US Gen Z alcohol trends: a shift toward mindfulness and moderation

The drinking habits of Gen Z stand out as remarkably different compared to older generations. So what does this mean for alcohol brands as we look ahead?

This cohort has grown up in a time when health, wellness and social awareness are at the forefront of public discourse. These factors have influenced their relationship with alcohol, leading many to consume less, abstain, and have an openness to choose alcohol-free alternatives.

To better understand what influences their alcohol choices, we surveyed 1,000 Gen Zers in the US aged 21 to 27 using Attest’s platform to provide relevant insights on these trends.

Quick summary

- 21.5% of Gen Z does not consume alcohol, and 39% drink only occasionally.

- Health concerns are a key factor in abstaining, with 34% citing mental health and 46% simply not being interested.

- Popular drink choices include spirits, beer, and wine, with hard seltzers (36.25%) and ready-to-drink beverages (42.97%) gaining traction.

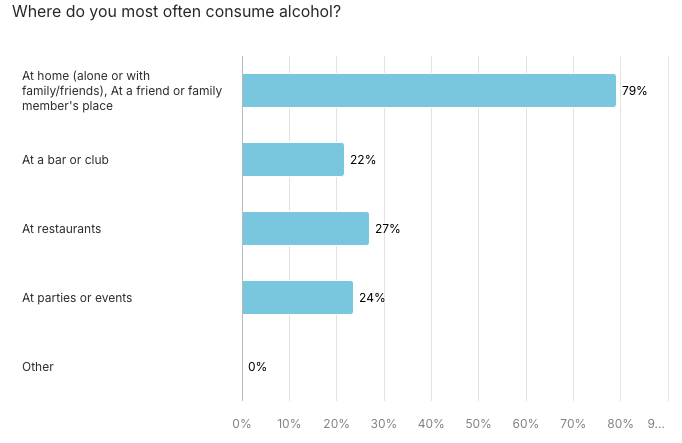

- Gen Z prefers drinking at home (65%) or at friends’ houses (27.3%) over bars or clubs.

- Taste, price, and individuality are important factors when purchasing alcohol.

In a nutshell: what are the latest Gen Z alcohol trends?

Alcohol choices among Gen Z are driven by a combination of factors ranging from health and affordability to social connection and relaxation. With a clear openness to non-alcoholic, young consumers are redefining alcohol norms in a unique way.

Let’s dive into the key insights from our survey.

Moderate drinking frequency and alcohol avoidance

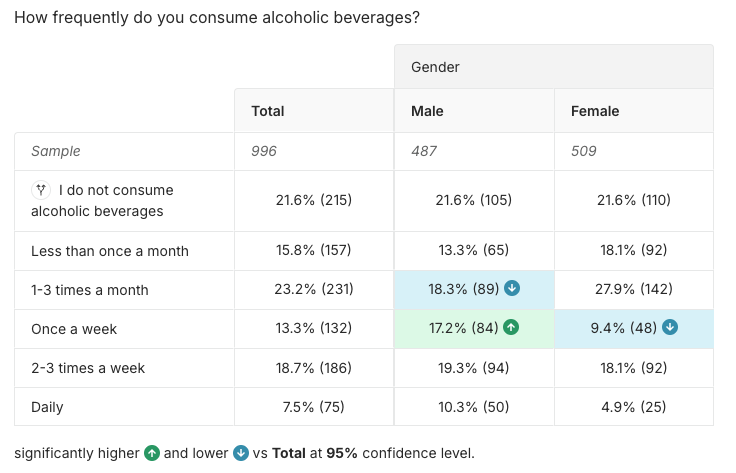

Our survey found that 1 in 5 (21.5%) said they do not consume alcoholic beverages and 39% drink only occasionally, with the majority consuming alcohol less than once a month or 1-3 times per month. A smaller portion of the Gen Z population drinks more frequently, but the general trend indicates a shift towards moderation or abstinence.

Among those we surveyed, female respondents reported lower frequencies of drinking in certain categories compared to their male counterparts. Women were significantly more likely to drink less than once a month (18.1%) or 1-3 times per month (27.9%) compared to men.

This data paints a picture of a generation that is far less likely to engage in regular alcohol consumption than their Millennial or Gen X counterparts. It also suggests a conscious moderation when considering alcohol.

Why is Gen Z drinking less?

Health consciousness and wellbeing

One of the main reasons for Gen Z’s reduced alcohol consumption is an increased awareness of their own health and well-being.

Unlike older generations, who may have prioritized social drinking as a key component of their social lives, many Gen Zers are more focused on maintaining their physical and mental health. Not to mention that younger people have found other ways to build connections that don’t include meeting new people in bars.

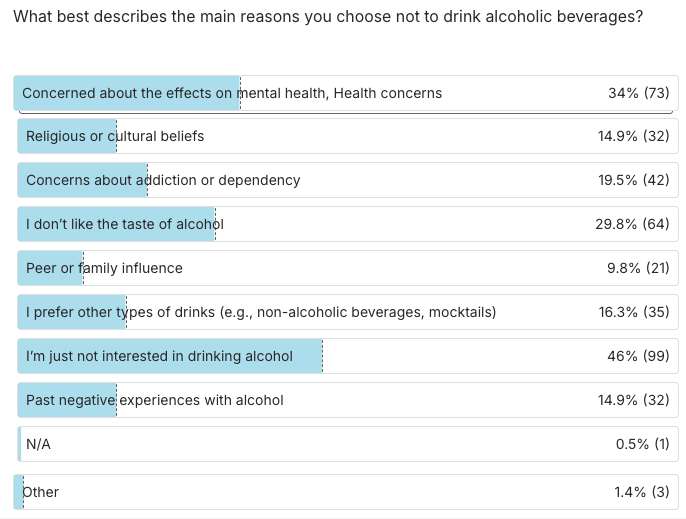

Of those we surveyed who do not drink alcohol, nearly half (46.0%) are just not interested in drinking and 1 in 3 (34.0%) abstain due to concerns for health and potential effects on mental health.

1 in 5 (20%) don’t drink due to concern about addiction, highlighting an acute awareness about the long-term impact of drinking alcohol. Additionally, with rising concerns around hang-xiety, depression, and stress, many in this generation view alcohol as a substance that could worsen their mental wellbeing.

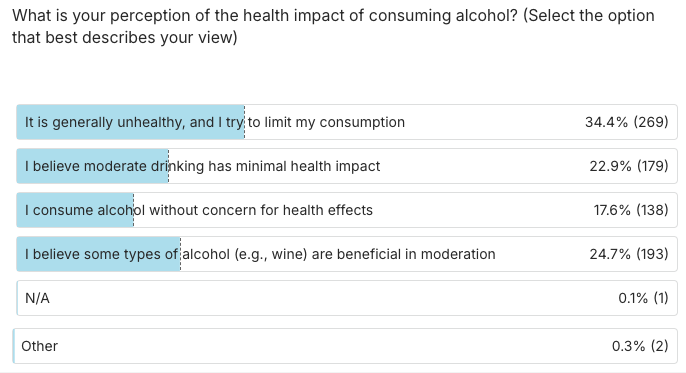

When it comes to those who do consume alcohol, over a third perceive a genuine health impact, and believe that it’s generally unhealthy and that they want to limit their consumption.

A quarter (24.7%) believe moderate consumption can be beneficial. This indicates an awareness of health risks and a balanced approach to drinking.

The harmful effects of alcohol, including addiction, are well-known today. Gen Z, with their exposure to health information from an early age through the internet and social media, seem to be acutely aware of these risks.

Drink choices vary by gender; drinking at home favored by all

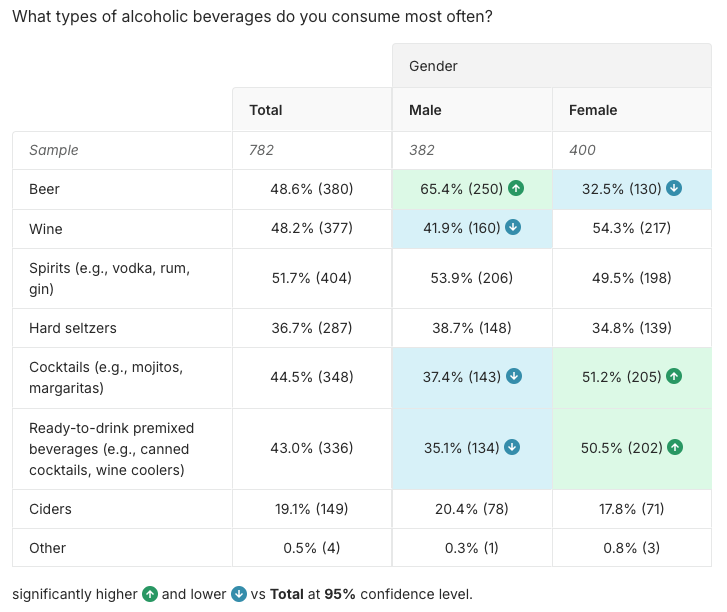

Spirits are the most popular, followed closely by beer and wine. Hard seltzers (36.25%) and ready-to-drink beverages (42.97%) are also gaining popularity showing a growing opportunity for portable on-the-go options and different flavor combinations.

Gendered differences appear when looking at the types of beverages preferred:

- Beer vs. wine: Males predominantly choose beer (65.4%) over other types, while females show a stronger preference for wine (54.3%).

- Cocktails and ready-to-drink options: Females show a significant preference for cocktails (51.2%) and ready-to-drink beverages like canned cocktails (50.5%), while males are less likely to favor these options.

These preferences indicate Gen Z’s inclination toward light, flavorful and convenient options.

Surprisingly, the majority of Gen Z claim they most often consume alcohol at home, either at their home (65.0%) or at a friend’s house (27.3%) indicating a preference for familiar, social settings over bars or clubs.

Gen Z’s motivations for drinking: taste, price and individuality

When it comes to buying alcohol, Gen Z has clear priorities:

- Taste explorers: For 2 in 3 (62.3%), taste is the primary factor influencing their alcohol choices, reflecting a preference for flavor and enjoyment over other considerations.

- Price consciousness: Price remains a key factor for 1 in 3 (32.0%) of Gen Z, which may be linked to budget-consciousness within this younger demographic.

- Convenience in purchase: 83.4% buy alcohol from supermarkets or liquor stores, while only 12.4% use online delivery services, suggesting that traditional retail outlets are still the preferred purchasing channel.

- Individuality vs social media recommendations: The majority of Gen Z (53.4%) say social media doesn’t influence their choice of alcohol much with only 1 in 10 (10.0%) saying it influences their buying choices.

These preferences show that while taste is paramount, affordability and accessibility are also important for Gen Z when purchasing alcohol. They are also not as easily swayed by typical influencer and social media marketing, which might be a surprise to some.

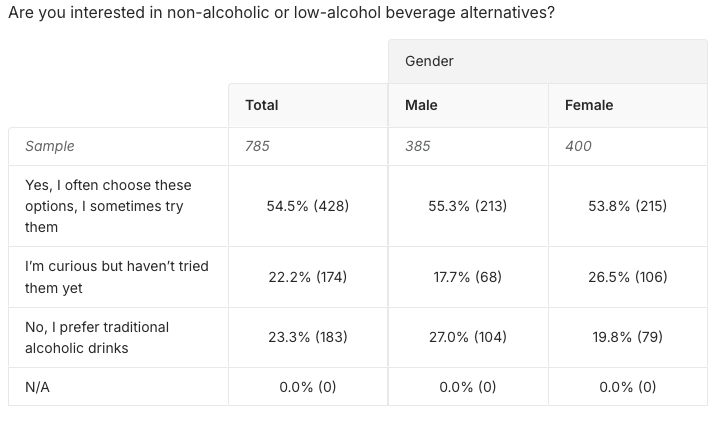

The rise of non-alcoholic alternatives

Another significant trend our data reveals is the rise in interest of non-alcoholic and low-alcohol alternatives. Gen Z is redefining what it means to ‘go out for drinks’ by embracing alcohol-free options that allow them to participate in social rituals without the effects of alcohol. Over half of respondents (54.5%) often or sometimes choose these options and another 22% are curious about trying non or low-alcohol alternatives.

Non-alcoholic beers, mocktails, and wellness drinks are increasingly popular among Gen Z and 12% have confirmed that the availability of these options has led them to switch to drinking non-alcoholic alternatives more often.

Interestingly, women seem to have a higher curiosity around these offerings in comparison to men.

Females also have a higher barrier to choosing them indicating a potential to reframe and educate this audience to understand appeal.

This shift is part of a broader move towards mindful consumption — whether it’s reducing alcohol intake or choosing products that align with personal values.

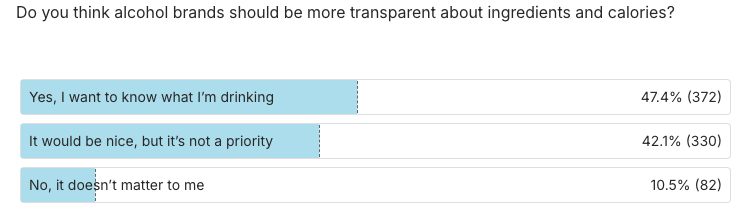

Demand for transparency in alcohol content and brand values

Gen Z’s demand for transparency in alcohol brands is clear with nearly half (47.5%) of alcohol drinking respondents wanting detailed ingredient and calorie information on their alcoholic beverages.

In addition to transparency, Gen Z’s expectations for brand values extend to social responsibility. This generation will hold brands accountable for their choices, with half (52.4%) agreeing they’re likely to stop purchasing from a brand if it supports a cause that conflicts with their beliefs. Consumers that are looking for transparency in their alcohol ingredients are significantly more likely to take action and buy elsewhere.

For alcohol brands aiming to appeal to Gen Z, meeting the call for transparency requires more than disclosing ingredients; it involves maintaining an authentic commitment to ethical practices and transparency across brand actions..

Conclusion: a new era of drinking

Gen Z’s relationship with alcohol is emblematic of a larger cultural shift toward mindfulness, health, and social responsibility.

As this generation moves into adulthood, they’re redefining what it means to drink — or not drink — alcohol. Our new survey data reflects a clear trend toward moderation, abstinence and the embrace of clean-label or non-alcoholic alternatives.

This change in drinking habits is not just a passing trend but could signal a long-term transformation in how society approaches alcohol. As Gen Z continues to influence social norms and consumer behaviors, the alcohol industry and society at large will need to adapt to this new era of mindful consumption.

How can businesses use these trends to appeal to Gen Z?

The alcohol industry is already adapting to Gen Z’s changing preferences. Many companies have expanded their offerings to include non-alcoholic products, and some are even marketing directly to sober or low-drinking consumers.

The rise of low-alcohol and non-alcoholic beverages reflects the growing demand for products that cater to health-conscious, mindful drinkers. This shift is likely to continue as Gen Z becomes a more dominant force in the marketplace.

These are the key takeaways from this new data that can help brands like yours make winning decisions…

Focus on health and transparency

Gen Z is conscious of health, with 1 in 3 believing alcohol is generally unhealthy. Offering low-calorie, clean ingredients or wellness-focused benefits will appeal to this audience. They are also interested in non-alcoholic beverage offerings.

Cater to less frequent drinkers

A sizable portion of Gen Z consumes alcohol sparingly. Providing single-serve, premium options or focusing on experiences (like special occasions) may align with their drinking habits.

Highlight at-home drinking experiences

The majority of Gen Z drinks at home, making this a critical area for engagement. Brands can create marketing around home gatherings, online experiences, and DIY cocktail kits to tap into this trend.

Prioritize in-store marketing and personalization

With the majority of purchasing happening in-store, marketers should not forget the importance of in-store influence. Social media is also seen with a critical eye among this audience — marketing should be personalized and transparent to be seen as authentic.

Tell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: