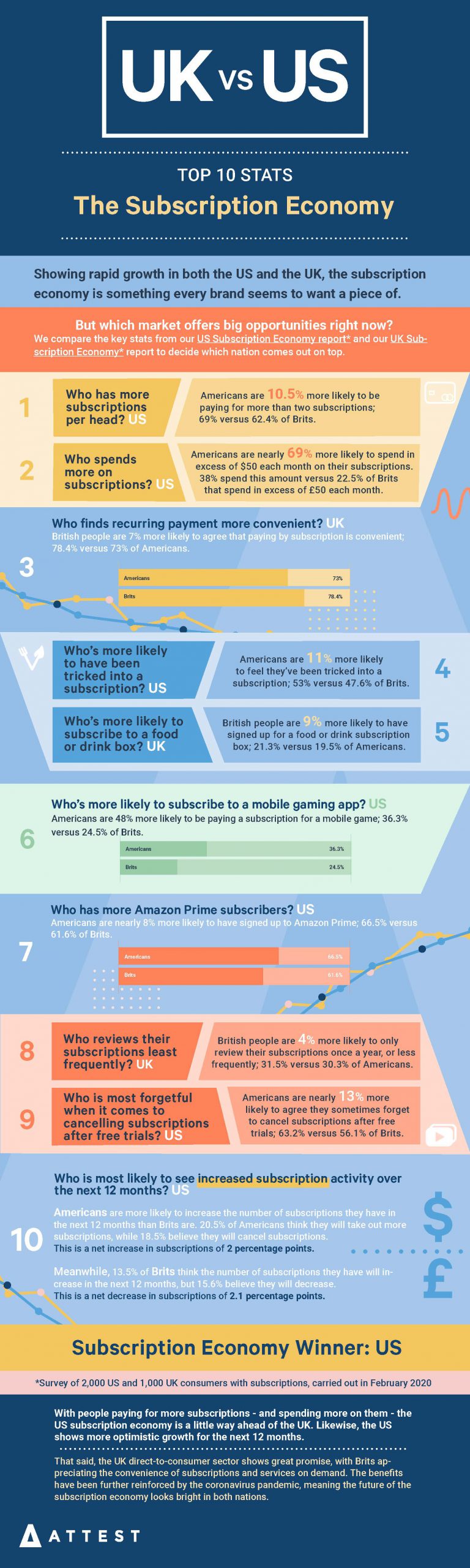

Subscription economy face-off: UK vs US

The subscription economy is something every brand seems to want a piece of. But which market offers big opportunities right now? We compare key stats from our UK and US Subscription Economy reports in an at-a-glance infographic.

- The UK vs the US subscription economy - 10 key stats

- . Who has more subscriptions per head? The US1

- . Who spends more on subscriptions? The US2

- Who finds recurring payment more convenient? The UK3.

- Who’s more likely to have been tricked into a subscription? The US4.

- Who’s more likely to subscribe to a food or drink box? The UK5.

- . Who’s more likely to subscribe to a mobile gaming app? The US6

- . Who has more Amazon Prime subscribers? The US7

- . Who reviews their subscriptions least frequently? The UK8

- Who is most forgetful when it comes to cancelling subscriptions after free trials? The US9.

- Who is most likely to see increased subscription activity over the next 12 months? The US10.

- The Subscription Economy Opportunity Winner: The US

Showing rapid growth in both the US and the UK, the subscription economy is something every brand seems to want a piece of.

But which market offers big opportunities right now? Check out our at-a-glance infographic where we compare the key stats from our US subscription economy and UK subscription economy reports*

*Surveys of 2,000 US and 1,000 UK consumers with subscriptions, carried out in February 2020

The UK vs the US subscription economy – 10 key stats

1. Who has more subscriptions per head? The US

Americans are 10.5% more likely to be paying for more than two subscriptions; 69% versus 62.4% of Brits.

2. Who spends more on subscriptions? The US

Americans are nearly 69% more likely to spend in excess of $50 each month on their subscriptions. 38% spend this amount versus 22.5% of Brits that spend in excess of £50 each month.

3. Who finds recurring payment more convenient? The UK

British people are 7% more likely to agree that paying by subscription is convenient; 78.4% versus 73% of Americans.

4. Who’s more likely to have been tricked into a subscription? The US

Americans are 11% more likely to feel they’ve been tricked into a subscription; 53% versus 47.6% of Brits.

5. Who’s more likely to subscribe to a food or drink box? The UK

British people are 9% more likely to have signed up for a food or drink subscription box; 21.3% versus 19.5% of Americans.

6. Who’s more likely to subscribe to a mobile gaming app? The US

Americans are 48% more likely to be paying a subscription for a mobile game; 36.3% versus 24.5% of Brits.

7. Who has more Amazon Prime subscribers? The US

Americans are nearly 8% more likely to have signed up to Amazon Prime; 66.5% versus 61.6% of Brits.

8. Who reviews their subscriptions least frequently? The UK

British people are 4% more likely to only review their subscriptions once a year, or less frequently; 31.5% versus 30.3% of Americans.

9. Who is most forgetful when it comes to cancelling subscriptions after free trials? The US

Americans are nearly 13% more likely to agree they sometimes forget to cancel subscriptions after free trials; 63.2% versus 56.1% of Brits.

10. Who is most likely to see increased subscription activity over the next 12 months? The US

Americans are more likely to increase the number of subscriptions they have in the next 12 months than Brits are. 20.5% of Americans think they will take out more subscriptions, while 18.5% believe they will cancel subscriptions. This is a net increase in subscriptions of 2 percentage points.

Meanwhile, 13.5% of Brits think the number of subscriptions they have will increase in the next 12 months, but 15.6% believe they will decrease. This is a net decrease in subscriptions of 2.1 percentage points.

The Subscription Economy Opportunity Winner: The US

With people paying for more subscriptions – and spending more on them – the US subscription economy is a little way ahead of the UK. Likewise, the US shows more optimistic growth for the next 12 months.

That said, the UK direct-to-consumer sector shows great promise, with Brits appreciating the convenience of subscriptions and services on demand. The benefits have been further reinforced by the coronavirus pandemic, meaning the future of the subscription economy looks bright in both nations.

Want to explore the opportunities of the subscription economy for your brand? Book a chat with one of our experts to discuss quick, easy and effective market research.

Tell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: