Flavor first: Why taste rules the yogurt and ice cream aisles

What’s driving people’s decisions when they buy yogurt and ice cream? Our new research reveals that it’s flavor, above everything else, that people prioritise. Not only is it the thing consumers look for, they’re prepared to pay more for it too!

Read on to learn more and hear the other insights from our latest research into the yogurt and ice cream industry in the US and the UK.

Quick summary

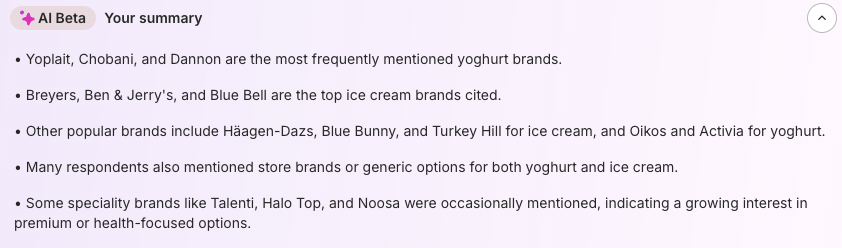

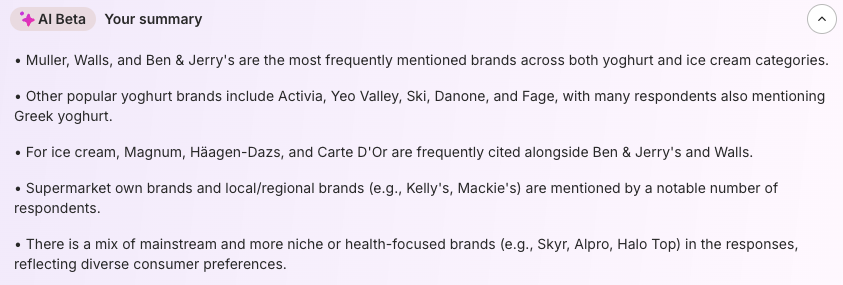

- Brand recognition matters – In the US, Yoplait and Chobani lead in yogurt brand recall, while Breyers is the top-mentioned ice cream brand. In the UK, Müller, Walls, and Ben & Jerry’s dominate.

- Flavor is king – Flavor is the top reason consumers choose a brand. In the US, 59.3% cite flavor as their primary decision driver.

- New flavors drive willingness to pay more – 43% of US consumers and 46.7% of UK consumers would pay extra for new flavors, making it the most lucrative product benefit.

- Premium = exotic flavors – 58% of US consumers associate exotic flavors with premium positioning.

- Generational splits in spending – Younger consumers (25-34) are significantly more willing to pay extra for product benefits than older demographics.

- Health and sustainability have an audience – While flavor wins overall, health-conscious and eco-friendly options like low fat, low carb, and sustainable production also attract consumer interest, particularly in the UK.

What US consumers think about yogurt and ice cream

Here’s a breakdown of the yogurt and ice cream survey results from the US.

Which brands lead the pack?

Unaided brand recall – the holy grail for any consumer brand – gives us a good overview of the yogurt and ice cream market:

New flavors are a money-spinner

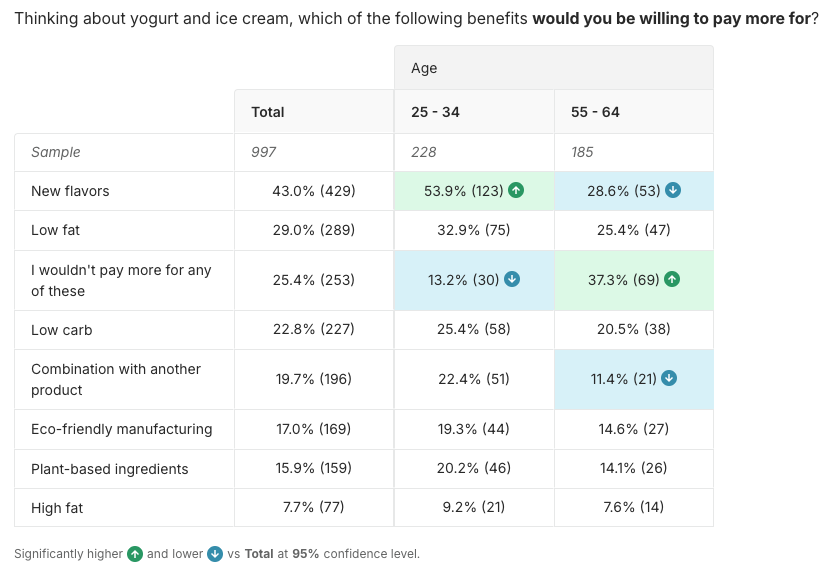

We asked what product benefits consumers would be willing to pay more for. New flavors came out the clear winner, with 43% choosing this, followed by low fat (29%) and low carb (22.8%).

It’s worth noting that a quarter of consumers (25.4%) said they wouldn’t pay more for any of the benefits we listed. It’s clear that while there’s plenty of appetite for some USPs, you shouldn’t forget that a lot of people just won’t pay more, regardless of how you frame your product.

When we dig into age groups, there are a couple of interesting nuances. People aged 25-34 are more willing to pay for new flavors (52.9%) while people aged 55-64 are considerably less willing to fork out (28.6%). In fact, that older group is significantly more likely not to pay more for any benefits.

And exotic flavors = premium product

Overwhelmingly, people associate exotic flavors with premium yogurt and ice cream.

Nearly 3 in 5 people (58%) chose this. When compared with the next most popular options – low fat (30%), eco-friendly manufacturing (27%) and low carb (27%) – it’s clear that offering new and interesting flavors to your target customers is a great way to go.

Flavor leads brand preference (surprise!)

When asked what are the main reasons people choose their preferred yogurt or ice cream brand, flavor comes top again.

Almost 60% (59.3%) said they choose a brand because they like the flavors they offer. The top options US consumers chose were:

- I like the flavors they offer – 59.3%

- I trust the brand and its quality – 49.1%

- It offers good value for money – 41.9%

- It feels like a special treat – 32.2%

- It’s easy to find in stores/online – 27.8%

What UK consumers think about yogurt and ice cream

And now turning to the UK results…

The UK’s leading yogurt and ice cream brands

Here’s the AI summary from the Attest dashboard, summarising what our UK respondents said when asked which brands they think of:

Flavo(u)r is also king in the UK

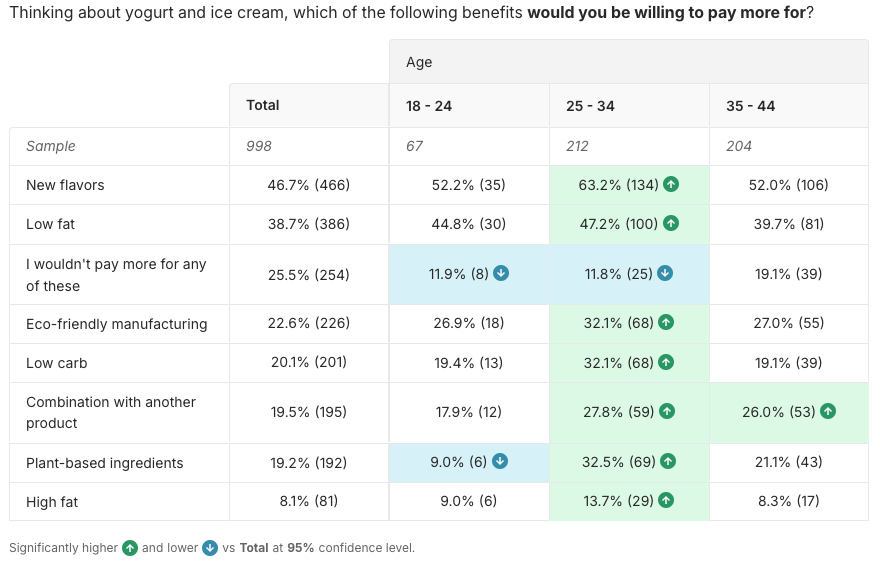

Matching the result from the US, ‘new flavors’ was the benefit the biggest group would be willing to pay more for. Nearly half (46.7%) of Brits chose this.

‘Low fat’ came second – 38.7%. Notably, the gap between ‘new flavors’ and ‘low fat’ was significantly smaller in the UK than it was in the US: ‘new flavors’ dominates in the US with a +14 point difference, which shrinks to an +8 point difference in the UK.

Gen Zennialls have cash to burn

When we drill down into which age groups in the UK would be willing to pay more for specific product benefits, we see a particularly interesting result.

Our results show that 25-34-year-olds are significantly more likely to pay more, for every product benefit we suggested. It seems that younger shoppers are more interested in innovation than older groups, and are prepared to pay more for it.

Tell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: