Tax return spending trends 2025: How consumers plan to use their refunds

Tax season is here, and for many Americans, that means an influx of extra cash in the form of a tax refund. But how are people planning to spend their returns in 2025, and what does it reveal about the current economic sentiment?

We analyzed a recent Attest survey of 1,000 working-age Americans to uncover key insights.

Quick summary

- Most Americans expect tax refunds under $3,000, but some anticipate over $5,000.

- 34% plan to use refunds to pay off debt, while 40.3% intend to save or invest.

- Nearly 25% of consumers, especially Millennials, plan to buy cryptocurrency.

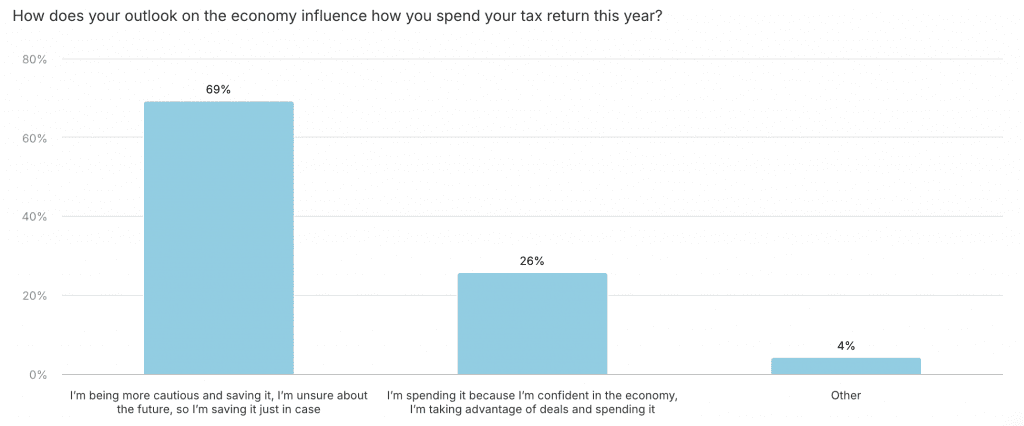

- Almost 70% are saving due to economic uncertainty, while those with improved finances are more likely to spend.

- Lowering individual tax rates is the most popular tax policy change, followed by taxing corporations and simplifying filing.

- Refund spending patterns reflect a mix of financial caution, debt management, and selective discretionary spending.

Tax return expectations

The survey results indicate a wide range of expectations when it comes to tax refunds:

- 23.6% of respondents expect less than $500.

- 16.9% anticipate receiving between $500 and $1,000.

- 20% expect a refund between $1,000 and $3,000.

- 9.3% foresee a return of $3,000 to $5,000.

- 7.8% anticipate receiving more than $5,000.

These figures suggest that while a significant portion of Americans expect modest refunds, a substantial number anticipate larger sums, making tax season a critical financial moment for many households.

How will Americans spend their refunds?

Understanding where this money will go can shed light on broader economic trends. According to our survey:

- 34% plan to pay off credit card debt or other loans, highlighting concerns about personal debt levels.

- 40.3% of respondents intend to save or invest their refunds, indicating a cautious approach in an uncertain economy.

- Some plan to use their refunds for day-to-day expenses, suggesting financial strain.

- On the flip side, over a third of Americans are looking at discretionary spending, including travel or major purchases, reflecting some confidence in personal finances.

What this says about economic sentiment

The fact that over one third of respondents are prioritizing debt repayment points to lingering financial stress, possibly from high interest rates and inflation. The emphasis on saving suggests many are bracing for economic uncertainty. However, those who are spending on non-essentials signal that not everyone is feeling the financial squeeze.

The foray into crypto

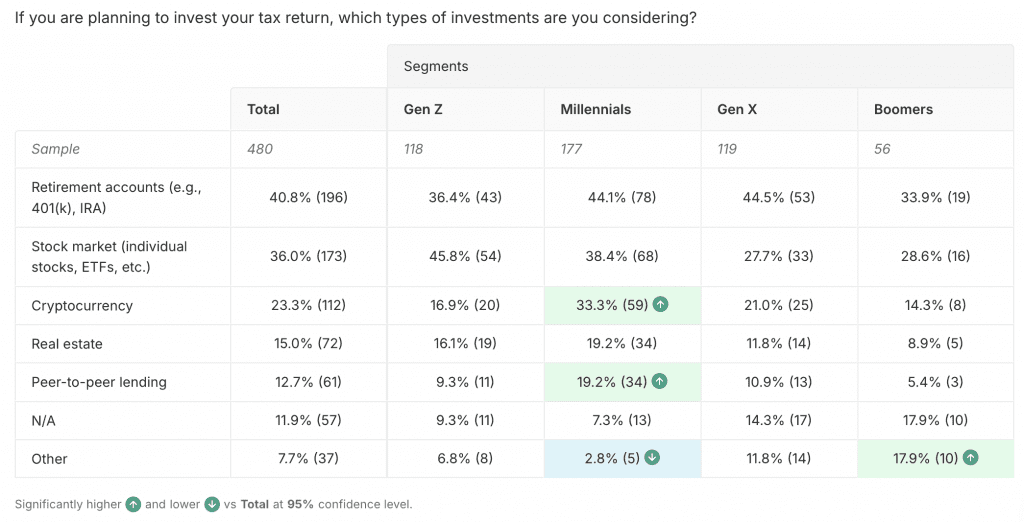

Of those that are saving or investing their tax returns, we see the majority of respondents deciding to invest either in their retirement accounts (40.8%) or the stock market (36%). Surprisingly to some, investments in cryptocurrency rounds out the list, with almost a quarter of respondents opting to purchase crypto.

The differences in generational investing become more apparent in this crosstab, where we see that Millennials are significantly more likely to invest in cryptocurrency when compared to the total.

Americans’ economic outlook in 2025

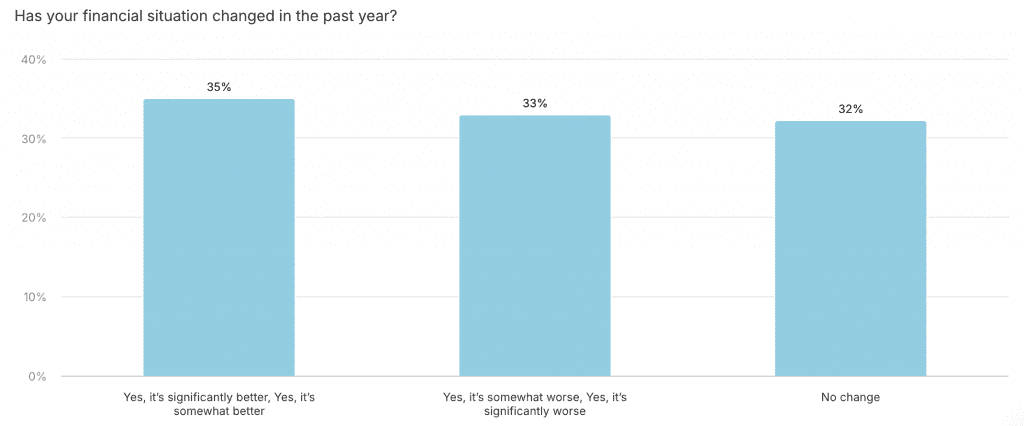

We see an almost even split of respondents who have had either a positive change, a negative change, or no change to their financial situation in the last year. This split seems to be a main driver on how that outlook is influencing spending.

Those whose financial situation has improved are overindexing on spending their tax returns, while those whose situation has gotten worse are more likely to save their return this year. All in all, almost 70% of respondents are planning to save their returns due to the outlook on the economy.

One question revealed strong support for tax-related policy changes, with lowering individual income tax rates (42.4%) emerging as the most favored option, particularly among Boomers (49.4%) and Gen Z (45.1%). Increasing taxes on corporations and high-income earners (33.0%) was the second most popular choice, with Boomers (36.9%) showing the highest support.

Simplifying the tax filing process (26.8%) was another priority across all generations. Notably, Millennials (29.1%) showed the strongest support for expanding tax credits, while Boomers (10.6%) were least in favor. These findings highlight generational divides in tax policy preferences, with younger generations favoring broader financial support and older groups prioritizing tax reductions.

Overall, the 2025 tax season appears to be a mix of financial caution and necessity, with only a portion of Americans feeling comfortable enough to spend freely. This aligns with broader economic concerns about inflation, rising costs, and potential financial instability.

Tax refunds provide a valuable snapshot of consumer behavior and economic sentiment. This year’s data suggests that while some Americans are using their refunds to get ahead financially, others remain cautious, prioritizing savings and debt repayment over discretionary spending.

As we move further into 2025, these spending patterns will likely reflect the ongoing economic climate and shape financial behaviors throughout the year.

Tell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: