16 Brand positioning survey questions that work

Do you know how your brand is positioned in the market? Use these brand positioning survey questions to find out & make smarter decisions about your brand.

Tinder and Bumble. Spotify and Apple Music. Nike and Adidas. Such similar products, yet in our minds, the brands are clearly differentiated. Why is that?

It has everything to do with positioning. People will place you somewhere in the market and their mind whether you like it or not, so better make sure you play a proactive role and get the best seat in the house.

It all starts with understanding what the market looks like and how people perceive your position in it (you can even use your understanding to give yourself some fresh brand extension ideas.) The best way to find out is by going straight to your target customers and asking them where they’d place you.

To help you get started, we’ve drawn up a list of sixteen questions that will help you determine your brand image.

But first, we’ll dive into what brand positioning is all about, and why you want to start asking these questions.

What is brand positioning and why is it important?

Brand positioning is about where consumers place your brand in the market—or, from another perspective, in their minds. It’s a perception of market range: do they see you as high-end or mid-range, or as low-end? It can also include other factors like taste, sustainability, convenience and much more.

You can visualise brand positioning in a perceptual map, in which you also place your competitors. You choose two attributes you want to focus on, and then put you and your competition into the map in the right place.

But brands don’t simply get to decide where their spot in the map is. You probably have a desired position, but consumers ultimately decide where they’d place brands, based on their experiences and impressions of the brand. You can adjust your brand development strategy to reach your desired position in the market.

That does mean, however, that everything your brand does—all of your interactions with customers—has an effect on your brand recognition, how you measure brand awareness, and brand image.

Why is brand positioning important?

Brand positioning is important to keep in mind when creating your brand’s values, tracking your brand and solidifying your brand image, brand identity and competitive strategy. Knowing where you stand in the eyes of consumers will help you define more effective marketing messages and select the right channels to communicate those.

Get the lowdown on how consumers position your brand over time with Attest’s brand tracker. Here’s what you need to know before you create your brand tracker. And with our brand tracking survey template you can start learning about your brand’s perception and positioning from today!

Brand positioning survey questions examples

- When you think of this brand, what comes to mind?

- How did you become aware of [brand] and the products/services they offer?

- What was your first impression of [brand]?

- Which other brands did you consider?

- Why did you choose [brand] over [competitor brand]?

- Rank these brands on price/quality/relatability on a scale from 1-10.

- What would you say is the biggest difference between [brand] and [competitor brand]?

- Which adjectives do you think best describe [brand]?

- If [brand] was a celebrity, which one of these below would we be?

- Who do you think [brand] is made for?

- How has your perception of [brand changed] over the last few months?

- How does buying/using [brand] make you feel?

- What elements do you consider when shopping for [product category]?

- How would you describe [brand] to a friend?

- Which of the following events/actions would influence you to switch providers?

- How would you describe your last experience with [brand]?

See our brand tracking templates and real-life surveys

Our in-house experts—the Customer Research Team—have written these brand tracking survey templates that are ready to go! And see the examples surveys we’ve sent to real consumers.

Our pro tip: mix, match and message

Every brand perception survey will look different, based on what you already know, and what you’re researching.

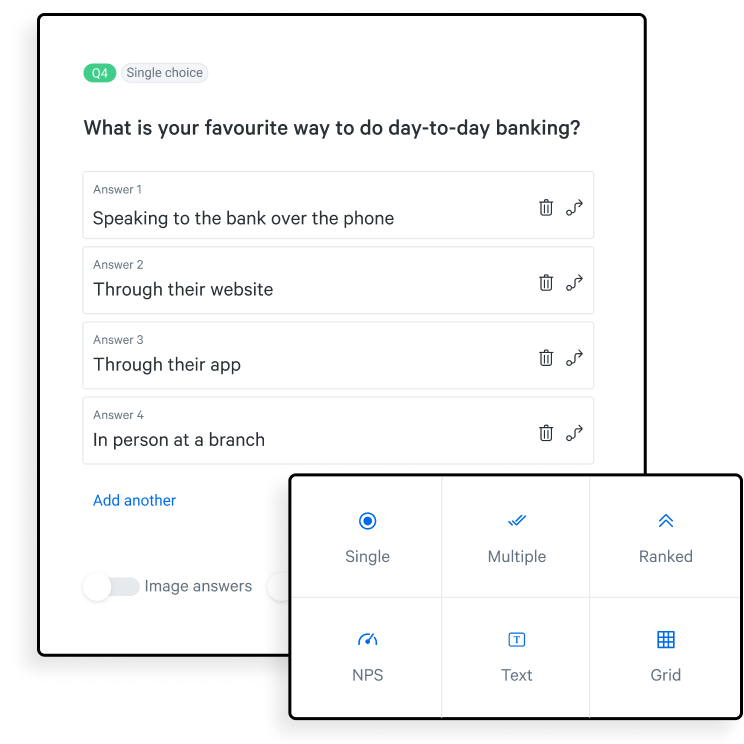

If you’re looking for some inspiration, use this list to shape your survey and pick out whatever applies to you! Try to make a mix of open text and closed questions: nobody is waiting for a long, only open-text survey to fill their day.

Try to use language that shows you are talking about “our” brand. This will bias respondents into giving a positive answer.

The benefits of conducting a brand positioning questionnaire

Time to talk to your target audience! There’s no better way to figure out where you stand in your target market, than asking them directly. Here’s how conducting a brand positioning survey can help your brand and business, especially if you notice the signs of a weak brand.

Determining your current brand position versus your desired positioning

It’s crucial to find out if there’s a gap between your actual and desired brand positioning. A positioning survey will help you find out where your messaging or channels are falling short.

Finding your competitive edge

Brand perception surveys look at the full picture and compare you to your competitors, instead of just looking at your USPs on their own.

By asking the right questions, you can easily find out what your real competitive edge is in the eyes of your target market and double down on those brand qualities.

Formulating better marketing messages

You don’t want to just be top-of-mind, you want to be the first choice for the right reasons. With brand perception surveys, you can find out what factors matter most to consumers and adapt your marketing and communication to this.

Discovering the key to customer loyalty

Brand positioning (or re-positioning) is also about why consumers choose brand X over brand Y. Knowing this information will help you define strategies that really tie people to your brand.

For instance, if you find out price and convenience matter most, set up loyalty programs or send out even more personalised product recommendations.

Choosing your brand positioning strategy

What will you do with all that information about your brand’s position in the market? You’re going to want to use it for a solid brand position strategy.

Having this in place will make it easier to make decisions about product, service and marketing messages. Here are some ideas on what positioning you could focus on.

Customer service positioning strategy

If your target audience appears to prefer brands that put customer service first, you can make your strategy revolve around that.

This means doubling down on the way you offer help, pre- and post-purchase. Think knowledge bases, smart FAQs and dedicated customer support agents or account managers.

Convenience-based positioning strategy

Free shipping, a flexible return policy, quick delivery: these are all elements that make peoples’ lives easier.

If you’re going for the convenience-based positioning strategy, find out what competitors are doing and how you can outsmart them by providing even quicker or better services.

Price-based positioning strategy

For certain markets or products, a price-based positioning strategy is the best way to go. This often happens in very crowded markets where there’s little differentiation in product features or service.

Quality-based positioning strategy

Some people perceive Apple phones as of higher quality than Samsung. It’s often not clear what they base it on—who really studies the specs of the phone camera?—but it has a lot to do with how both Apple and Samsung communicate about their products.

If you’re looking to adopt a quality-based position strategy, the quality of your communication and service matters just as much as the quality of your products.

Differentiation strategy

Ready to do things differently? The differentiation strategy is ideal for companies who are looking to shake things up. Think of healthy candy, sustainable on-demand clothing, or fully digital banks.

Get started with Attest

Start using consumer research to provide confidence in every decision with the right insight, at the right time.

Get started for free16 questions for a brand positioning survey

Here are 16 example questions for your brand perception survey. These brand perception survey questions are meant as a guide to steer you in the right direction when running your brand survey and market research—there are no hard and fast rules for market research, so there’s absolutely nothing wrong with adding your own flavour to your brand survey.

1. When you think of this brand, what comes to mind?

This open-ended question shows you what people think of when they see a brand, which is a great starting point for figuring out your current positioning.

If you’re looking to determine whether your desired position and actual positioning are a match, the answers to this question will help you get started. For instance, people might think of your stellar customer service first, when you’d actually like them to notice your price-to-quality ratio.

2. How did you become aware of [brand] and the products/services they offer?

Where people find out about your brand is relevant to your brand positioning, because it helps you determine which channels and messages are most used and resonate best with your target customers.

Moreover, the channel often also influences the first impression people have of your brand.

3. What was your first impression of [brand]?

Was it love at first sight, or did they grow to like you? Often, the first impression we have of a brand sticks with us and solidifies the positioning of that brand in our mind, so find out what people think of your brand or product when they first lay eyes on it.

Follow up with questions that will help you find out if their opinion has changed, and what helped change it. We’ll give some example questions for that below!

4. Which other brands did you consider?

Positioning is only relevant if you put it in perspective: find out what other brands consumers put in the same quadrant as yours. When defining your positioning, it’s crucial that you take into account what your position is related to your competitors.

It’s great to know that people see you as a reliable and cost-efficient choice, but that doesn’t mean anything if you don’t look at where other brands stand.

5. Why did you choose [brand] over [competitor brand]?

Following up on the previous question, you can dive a little deeper into how people differentiate between specific brands in your product category, and what people value in your brand.

This question will also show what matters to shoppers in general: do they mention price a lot, or do they value other aspects such as sustainability, customer service or location more?

6. Rank these brands on price/quality/relatability on a scale from 1-10.

After you’ve determined which factors are important to consumers when shopping in your product category, you can ask them to rank you and your competitors based on these factors.

This is an easy exercise to find out how customers perceive you and other brands and helps you draw up a simple perceptual map.

7. What would you say is the biggest difference between [brand] and [competitor brand]?

If it’s a close call between you and another brand, you can use this question to find out what people think sets you apart from a certain competitor. With these kinds of questions, it can help to give people a few examples of adjectives to choose from, based on previously given answers.

8. Which adjectives do you think best describe [brand]?

Word associations are a great way to find out what people are thinking of when they hear, see or use your brand. You can make this a multiple-choice question and give people options. Be aware that you’re not merely fishing for compliments, and give them options of adjectives you’d rather they don’t pick.

Here’s some inspiration:

- Simple

- Complex

- Expensive

- Cheap

- Reliable

- Adventurous

- Classy

- Authoritative

- Calm

- Down to earth

- Inclusive

- Luxurious

- Practical

- Indulgent

- Accessible

- Inspirational

- Witty

- Inspiring

- Safe

- Calm

9. If [brand] was a celebrity, which one of these below would we be?

Sometimes it’s easier for people to compare your brand to widely known celebrities than it is to describe it in a few words. This fun question can help spark people’s imagination and help them with other questions down the road.

Make sure you pick celebrities who are known to your target group, and have clear differences between them. For instance: George Clooney and Pete Davidson, or Kim Kardashian and Taylor Swift.

10. Who do you think [brand] is made for?

Chances are, your customers aren’t necessarily seeing themselves as a ‘target group’, but if they would describe themselves as consumers, what words would they use?

With this question, you ask them to put themselves in a certain group of people, which can be a great aid in defining where you stand in the market.

11. How has your perception of [brand] changed over the last few months?

Unfortunately, positioning is rarely static—unless you’re a giant like Coca-Cola. For a lot of brands, events in their market can easily affect their positioning. A campaign gone wrong, a new product line, rebranding or even the entrance of a new competitor in the market could shift the way things are positioned in your market.

Find out what has changed and what events led to these changes. You can make this question easier to answer by giving people options: their perception hasn’t changed, it changed for the better, or it changed for the worse.

Follow up with a question that will help you determine what exactly sparked that change.

12. How does buying/using [brand] make you feel?

Does someone feel confident when buying your brand? Do they feel proud and want to show off their new products to the world, are they excited to try your innovations or are they dreading the learning curve?

Find out how people feel when they buy or use your brand, and you’ll get a better idea of their buying reasons and therefore your positioning.

Plus, you can use this information for your next campaign and to improve your messaging.

13. What elements do you consider when shopping for [product category]?

To create a perceptual map, you’ll need two of the most important factors people consider when shopping for your product category. Is it price and quality? Sustainability and innovation?

Whatever it is, with this question you can find out and start drawing up an accurate map.

14. How would you describe [brand] to a friend?

This is a great open-text question to find out what people will highlight when talking about your brand, which makes a lot clear about your positioning.

Keep an eye out for words or phrases that are often repeated and group related words in word clouds to visualise this data.

15. Which of the following events/actions would influence you to switch providers?

What would a price drop mean for your positioning? Or your competitor introducing a sustainable line of products?

This question would help you find out what’s most likely to tip the scales in your positioning so you can get ahead of the game.

16. How would you describe your last experience with [brand]?

Your brand positioning is about so much more than your product or price—the experience your target audience has with your brand and general customer satisfaction will also give you valuable insights into your brand’s positioning.

These 16 questions are just the start! Learn about 100 great survey questions and examples.

Partner with Attest to improve brand positioning

Now, you’ve got the questions, we’ve got the tools. You can start building your own brand positioning survey in just a few clicks.

Tell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: