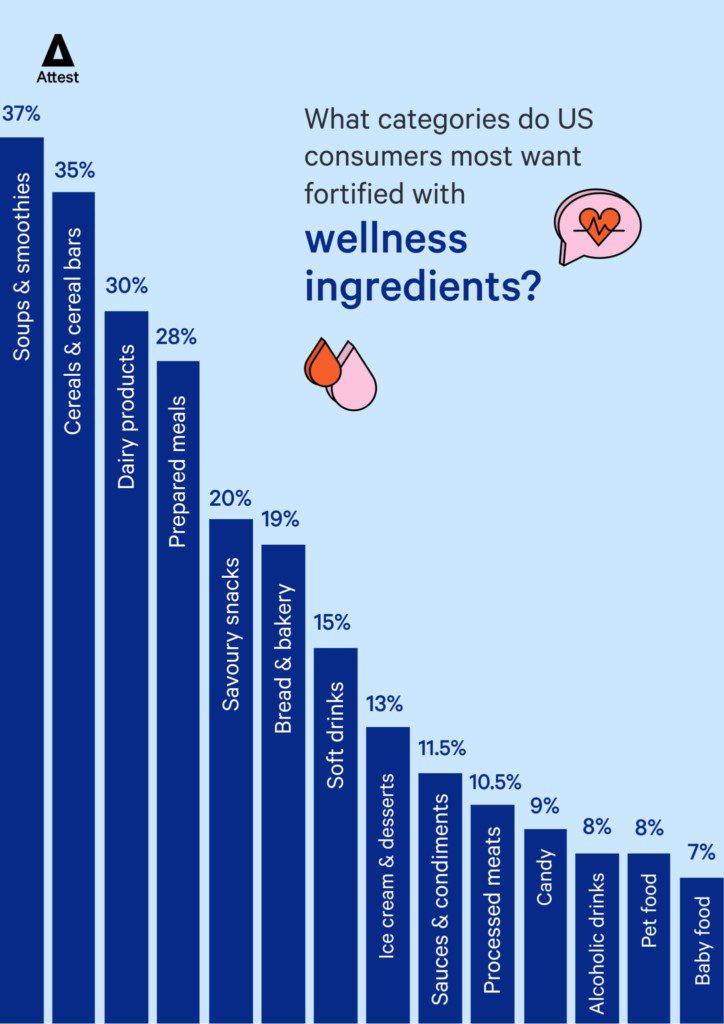

Categories with the most potential

Now we know what wellness ingredients people are most attracted to, let’s find out which products they most want to see them in. We asked respondents to choose the top three food and drink products they would like fortified with functional ingredients.

First choice, chosen by 37% of respondents, was soups & smoothies – universally popular across the demographics. Cereals & cereal bars are also popular choices for fortification; 35% want health-boosting ingredients added. Boomers especially want wellness ingredients in this category. The third-most popular category is dairy products (30%), with Gen X (aged 41-55) over-indexing for this selection.

Gen Z are attracted to wellness ingredients in savoury snacks and processed meats more so than the other demographics, while the soft drinks category shows the most potential among Millennials.

28% of people will pay a significant premium for wellness ingredients.

How much do brands stand to benefit from expanding or reformulating their range to incorporate these in-demand ingredients? Our data shows that people are prepared to pay a premium for wellness ingredients; 47% will pay a ‘little’ bit more than for a standard product, while 19% will pay a ‘moderate’ amount more, and 9% a ‘lot’.

But Millennials are the most willing to fork out for functional foods, with a significant 37% claiming they’d pay a moderate amount/a lot more. This represents a rich vein for brands to tap into by providing innovative products that satisfy consumers’ desire for better health and well-being.

Expert support at every step

Want access to quality insights without the fuss? Our team of experts is here to help get the most out of your research and save time at every step of the journey.

Book a demo

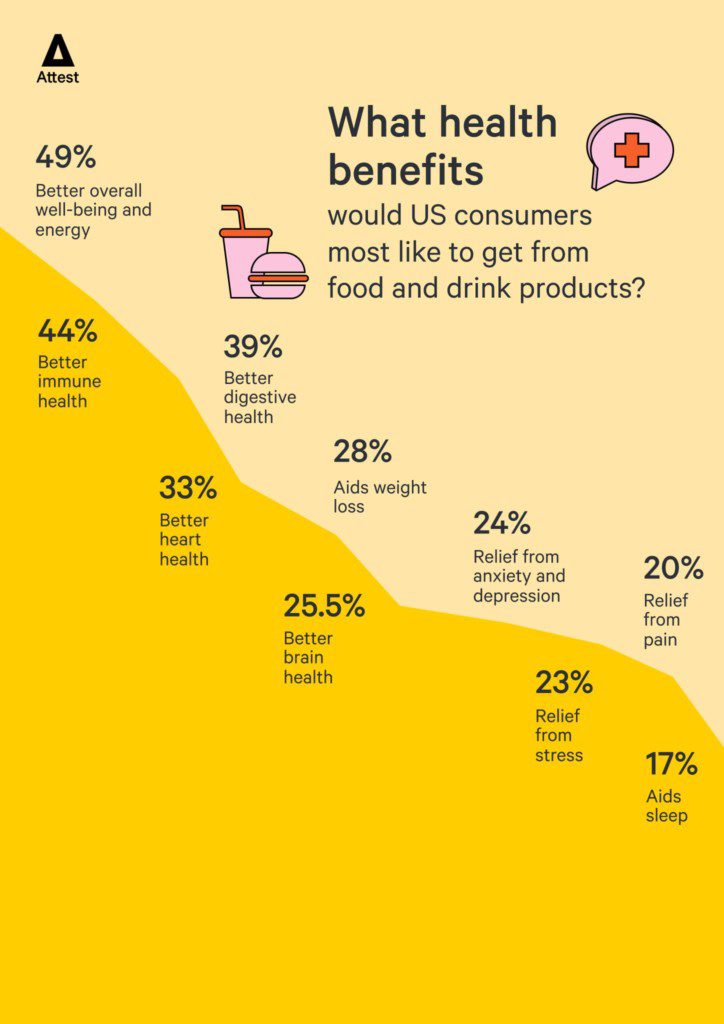

The pandemic has changed what we want from our diets, with shoppers looking to foods and supplements to protect them from illness.

Americans are aiming to eat their way to better physical and mental health in 2022, with a particular spike in interest around immunity and gut health.

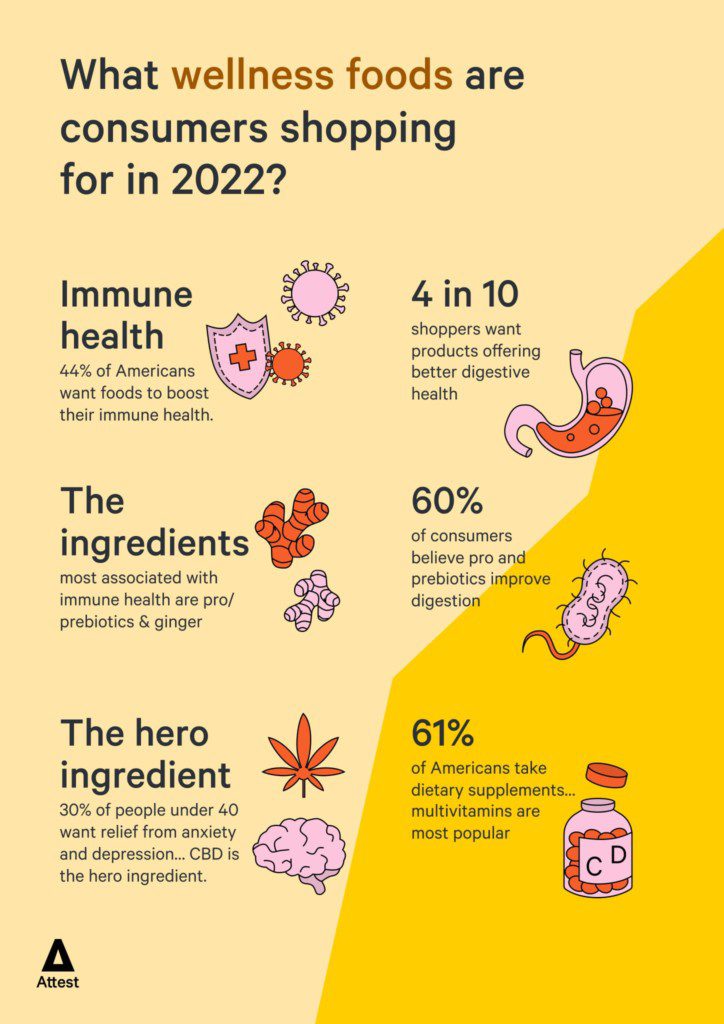

As we face a future of ‘learning to live with coronavirus’, it’s clear that US consumers want to take steps to boost their natural immunity. Our data from 2,000 working age consumers shows that ‘better immune health’ is one of the top health benefits respondents would like to get from food and drink products.

While almost half of Americans (49%) want food to offer them better overall health and well-being, 44% of people would like it if products supported their immune system. A further 39% want food and drink to provide better digestive health (with gut health also being closely linked to immunity).

People aged 56-66 (Boomers) over-index for desiring immune-supporting products, yet it’s Millennials (aged 26-40) who are most likely to say they are actively looking for them when out shopping (39%). Pro and prebiotics are the ingredients consumers most associate with both immune health (37%) and digestive health (60%). They also believe in the power of ginger to support both functions.

Mental health is front of mind for Gen Z and Millennials

The pandemic hasn’t just taken a toll on our health physically, it has affected us mentally too. We see the impact of this in the number of people who say they’re consciously on the look out for food and drink to support their mental health; 22% of Americans in general, rising to 30% of people aged under 40.

Around a third of people in this demographic say they would like food and beverage products to provide relief from anxiety and depression, while only slightly fewer are looking for relief from stress.

42% of consumers associate CDB with relief from anxiety and depression.

CBD/hemp is seen as a hero ingredient when it comes to mental well-being; 42% of consumers associate it with relief from anxiety and depression, 45% think it provides relief from stress, and 33% believe it aids sleep.

Another ingredient believed to offer mental health benefits is green tea/matcha, with 29% of people thinking it helps with stress, and 21% thinking it can help with anxiety and depression.

Supplements play a vital role in Americans’ diets

The debate around supplements and whether they’re necessary has been going on for years but it looks like the pandemic could have reinforced Americans’ belief in bottled vitamins. We see that more than half of US consumers (61%) now take dietary supplements.

Multivitamins or daily vitamins are the most popular type of supplement, followed by vitamins D and C, both of which play important roles in defending the body against infection. When it comes to supplements and wellness foods, respondents say they’re most attracted to ingredient combinations that support better general health (41%), while 24% prefer ingredient combinations for specific health benefits, such as heart health or brain health.

41% of consumers want ingredient combinations that support overall health.

However, we also see a burgeoning trend towards personalization in this sector, with 23% of Americans most attracted to ingredient combinations personalized to their individual needs. Giving consumers the opportunity to customize their products could create a compelling value proposition, particularly in the direct-to-consumer space.

Data reveals what factors help US shoppers to have trust in new wellness products and brands.

Overcoming consumer mistrust is vital for F&B brands looking to take a bite out of the lucrative wellness foods sector.

Our data from 2,000 nationally representative US consumers shows that shoppers have a variety of concerns when shopping for food and drink products containing health-boosting ingredients – but the data also offers solutions for how these misgivings can be overcome.

Pricing is most pivotal of all, with 52% of people worried that food and drink products containing special ingredients are overpriced. Although 75% of consumers say they’re prepared to pay a premium for wellness foods, it’s important the product delivers value for money. This means that brands must not only work hard to achieve a competitive price but also on messaging around value.

Money off coupons are also a valuable tool for persuading shoppers to try a wellness product for the first time. For 20% of consumers, being able to try a product at a discounted price is one of the top three things that would increase their trust. Of all the demographics, Millennials (aged 26-40), in particular, can be convinced with coupons.

Letting people sample the goods

In-store sampling could be potentially more important in the wellness foods space than in others, because another big consumer concern is that they might not like the taste. Over 42% of respondents worry the flavor will not be to their liking, rising to 46% of Gen X (aged 41-55).

Giving shoppers a chance to try products before they buy is something that 26% of consumers would greatly appreciate, especially those in the younger demographics. However, it’s not just about taste; 46% of Americans worry that products marketed as good for their health are actually high in sugar, salt and saturated fat. It’s something that worries Boomers especially.

42% of Americans worry they won’t like the taste of wellness foods and drinks.

Other concerns that marketers need to tackle center around the effectiveness of the wellness ingredients themselves. Four in ten people say they’re concerned that the health benefits of the ingredients haven’t been scientifically-proven, while 32% worry that the amount of active ingredients included isn’t actually enough to make a difference.

Interestingly, the older you become, the more likely you are to have these concerns about effectiveness. On the other hand, it’s the younger demographics who are most worried about the possibility of wellness ingredients causing harm to their health; a third of Gen Z (aged 18-25) have this concern.

Labeling central to building trust

The packaging of wellness products is one area brands should focus on if they want to increase consumers’ likeness to purchase. Information provided on-pack for these types of products is under more scrutiny, so transparency is key for building trust.

According to our respondents, putting clear nutrition labeling on-pack is the number one thing that brands can do to increase trust in their products (47%). Boomers are the most likely to want easy-to-understand nutritional information, but the demand is universal across the age groups.

Americans rank a nutrition label that indicates a product is good for their health as the factor most likely to influence them to select a food or drink product. This is ahead of details about the wellness ingredients included in the product or on-pack health claims.

47% of consumers would have more trust in wellness foods with clear nutrition labeling.

Other information consumers want to see on the front of wellness foods packaging is the amount of active ingredients; this would significantly increase trust for 29% of people. Using and promoting natural ingredients in products would have an even more persuasive effect, with 48% of respondents calling for this. And Gen Z, especially, would like wellness foods to be produced organically (36%).

Endorsements and certifications are also extremely valuable for the successful marketing of wellness foods. More than a third of people would be convinced by an endorsement from a health professional or organization (they represent the most trusted source of information about health-boosting foods). Meanwhile, 24% of consumers say seeing certification logos on-pack would significantly boost their trust.

How OTO discovered CBD’s most valuable consumers

Consumer profiling revealed that it’s menopausal women who are prepared to pay a premium for luxury CBD products.

Think you know who your target audience is? You might want to think again, because your most valuable customers are not always the most obvious ones – as OTO, a direct-to-consumer CBD brand, found out.

According to Marketing Director Holly Rix, OTO had built their marketing strategy around young people. This was the demographic most open to products containing CBD, and most aware of the benefits CBD can offer. But OTO had begun to question if they were the consumers actually most in need of the products.

To find out, they worked with Attest to explore consumers’ awareness of CBD in the UK, as well as their attitudes to the category.

“We wanted to find out who knew about CBD, whether they were using it, whether they were interested in it or not,” explains Rix. “And if they weren’t, what the barriers were to them understanding it and wanting to buy into the category. Then, if they were open to it, what was important to them when they were looking for products.

“We also wanted to understand the awareness of our brand and the purchase behaviour. For example, the purchase intent and claimed usage of our brand versus competitors.”

The results confirmed the niggling feeling Rix and her team had been having – they weren’t going after the right people. Younger people might be more open to CBD but they simply don’t have as many ailments as their older counterparts – or as much disposable income.

“We’re a luxury brand in the category, so we’ve been targeting too young basically. This audience are lovely and open, but really don’t care about or need CBD and can’t afford our products, so we weren’t seeing any conversions,” she says.

We’re a luxury brand in the category, so we’ve been targeting too young basically.

Holly Rix, Marketing Director, OTO

Zoning in on menopausal women

OTO identified that middle-aged consumers represented the sweet spot between openness to (and need for) CDB, and ability to afford their products. They shifted their target audience accordingly.

“Our primary target now is about 40 years old. They’re at a point in their lives where they are stressed and/or struggling to sleep. An important and engaged sub segment for us are menopausal women because they are hyper engaged with finding solutions to their symptoms, which CBD can help with. For example, not being able to sleep, low mood, brain fog and hormonal skin.”

Rix says OTO’s work with Attest also highlighted the primary reasons that people buy CBD, with help sleeping being the number one reason. This knowledge has empowered them to confidently focus on sleep as the main way to recruit consumers.

“We’ve stopped doing all of the stuff we were doing around skincare, which just wasn’t working and was targeted too young,” she says. “And we are focusing primarily on associating our brand with helping people sleep.”

The change in strategy has led to OTO working with different influencers and curating new product selections.

“We’re now using influencers with a much older following. We worked with Lisa Snowden who is famous for talking about HRT and the menopause, and she talked about not being able to sleep. That’s worked really well.”

Rix adds: “We have also made a menopause collection, which is a collection of existing products that we put together. And then we did a survey through Attest where we sent products out to 100 menopausal women that signed up and they then rated the impact of those products on their symptoms.”

We were using beauty influencers to talk about skincare and it just wasn’t having any impact.

Capturing the C-suite in Japan

Following the impactful results of the UK survey, OTO wanted to dig into customer profiles in other markets. The brand currently has a presence in Japan and Hong Kong.

“We rolled out effectively the same survey in Japan, which has got different results in line with that market,” says Rix. “It’s more conservative, the number of people that aren’t aware of CBD is higher and the openness to trying it is lower. But we’re still seeing that age is a factor, not in terms of old age but in terms of career seniority and education level. So at C-suite and director level all of a sudden you see the awareness and the engagement completely change and also, obviously, income level.”

Rix says OTO’s enhanced knowledge of their target customers has not only improved their marketing but also their media planning. It has enabled them to build out a tighter audience profile, making sure their ads are targeted at people over a certain age and income threshold whilst maintaining to their attitudinal segmentation that still very much holds true.

And the new direction of OTO’s marketing is already translating into better financial performance for the brand.

“Our run rate after doing some work with Pandora Sykes, for example, in December is much higher. It was about how our Sleep Drops have enabled her to sleep better (she’s pretty vocal about being an insomniac), whereas before we’ve been using beauty influencers to talk about skincare and it just wasn’t cutting through that cluttered market.”

OTO are now preparing to run a major PR campaign and, afterwards, they plan to repeat the brand awareness survey to see if they’ve been successful in shifting their awareness.

Attest’s CEO and resident scientist Jeremy King investigates… CBD products

Words by Jeremy King

There’s been a noticeable increase of CBD products on the shelves in recent years. I’m curious to learn why people do or don’t buy CBD products.

To find out, we’ve run identical surveys in the US and the UK to get to the core of what consumers think about these products, and about what might compel them to purchase in the future. Each market is at a different stage of CBD evolution and maturity, and it’s always fascinating to understand what matters most in the minds of real consumers.

I’ll summarise my findings below, but make sure to check out our public dashboards where you can see the data in full, drill down into demographics and run statistical significance tests to interrogate the numbers.

Little difference in awareness

In a first surprise, we’ve found that there’s only a small difference in awareness between the US and UK markets. In the US, 83% of respondents know a little or a lot about CBD products, compared to 79% in the UK. Personally, I’m surprised to see awareness so high in the UK, as subjectively I thought that the US was even further ahead on CBD market development… but awareness is still just the top of the funnel.

Another surprise emerged, this time between the genders in the UK. For whatever reason, I’d expected males to be more aware of CBD products, but we actually find that it’s females who are more in the know, and by quite a margin – 87% of females say they know a little or a lot, compared to just 70% of males.

Disparity in usage across the pond

Where we start to see some juicy differences between the US and UK markets is when we drill into CBD product usage. Overall, 57% of Americans have tried the products, while just 31% of Brits said the same.

There also appear to be some significant transatlantic generational differences. When we filter to see how under 30s responded, we see that there’s a negligible difference in usage for this group in the US, when you compare with the overall results. But in the UK the split between the have-trieds and the haven’t-trieds narrows significantly for under 30s:

- Under 30s in the UK: 49% have tried CBD products

- 30 and overs in the UK: 24.5% have tried CBD products

I find this generational difference fascinating, particularly when you see that there’s no such difference in the US.

We asked those who haven’t tried CBD products why that was, and we find no explanation as to why there’s such a stark British generational divide that’s absent in the US. Among all UK age groups, the standout reason is that they don’t know enough about CBD products and their effects.

Here’s the full breakdown of the reasons Brits haven’t tried CBD products (we asked people to select all reasons that apply to them):

- I don’t know enough about CBD products and their effects – 60.6%

- I don’t like the idea of CBD products – 31%

- I’ve heard negative stories about CBD products – 7.7%

- Products are too expensive – 5.6%

- I haven’t been able to find CBD products available to buy – 4.9%

And here are the reasons Americans gave:

- I don’t know enough about CBD products and their effects – 55.3%

- I don’t like the idea of CBD products – 28.2%

- Products are too expensive – 13.6%

- I’ve heard negative stories about CBD products – 8.7%

- I haven’t been able to find CBD products available to buy – 5.8%

As we can see, awareness and lack of understanding is the most powerful force in both markets among consumers who are new to CBD products. It’s clear there’s work for brands to do to raise the profile of products and let potential customers know about their safety and benefits.

Among all UK age groups, they don’t know enough about CBD products and their effects.

Jeremy King

Price seems to be a deterrent

Another nugget from above to emphasise is that 13.6% of people in the US think CBD products are too expensive – this is more than twice the amount of Brits who think the same. This shows some price sensitivity that brands should absolutely be aware of when launching in the US.

We see this price sensitivity even more emphatically expressed among those who’ve tried CBD products but don’t plan to again. In the US, 30.6% said price was a reason they don’t want to buy again, while 27.3% in the UK said the same.

There are interesting analogues and potential solutions to draw from other industries here: beauty products finding ways to justify a premium price point for a specific core ingredient, and laddering of brands to offer a wider range of pricing choices to consumers. CBD can repeat all of the tried-and-tested formulas, and while the CBD market is still maturing, there is all to play for!

Top 3 takeaways from the research

1.CBD products see fundamentally no difference in consumer behaviour vs. many products and sectors: awareness and education are essential for tapping into new markets – this emerged as the top reason consumers gave for not having tried CBD products at all.

2. Young Brits appear to be a much more receptive audience to CBD products than Millennials and older groups (not a trend we see replicated in the US, where receptiveness comes from all age groups), so definitely an exciting UK growth opportunity for brands there.

3. Ignore price sensitivity at your peril – it’s one of the main reasons people choose not to buy CBD products. Most consumers have no idea how to think about CBD product pricing, and that’s both a big opportunity, and a significant barrier to overcome.

Get started with Attest today

See how you can use data to make great decisions.