Smart carts & in-store satnav: the grocery tech US shoppers want

New data shows US consumers desire a more automated grocery shopping experience.

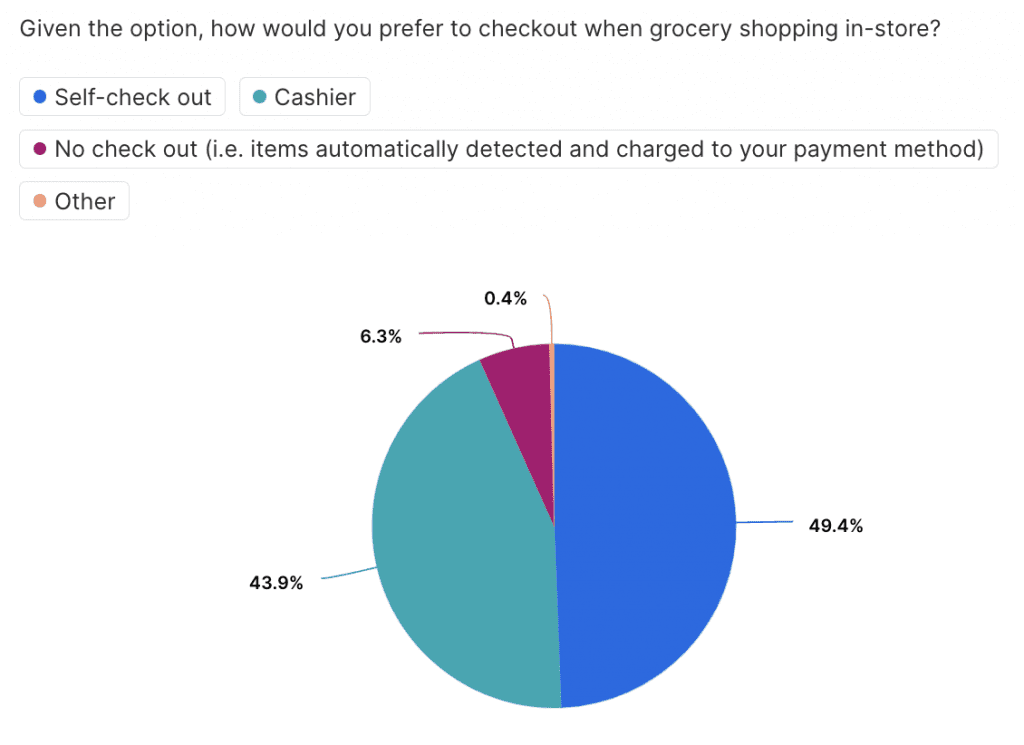

Americans are in favor of a more automated grocery shopping experience, a nationally representative survey of 2,000 consumers shows. Although they add the human touch, less than half of people (44%) would choose to check out with a cashier.

The younger you are, the less likely you are to desire human interaction when paying for your groceries; only 28% of Gen Z (aged 18-25) would opt for a cashier. As one respondent commented, “I have social anxiety.”

The data comes as Amazon announces the launch of a new Amazon Fresh store in Bellevue, Washington – the first full-sized supermarket to be equipped with the brand’s Just Walk Out checkout-free technology.

The technology relies on computer vision to track items as they move from shelves to carts. Customers using the system identify themselves as they enter by using a QR code, scanning their palm with an Amazon One reader, or inserting a credit or debit card connected to their Amazon account. When ready to leave, customers use the same method they used to enter to finish their transaction.

Amazon aren’t the only ones investing in automation; Giant Eagle are adding Grabango’s checkout-free technology to stores in Pittsburg. Grabango, who have recently secured $39m series B funding, say they have also signed deals with four other retailers. Meanwhile, Israeli tech firm WalkOut are making smart carts less expensive, with cameras and touch screens that can be retrofitted.

Nearly 41% of respondents say they would use smart carts that automatically detect items added, while a further 38% might use them. Only 21% wouldn’t want to use a smart cart, indicating that this tech is likely to prove popular.

Consumers reject biometric payment methods

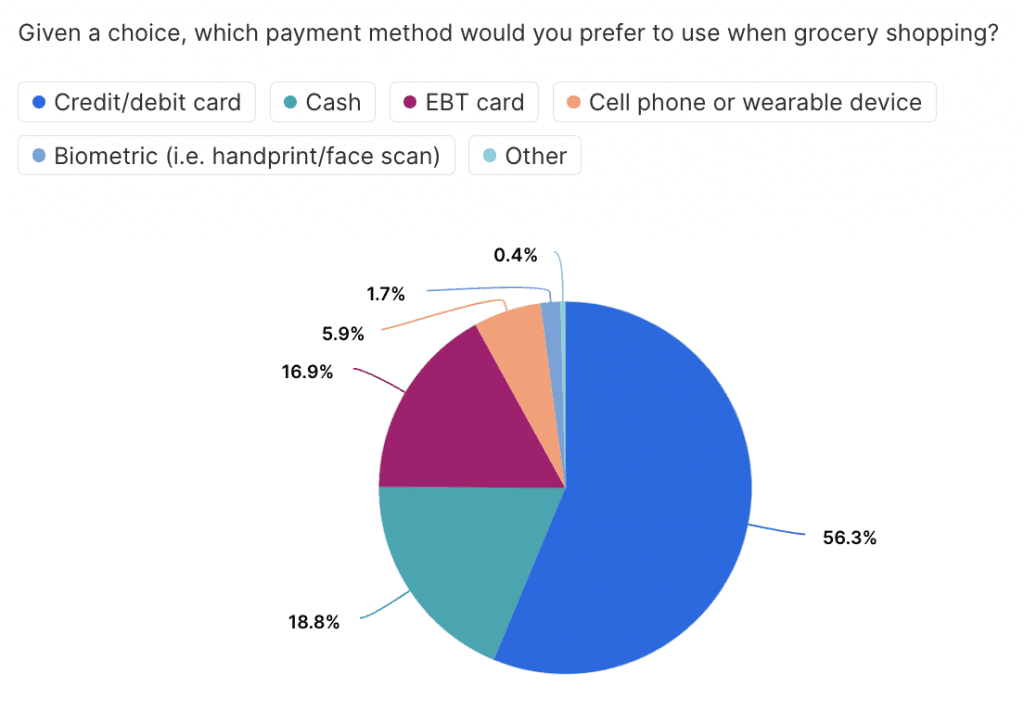

While Americans show high interest in checkout-free technology, they’re still most likely to want to pay using traditional methods. Only a tiny 2% would choose a biometric payment option, such as Amazon One, which lets users pay with their palm prints and is being rolled out in Whole Foods Market stores.

Adoption of contactless payment, such as Apple Pay on a cell phone or smartwatch, also remains surprisingly low. Just 6% of people would select this method given a choice.

Credit or debit card is still the most popular method for paying for groceries in-store, chosen by 56% of respondents. And behind that, it’s good ol’ cash (19%), which is something retailers thinking of going cashless should take note of. Lower-income individuals can be more reliant on cash, so retailers must take care not to discriminate when integrating checkout-free technology.

Interestingly, younger people also show a preference for cash, with 25% of Gen Z opting to pay with it. On the other hand, Boomers (aged 56-66), perhaps having the most access to credit, are the demographic least likely to choose cash (14%).

Equally important for inclusivity is accepting payment via EBT card; 17% of Americans wish to pay for their groceries this way.

In-store satnav is consumers’ most desired tech

We asked consumers about their likelihood to adopt other emerging in-store technology, and we found that in-store navigation is most in demand. Nearly 54% of respondents say they would use a navigation tool to help them find the locations of products, while a further 32.5% say they might use it. Satnav functionality is something that can be provided via smart carts.

For retailers looking to expand their product range without extending their square footage, introducing ‘virtual aisles’ could be a good solution. Just over 35% of Americans say they would use in-store screens to browse items and order them for home delivery, and 36% say they might use them. Giant Eagle have recently partnered with Vous Vitamins to install 220 Higi Digital Stations across stores, creating virtual vitamin aisles.

Meanwhile, tools that use artificial intelligence and augmented reality to let shoppers virtually try on makeup or clothes can help stores be more Covid-safe. Whole Foods Market is rolling out Mineral Fusion’s virtual makeup testing tool, which people can use via their smartphones. It’s tech that 34% of people say they would use and 34% might use.

And even though it could save shoppers lots of time hunting down items, the least desired in-store tech is robotic pickers. This is what Urbx Market is planning to use at its sky scraper-style vertical stores. Shoppers will order at kiosks in the lobby and robots will bring their orders out to them within minutes (the system can retrieve 50 items in 135 seconds). According to our respondents, 30% would use this facility, a third might use it, while 37% wouldn’t use it.

Openness to new tech correlates to age, with Boomers significantly less likely to be interested in using it than their younger counterparts.

Boosting browsing post-pandemic

In our last US F&B study carried out earlier this year, we discovered that shoppers were spending less time browsing in grocery stores than they used to, due to the pandemic. We highlighted that retailers would need to consider this when designing store layouts and product displays.

One new solution to this problem is coming out of Europe from retail design firm Interstore | Schweitzer. They have developed a modular grocery store concept centered around mobile fixtures that can easily be rearranged. It means retailers can experiment, test new concepts, and have temporary pop-ups.

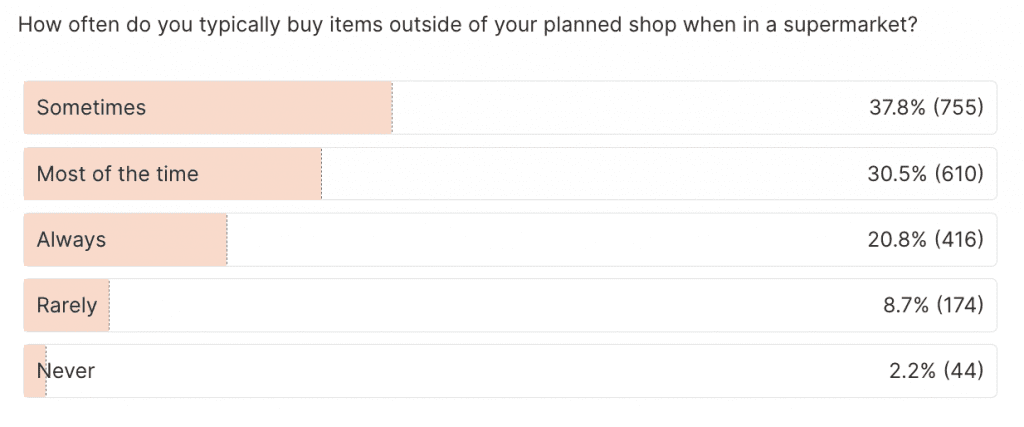

Our data shows that more than half of American consumers frequently make an unplanned purchase when shopping for groceries (21% ‘always’ do and 30.5% do so ‘most of the time). The demographic most likely to buy items outside of their planned shop are Millennials (aged 26-40); 28% say they always do and 30% do most of the time.

Trialing different layouts and displays will help retailers appeal to these shoppers and boost discovery of new brands and products. This will be increasingly important if footfall in grocery stores fails to return to pre-pandemic levels due to the increased adoption of online shopping.

Membership model could work for grocery stores

Another idea to increase in-person sales is extending grocery store opening hours. Main Street Market, which has opened in Evansville, Minnesota, offers 24-hour access to members who pay a $75 annual fee. The unmanned store lets shoppers scan items and pay with their phones, or use a self-checkout terminal. But is a membership model likely to catch on?

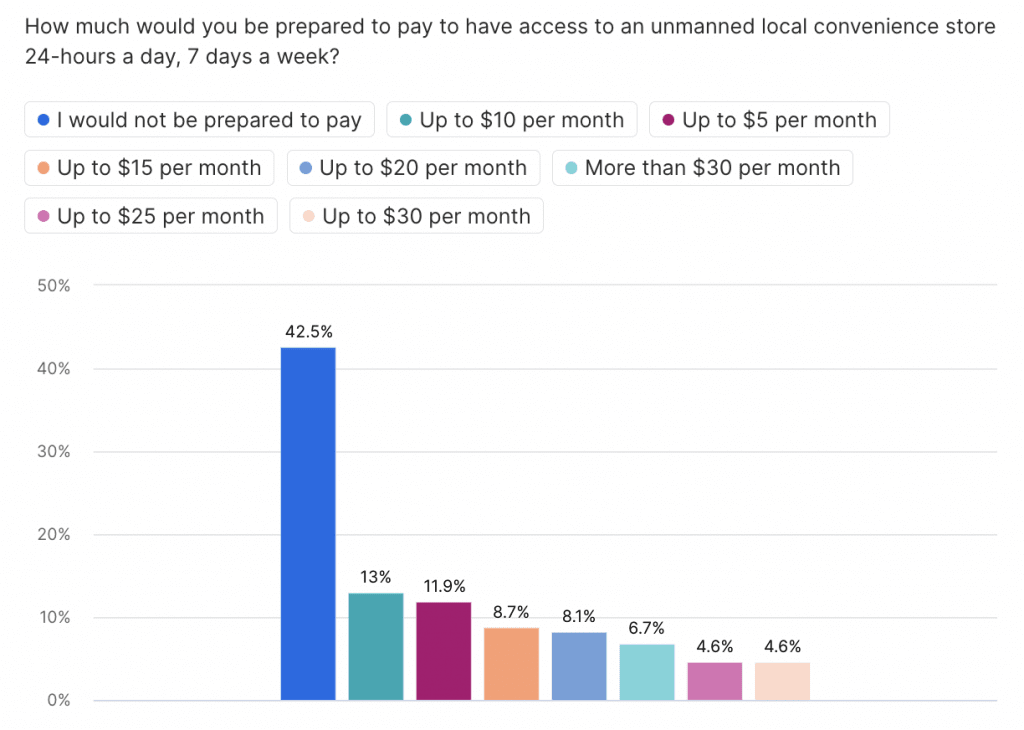

Nearly 43% of Americans say they wouldn’t be prepared to pay for 24/7 access to a convenience store, however, more than half would. The key is finding the sweet spot on the membership fee. The single largest percentage (13%) say they would be prepared to pay up to $10 per month, but a further third would pay even more than this.

Gen Z show strong interest in the membership model, with only 22% not prepared to pay for grocery store access (this is in contrast to the 74% of Boomers who aren’t willing to pay). They’re also prepared to pay the most for the privilege; 12% would pay more than $30 a month, making this a concept well worth exploring.

Tell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: