Gen Z beauty trends 2025: What’s driving the next generation of US beauty consumers

Explore the top Gen Z beauty trends for 2025, from authenticity and inclusivity to the growing influence of tech and sustainable beauty products.

As the beauty industry continues to evolve, Gen Z has emerged as a driving force, shaping trends and challenging traditional beauty standards.

It’s estimated that the beauty and personal care industry is worth $100.3billion in 2024, and set to grow annually by 2.19%. And consumers aren’t just looking for glowing skin – there’s growing demand for good skin health, cosmetics with non-toxic ingredients, sun protection… and that’s before we get into the increased importance on self expression in the beauty category.

To better understand what influences their beauty choices, we surveyed 1,000 Gen Zers aged 18 to 27 using Attest’s platform to provide relevant insights on these trends.

Quick summary

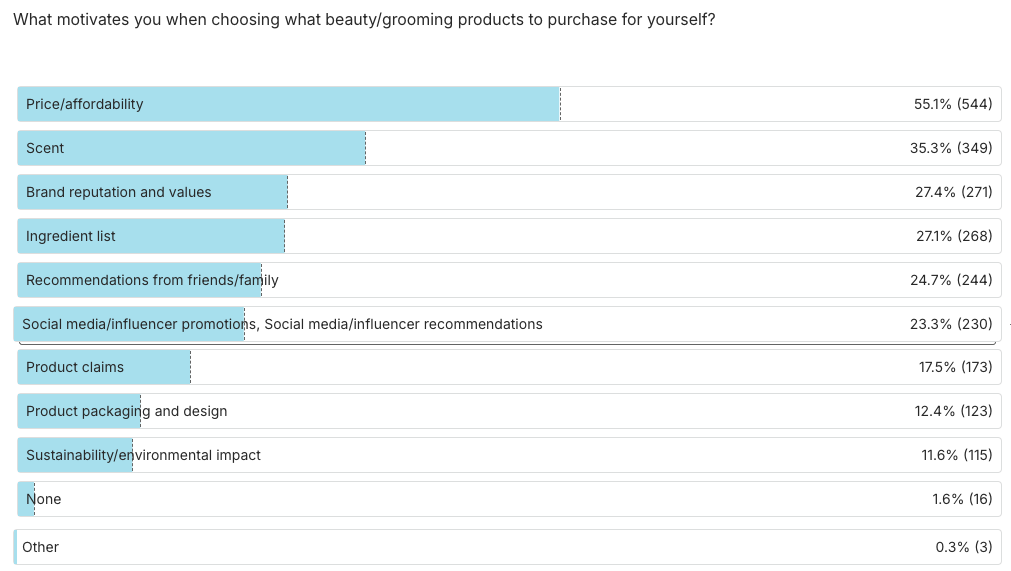

- 55% of Gen Z prioritize affordability when choosing beauty products, with brand reputation influencing 27.4%.

- 67.7% value sustainability, and over half (56.2%) are willing to pay more for sustainable or ethically sourced products.

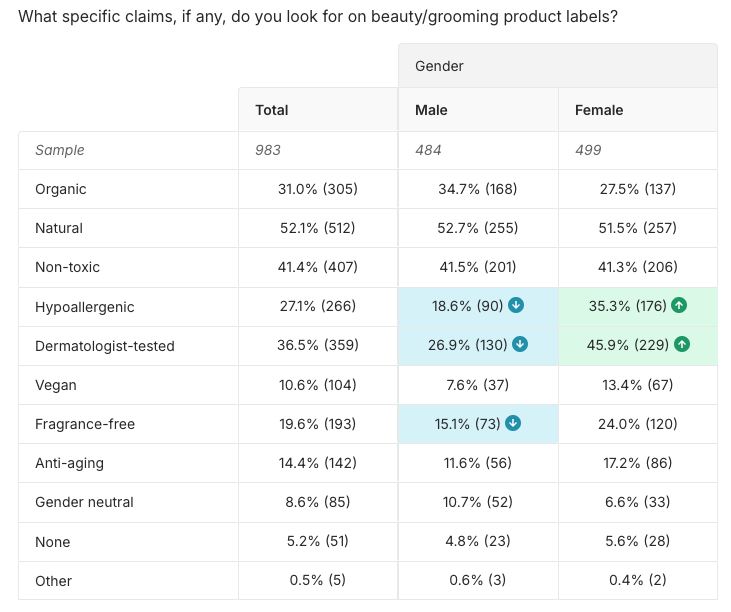

- Over 52% seek “natural” claims, and 41.4% look for “non-toxic” options in beauty products.

- 61.1% wish there were more clean label options available.

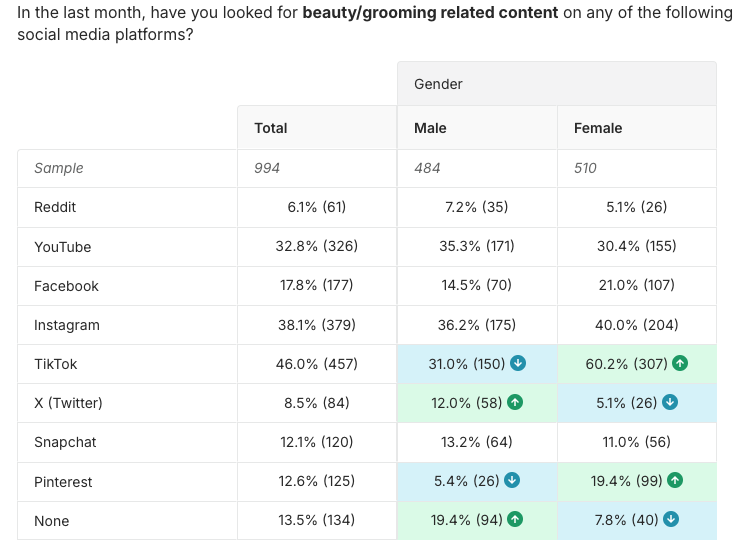

- 53.9% of Gen Z discover beauty content on social media, with TikTok being the top platform (46%).

In a nutshell: what are the latest Gen Z beauty and grooming trends?

Beauty and grooming choices among Gen Z are driven by a combination of factors ranging from affordability to personal expression. From demanding diversity to clean label ingredients, young consumers are redefining beauty norms (and the beauty industry) in a unique and purposeful way.

Let’s dive into the key insights from our survey.

What motivates Gen Z’s beauty choices?

Affordability and brand perception

When it comes to choosing beauty and grooming products, affordability is the most influential factor for Gen Z. More than half (55%) prioritize price/affordability when selecting beauty products. This continues trends in the food industry, as well as in a bunch of other sectors.

As a generation facing economic challenges, Gen Z is looking for products that offer value for money without compromising quality.

But it’s important to note that price isn’t the only consideration. After scent, brand reputation and product claims also carry weight, with 27.4% of respondents indicating that a brand’s values influence their decisions.

Sustainability: Environmental concerns are impacting beauty decisions

Almost 2 in 3 (67.7%) view sustainability as important when choosing their beauty and grooming products and more than half (56.2%) are likely to pay more for a product that is sustainable or ethically sourced.

From non-toxic ingredients to clean labels, Gen Z consumers are actively seeking skincare and makeup products that align with their desire for a greener future.

The rising demand for clean, natural ingredients and wellness-oriented products

Health and wellness have emerged as pivotal in Gen Z’s beauty regimen, with many prioritizing products that offer clean, non-toxic, and natural ingredients.

In fact, over 52.1% of respondents actively look for ‘natural’ claims on product labels, and 41.4% seek ‘non-toxic’ options. ‘Dermatologist-tested’ and ‘hypoallergenic’ resonate significantly with women – here we see 45.9% and 35.3% of females look for these claims, compared to 26.9% and 18.6% respectively.

This generation demands transparency in product formulations with nearly 2 in 3 (61.1%) wishing there were more clean label beauty/grooming items to purchase. These preferences illustrate a trend towards clean and safe formulations.

How social media is shaping Gen Z’s beauty and grooming choices

Gen Z actively engages with beauty and grooming content on social media, with more than half (53.9%) saying that they enjoy discovering beauty content on these platforms. For brands, this makes social media a critical channel for reaching younger audiences.

Here we see a gender divide in how Gen Z uses social media. Close to 2 in 3 (61%) of women agree that they love finding beauty/grooming content on social media compared to 45% of males, showing that women are be more engaged with digital beauty/grooming content. But the 45% of males is also a significant portion, so you shouldn’t discount males from paying attention to your social content.

Viral skincare hauls and product reviews

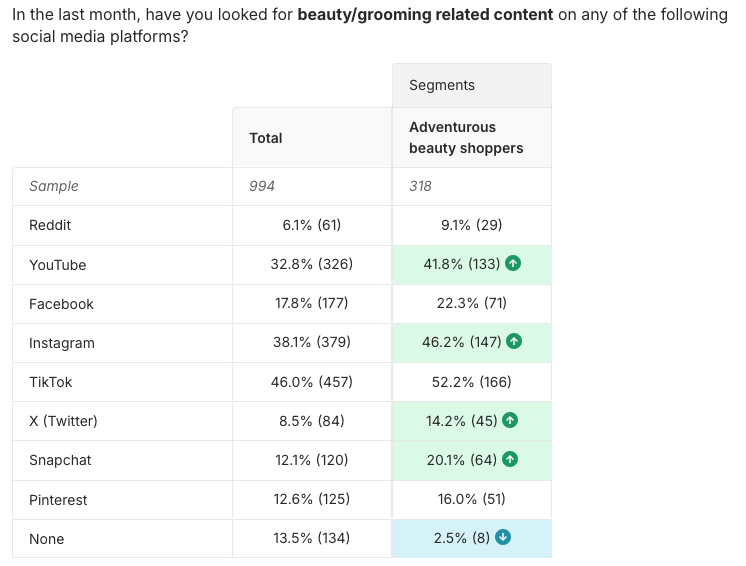

From sharing Korean skincare to hair grooming tips, TikTok garners the highest engagement of all the social media platforms with 46% of Gen Zers looking for beauty/grooming related content on the app. This is followed by Instagram (38.1%) and YouTube (32.8%). Once again looking at gender split, we see 60.2% of women look for beauty/grooming related content on TikTok, compared with 31.0% of men.

Noticeably, 13.5% have not looked to any social media for any content in this category.

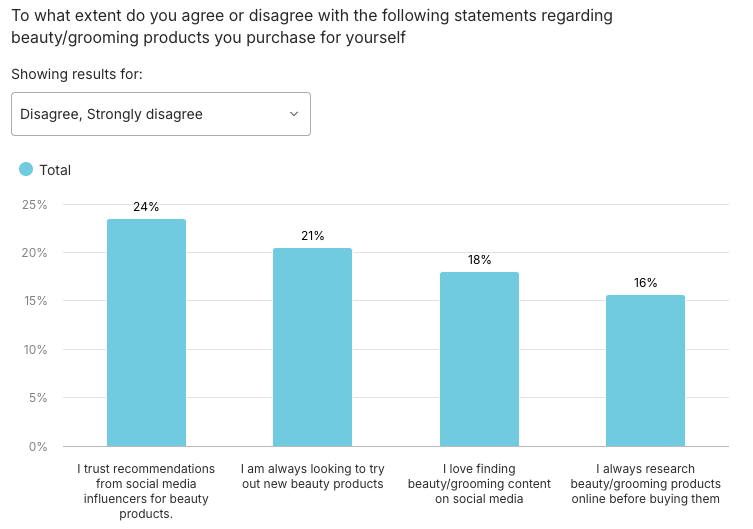

Caution over influencer content

Despite their reliance on digital influencers, Gen Z is also cautious. Close to 1 in 4 (24%) do not trust recommendations from social media influencers. This suggests that while influencers are certainly a big part of the beauty industry, authenticity and transparency are crucial for earning and maintaining Gen Z’s trust.

Personal expression and identity

This research shows Gen Z’s beauty choices are tied to self-expression and individuality.

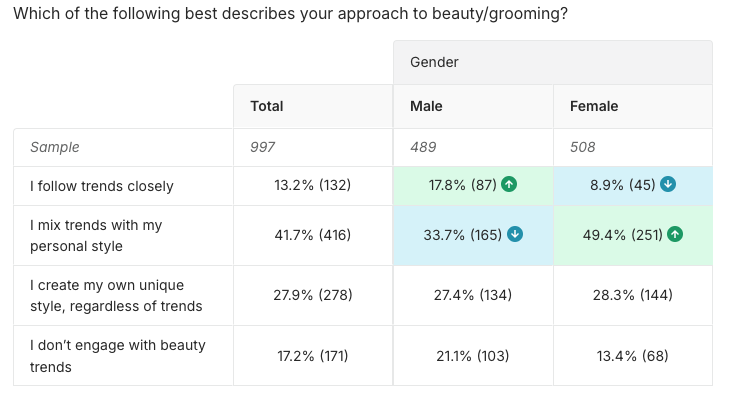

Two fifths (41.7%) say they mix trends with their personal style, and 27.9% claim to create their own unique look, regardless of trends. This desire for individuality is especially pronounced among women, with nearly half (49.4%) blending trends with their personal aesthetic vs 33.7% of men.

Slightly bucking the assumed gender trend, our data shows men follow trends more closely than women – 17.8% of men said this, compared to only 8.9% of women.

What does inclusivity mean to Gen Z?

Within the beauty and grooming category, Gen Z are looking for companies that represent a wide variety of identities, across race, gender, body type and sexual orientation.

Gen Z places a strong emphasis on inclusivity in terms of representation and product diversity in beauty and grooming. Two fifths (39.5%) of respondents value a wide range of shades for different skin tones, highlighting the importance of racial and ethnic representation in product offerings. Body positivity and inclusive messaging also resonated with 1 in 3 (33.9%) of Gen Z. Perhaps unsurprisingly women were found to consider and prioritize these topics significantly more than men.

It’s clear that individuality is more than skin deep for this generation of consumers, and they often use beauty as a way to express their identity. Whether it’s through gender-neutral products, bold makeup choices, or minimalist routines, Gen Z’s influence over the values and authenticity of the industry is significant.

In-store is still important

While we have all seen the TikTok beauty hauls, when it comes to shopping for beauty and grooming products, Gen Z primarily favors in-store experiences, with more than half (58.1%) saying they primarily shop for beauty/grooming products in-store.

While the rise of e-commerce is evident, in-store shopping holds significant appeal for beauty and grooming products, likely due to the tactile experience of testing, smelling and trying out products before purchasing.

But brands should definitely remember how important online content is for Gen Z when they’re making buying decisions – so make sure you offer a fully considered online and in-store experience if possible.

Beauty brand explorers

Gen Z consumers are looking to experiment with skincare brands, our data shows. The majority (88%) are open to trying new beauty abd grooming brands that they have never used before.

Looking even closer, 1 in 3 (32%) are exploring a new brand at least once a month. Let’s look more into this audience we will call Adventurous Beauty Shoppers.

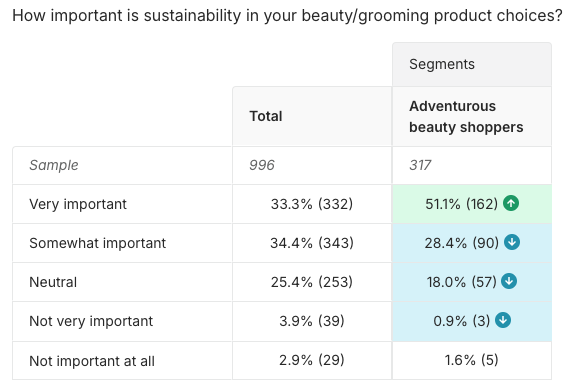

More than half (51.1%) of Adventurous Beauty Shoppers consider sustainability ‘very important’ in their beauty product choices. This is significantly higher than the total population (33.3%).

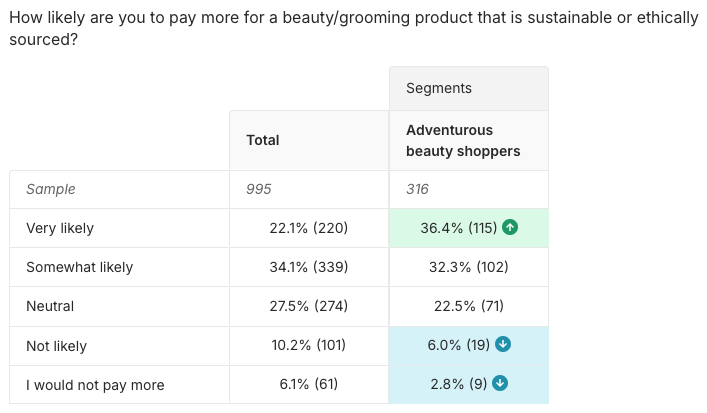

This segment also demonstrates a strong likelihood to pay more for products that are sustainable or ethically sourced, with more than 1 in 3 (36.4%) being ‘very likely’ to do so.

Non-legacy beauty brands looking to win over new consumers need to be able to answer for their sustainability credentials. They’re also more likely to be present on YouTube, Instagram, or Snapchat, than their less adventurous counterparts.

How can businesses use these trends to appeal to Gen Z?

These are the key takeaways from this new data into Gen Z beauty shoppers that can help brand like yours make winning decisions…

Think online AND in-store

Gen Z is purchasing this category online and more predominantly in-store. Understand where your brand can stand out across both ends of the spectrum

Inclusivity is non-negotiable

Beauty brands that want to remain relevant must fully embrace inclusivity in every aspect, from product formulations to marketing campaigns. Gen Z is leading the charge in breaking down outdated beauty norms, and brands that champion diverse beauty ideals will thrive in this new landscape.

Transparency and clean beauty

Gen Z demands full transparency from brands about what goes into their products. Brands that can clearly communicate their ingredient list and sustainability efforts will stand out.

How Attest can help gather insights from your Gen Z audience

Understanding how your Gen Z target customers think, act and buy is key to making decisions that help you build beauty products they will love, and put your brand ahead of your competitors.

Getting to grips with your target customers’ behavior lets you:

- Define your most valuable customers

- Understand purchase barriers and drivers

- Find the right marketing channels

Attest gives you the platform you need to do all of this. Here’s some of what you can do with Attest to figure out how to win with your Gen Z customers:

- Compare customer segments side-by-side

- Keep your insights costs straightforward with flat audience costs

- Localize surveys for each of your markets.

- and more…

Research methodology

For this research we surveyed 1,000 Gen Zers aged 18 to 27 in the United States in October 2024 using Attest’s platform. We asked questions about their beauty and grooming habits, as well as how they access content online and on social media.

Tell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: