Gaming in 2025: what brands need to know

Gaming isn’t just a pastime anymore – it’s a massive, diverse industry that continues to shape entertainment, culture and the economy. How can brands like yours make the most of this ever-booming market?

Video games have evolved from a niche pastime to a cultural phenomenon. New technologies, changing player behaviors and growing opportunities for brands, mean that 2025 is set to be another bumper year for gaming.

We surveyed 1,000 consumers in the US to uncover the latest trends and what they mean for businesses looking to engage with this dynamic audience.

Quick summary

- 68.7% of consumers play video games regularly, with 36.5% playing daily.

- Mobile gaming leads with 69% of consumers playing on mobile devices, followed by 48.8% on consoles and 32.2% on PC.

- 71.3% of gamers notice in-game ads, but only 14.6% feel positively about them.

- Skippability (46.8%) and rewards (41.4%) are key features that make in-game ads acceptable.

- 20% of gamers are influenced by in-game ads, while 52.1% may engage with brands.

- Trends shaping 2025 include AI-powered experiences, subscription gaming, and cross-platform play.

Gaming is bigger than ever – and still growing

The global gaming industry is worth over $200 billion, and consumer interest shows no signs of slowing down.

Our research found that 68.7% of consumers play video games regularly. And over a third of surveyed respondents (36.5%) reported that they play games daily.

This frequency underscores gaming’s deep integration into daily life, making it a prime space for marketers to engage with audiences. Another 23.8% play several times a week, solidifying that over half of respondents are active gamers multiple times within any given week.

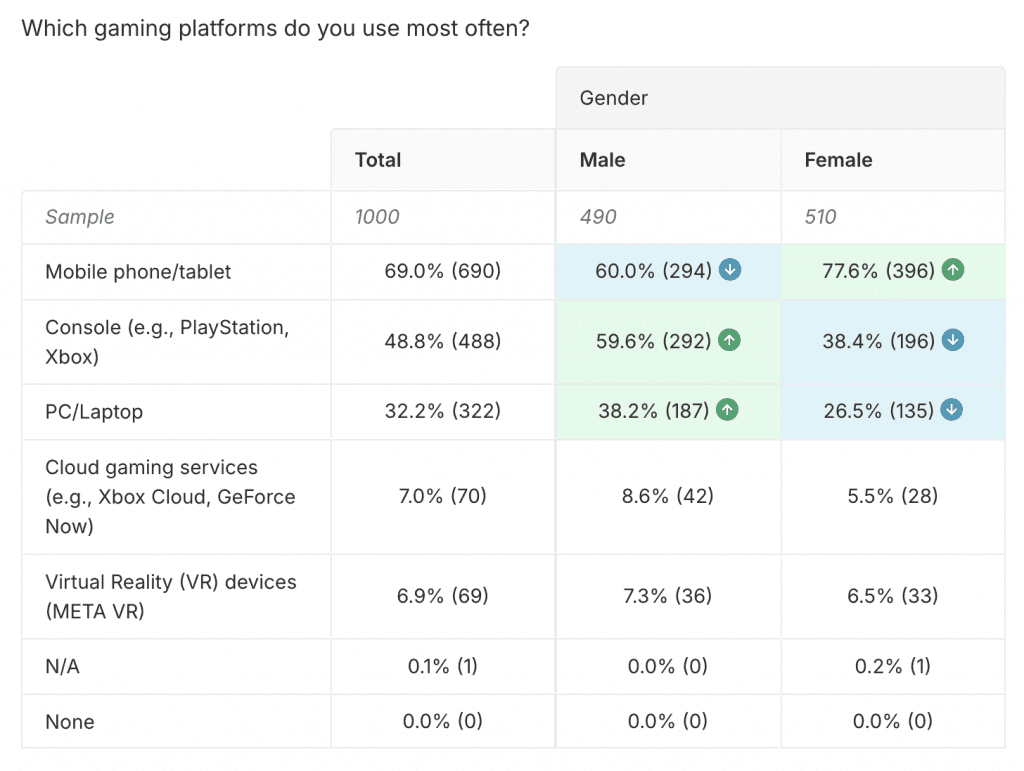

We also found that mobile gaming leads the charge:

- 69.0% play on mobile devices

- 48.8% game on consoles

- 32.2% prefer PC gaming

We also saw some significant gender splits when we looked at the platforms people use to game. Females are more likely to play on their phone or tablet, while males prefer a console or PC/laptop.

The takeaway? Mobile gaming continues to dominate, but there’s still significant engagement across other platforms. Brands looking to tap into gaming should consider multi-platform strategies to reach the widest audience.

Gender splits over game genres

We asked what genres of games people play most frequently. The responses revealed some clear gender differences.

Females overwhelmingly prefer casual or mobile games (70.1% compared to 46.5% of males). Whereas across the other genres, females showed significantly lower preference compared with males.

And getting into specific titles, here’s the Attest AI summary of people’s open-text responses:

The rise (and risk) of in-game advertising

Gaming is no longer just about playing – it’s a thriving digital ecosystem where brands can have a real presence.

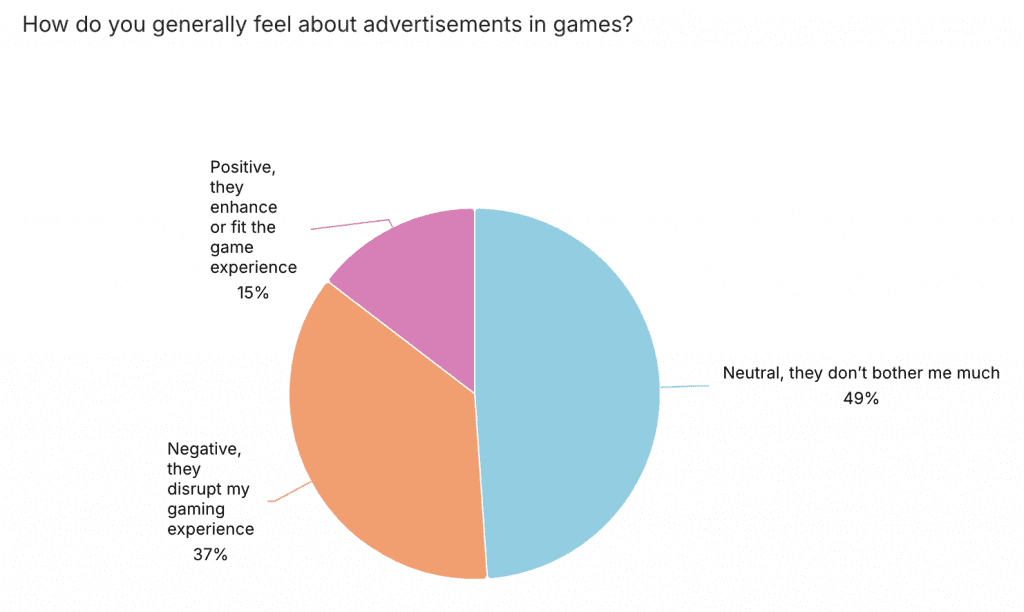

More than seven in 10 (71.3%) gamers say they’ve noticed ads while playing, but only 14.6% of people have a positive feeling about ads in games.

The message is clear: gamers don’t love ads, so you need to make them worthwhile.

We asked people to select what makes in-game ads acceptable to them:

- Skippability came out on top – 46.8% of people chose this

- Offering rewards like free items or in-game currency came second – 41.4% chose this.

And there are certain verticals that will likely have more success with gaming ads in the US. Nearly half (48.0%) of people said tech and gaming products is what would best fit in-game advertising, followed by entertainment (43.0%) and food/drinks (33.2%).

Do in-game ads influence purchase behavior?

When asked whether in-game ads influence their purchasing decisions, responses varied.

One fifth (20.0%) of gamers are open to being influenced, particularly when the ads align with their interests or enhance their experience.

More than a quarter (27.8%) of respondents said ads don’t influence them, suggesting that while ads may increase awareness, they rarely translate into direct action.

The remaining 52.1% said ads might influence their engagement with a brand. But some caution is required here – people’s interpretation of ‘engagement’ likely varies, and doesn’t necessarily translate into dollars spent across the board.

Make sure you drill down into your specific target market and segments to properly understand their opinions and behaviors.

What’s next for gaming in 2025?

As the industry evolves, several key trends are shaping the future of gaming:

- AI-powered game experiences: From NPCs with advanced intelligence to procedurally generated content, AI is making games more immersive than ever.

- The continued rise of subscription gaming: Services like Xbox Game Pass and PlayStation Plus are changing how players access and pay for games.

- Cross-platform play and metaverse-style experiences: The barriers between gaming platforms are breaking down, allowing for more seamless, social and immersive play.

What this means for brands

Gaming is no longer just about entertainment – it’s a cultural powerhouse with deep engagement and diverse opportunities for brands to connect with consumers.

Whether through in-game activations, influencer partnerships, or advertising that adds value to the experience, brands that understand the gaming world and respect its audience will see the biggest wins.

Get deeper into these insights with our interactive dashboard.

Tell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: