Top 10 UK food & beverage

trends of 2023

Trend 1: Consumers are shopping around for the best prices

Today’s shopper is savvier than ever: 59.0% say they’re ‘very likely’ to shop around for the best deals on food and beverage products right now. A further 33.5% say they’re ‘somewhat likely’. Strong intent to shop around is evident across all demographics.

Top tip: Keep a close eye on your competitors’ prices and promotions and, where your brand offers better value, shout about it!

Trend 2: Shoppers visit multiple supermarkets

In their bid to find the best deals on groceries, 58.7% of Brits say they visit different supermarkets in person, while 43.7% compare them online. Millennials are the most likely demographic to visit multiple shops and online retailers, while Gen Z are least likely to compare F&B prices online.

Top tip: UK consumers are more supermarket-agnostic than they were before, so use a loyalty scheme as a means to keep them coming back.

What’s the outlook for your brand?

Speak to your customers today

Send a free survey

Trend 3: Advertising is key for communicating value

Brands often cut their marketing budget when times are tough, but scrimping on advertising is a false economy: 47.4% of consumers who say they shop around for F&B deals rely on ads to stay informed. Promotional emails and mailings are also effective for reaching bargain hunters (36.4%)… although Gen Z are unlikely to pay attention to them.

Top tip: Radio ads can provide an affordable but effective way to educate consumers about weekly special offers.

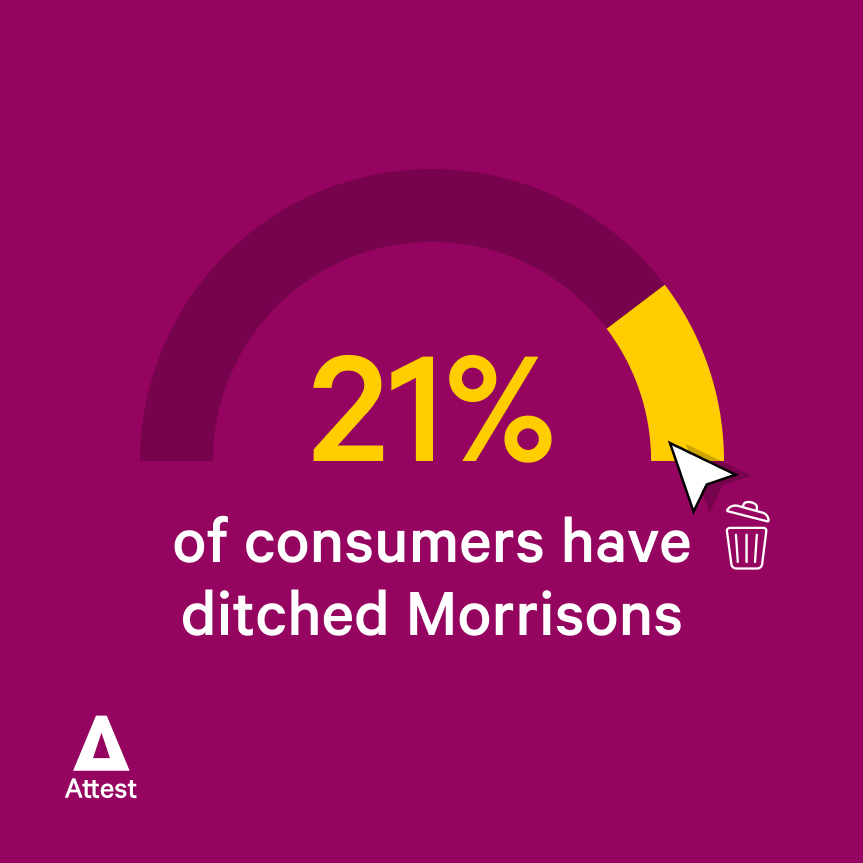

Trend 4: Expensive supermarkets will get the chop

Failure to stay competitive could cost supermarkets custom in the long term. When asked if they had stopped shopping at any supermarkets because of high prices or lack of deals, respondents were most likely to name Morrisons, followed by Tesco and Waitrose.

Top tip: Discounter supermarkets like Aldi and Lidl are poised to pick up customers from other retailers; make sure your brand is available there.

Attest is the best of all worlds. You’re getting high quality data with appropriate samples, but with a self service front-end that allows you to manage costs more effectively.

Ross Farquhar, Marketing Director, Little Moons

Trend 5: In-store shopping is perceived as better value

The pandemic might have boosted the adoption of online shopping, but consumers still believe it’s better to go to a shop when searching for the best deals on groceries. More than 53% of Brits think in-store shopping is best for bargain hunting, while only 13.3% favour online (the remainder don’t think there’s a difference).

Top tip: Incentivise shoppers to shop online by promoting online-only special offers alongside free delivery or curbside pickup.

Trend 6: Discounts are the most effective promotion type

Discounting the price of a product is the tactic most likely to get Brits to buy it. Out of six promotion types, a discount was ranked as the most effective, closely followed by ‘buy one get one free’ deals. Offering a % of extra product free was ranked third, alongside a ‘pre-inflation price freeze’.

Top tip: Shoppers showed a clear preference for BOGOF over ‘buy three products, get the cheapest free’ deals (ranked least popular).

Do you need help making business decisions?

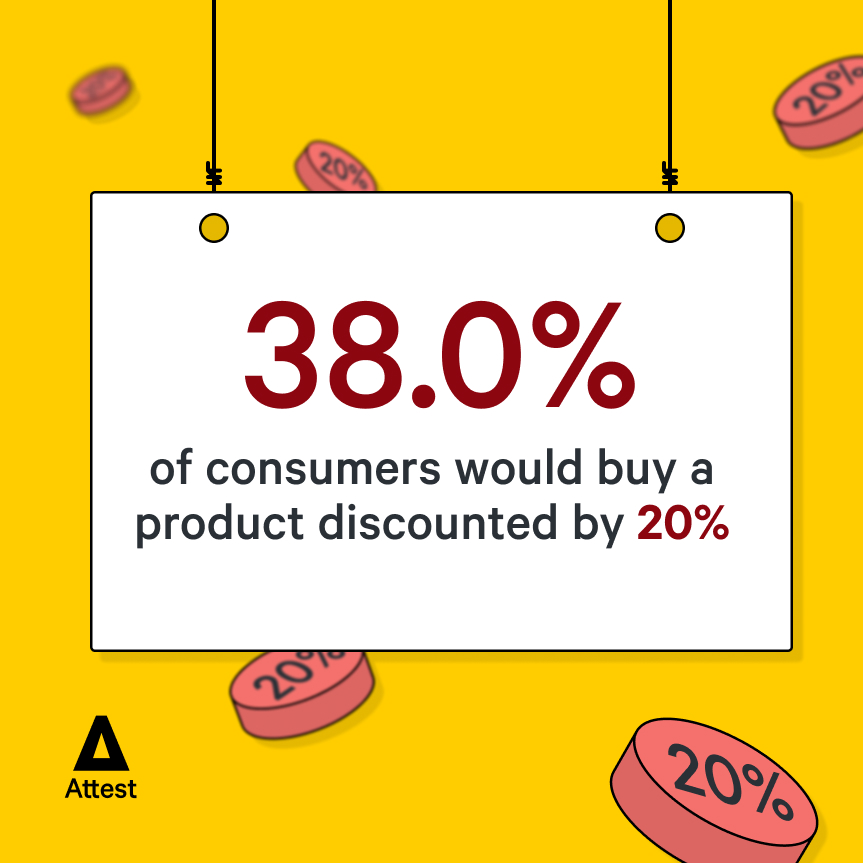

Get reliable data nowTrend 7: Small discounts motivate shoppers

Discounts don’t need to be huge to incentivise shoppers to buy F&B products. We asked respondents about the minimum discount that would persuade them, and the top answer was 20% (38.0% of people said this). A further 22.3% would buy with a 30% discount. But 20.4% would be convinced by a discount of 10% or less.

Top tip: Boomers are most likely to be incentivised by a small discount.

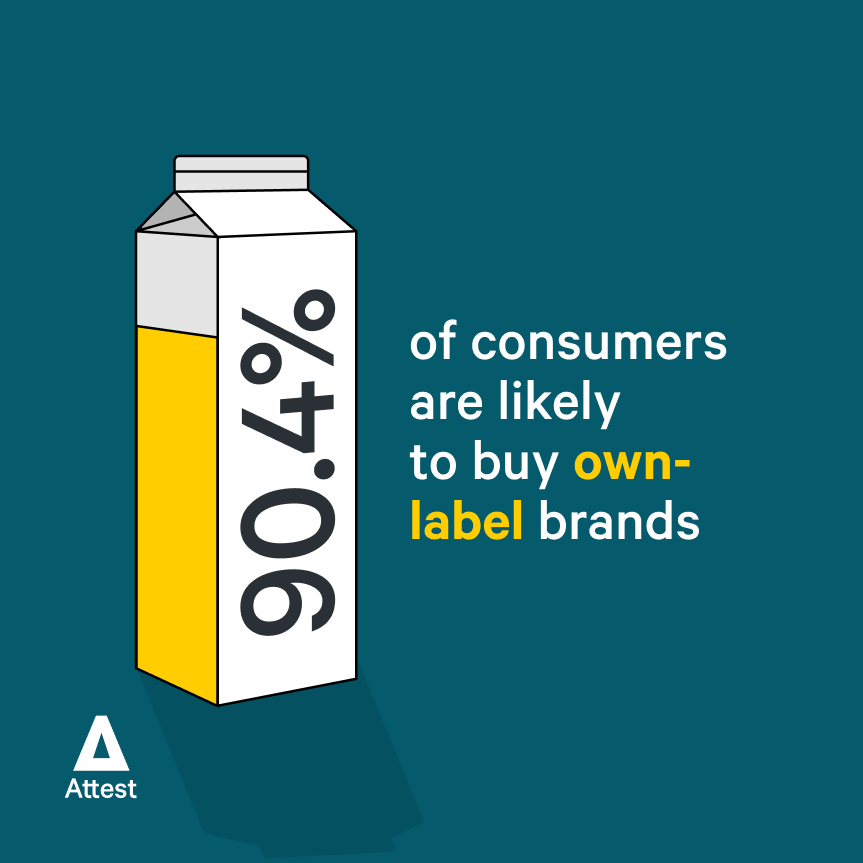

Trend 8: Own-label brands are winning fans

Supermarkets’ own-label brands have benefited from the rising cost of living, with shoppers turning away from more expensive household names. More than 60% of Brits say they are ‘very likely’ to purchase them, with a further 30.3% ‘somewhat likely’. Less than 3% are unlikely to buy own-label brands.

Top tip: Millennials are most likely to seek out own-label brands, while Gen Z will pick them up if they take their fancy.

We literally put Attest survey data into the initial sales pitch. We’ve had a lot more success with launches since we’ve been doing it this way.

Claire Evans, Category Manager, The Big Prawn Co.

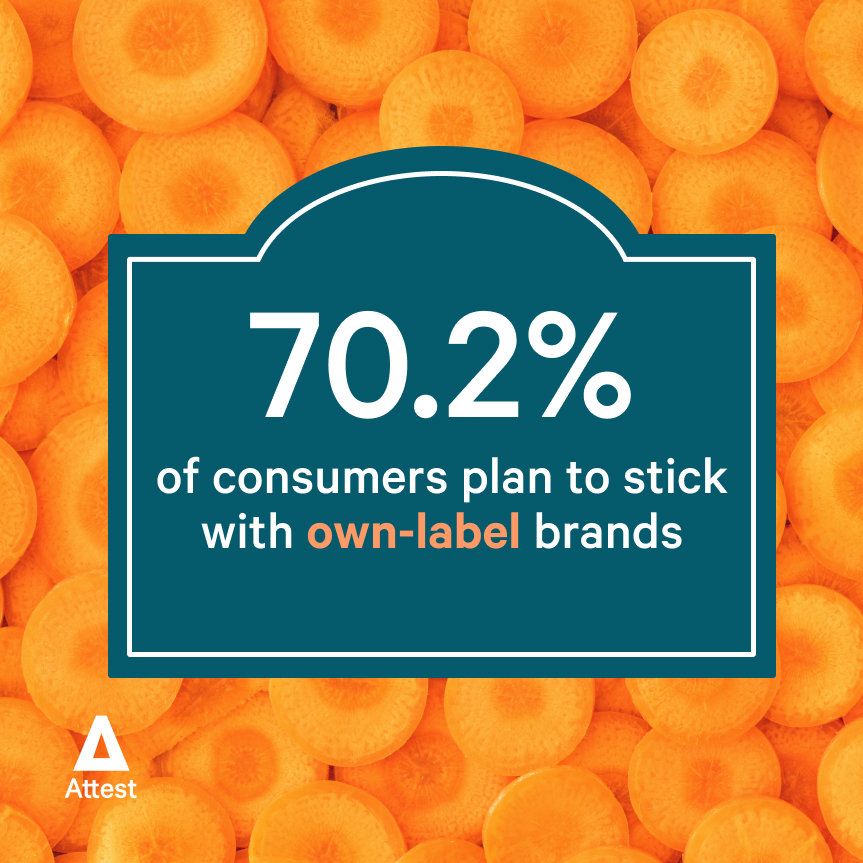

Trend 9: Own-label growth is for the long-term

Even once inflation eases off and the economy picks up, it seems UK shoppers have little intention of reverting to household brands. Nearly 26% say they would ‘definitely’ stick with own-label brands if price wasn’t an issue, while a further 44.6% ‘probably’ would. Only 12.9% say they wouldn’t stick with them, although Boomers show the greatest intent to abandon own-label.

Top tip: With more competition than ever, brands will have to work hard on reasons shoppers shouldn’t switch to their own-label counterparts.

Trend 10: Price is the ultimate battlefield

Lowering prices overall is the primary action supermarkets can take to keep customers: it’s more than 4x as effective as implementing store-wide special offers and promotions (ranked the second most effective action). Interestingly, generalised special offers are more popular than personalised ones.

Top tip: Fancy in-store technology is ranked as the factor least likely to incentivise shoppers, so put plans for new tech on ice and invest in rolling back prices instead.

What opportunities do these trends represent

for your brand?

Get a direct line to

inflation-squeezed consumers

Quick and easy to run surveys

Get going in minutes with our intuitive platform and get results quickly, our average survey closes in 1 day 19 hours.

High data quality

We use automated and human checks on your data, you can be sure you’re making the right business decisions.

Research guidance

You’ll be supported by a dedicated industry professional every step of the way to help you get the most from your research.

Find your target audience

Our audience lets you access 150+ million people across 59 countries, and use filters and quotas to make it as targeted as you need.