Delivery fees – or delivery for free?

With the cost of living rising, are consumers less willing to pay delivery fees for subscription products? We investigate...

Who doesn’t love the convenience of having items delivered to their door? And the regular treats provided by D2C subscription brands have seen the sector surge in popularity in recent years.

However, providing high-quality products at a reasonable price on a regular basis is a challenge. Delivery charges are one especially tricky part of the equation—it’s a cost manufacturers and retailers have no choice but to pay, but thanks to the likes of Amazon Prime consumers have become used to paying little or nothing for receiving good ordered online.

We questioned consumers in the US and UK to find out exactly how important delivery fees—or lack thereof—are when choosing which D2C subscription brands to sign up to.

If you want to interrogate the data for yourself, then you can do so using our insights dashboard.

And read on for our report of the results.

Top 3 takeaways from the research

- How much importance you attach to delivery charges depends on your age. Respondents in the 18-25 age group—Generation Z—are least bothered.

- Certain categories are more price sensitive than others. People expect lower delivery charges for toiletries & cosmetics than they do for clothing & shoes.

- Americans are more prepared to pay for delivery than Brits, but location matters. In the UK rural consumers are most swayed by free delivery, while those in western and West Coast US states are most likely to cite this as the key factor in their decision.

Results

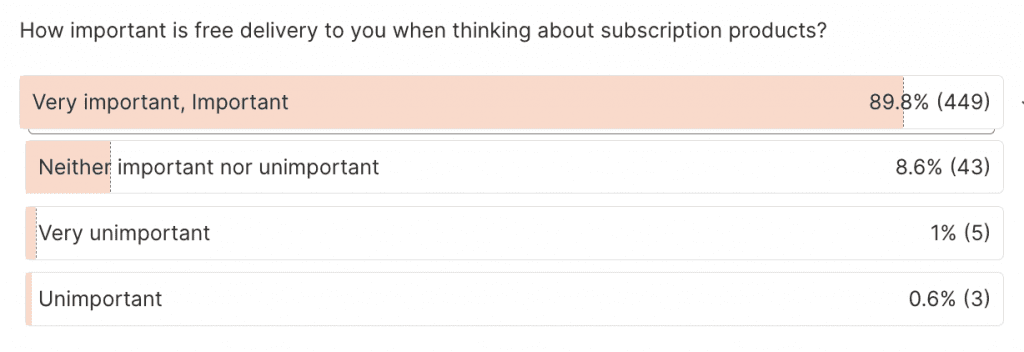

Value for money is the top concern for consumers

When asked to choose from a list which factors they find important when signing up to a subscription, consumers in the UK chose ‘offers value for money’ as their top concern (73.2%), followed by ‘easy to pause or cancel’ (58.8%), with ‘free delivery’ coming in third (55.4%). Respondents in the US agreed that value for money was the most important factor (62.3%), but chose free delivery in second place (59.5%).

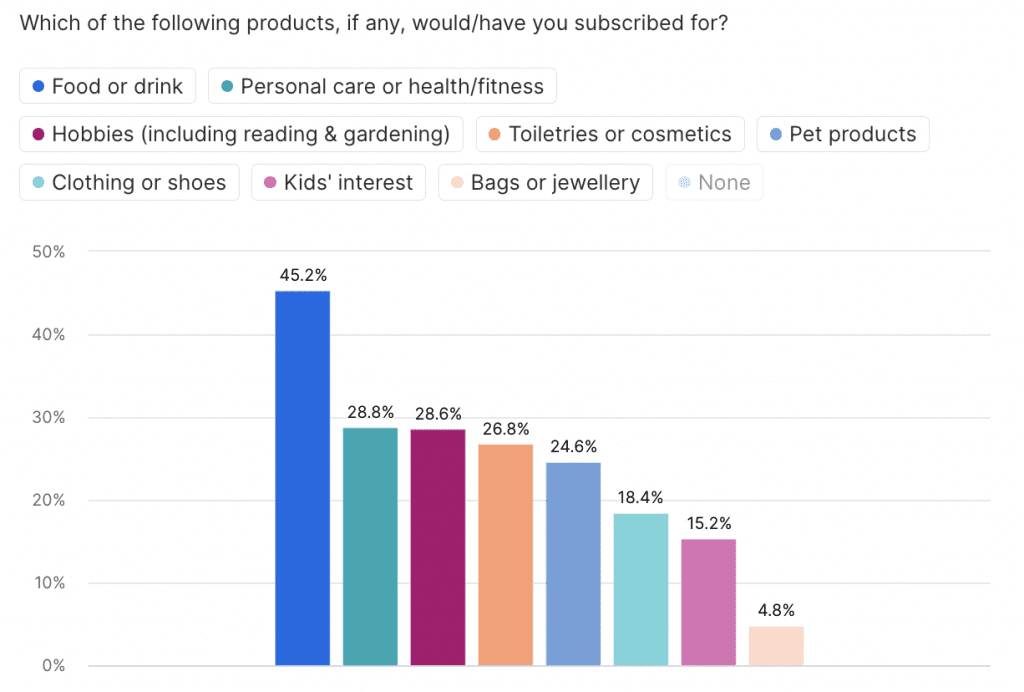

UK results:

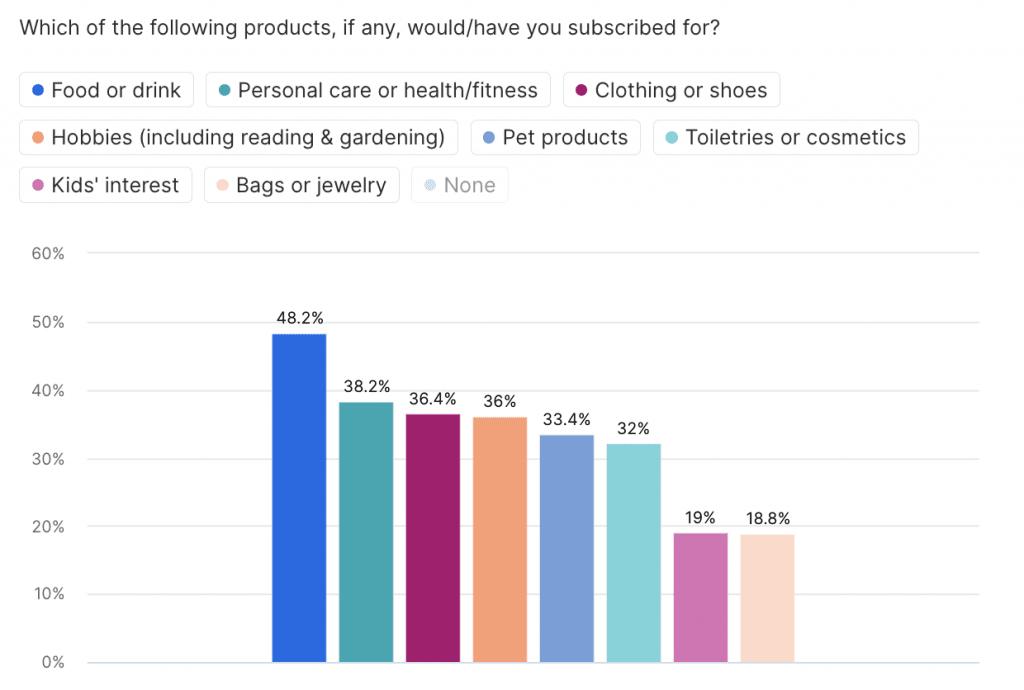

US results:

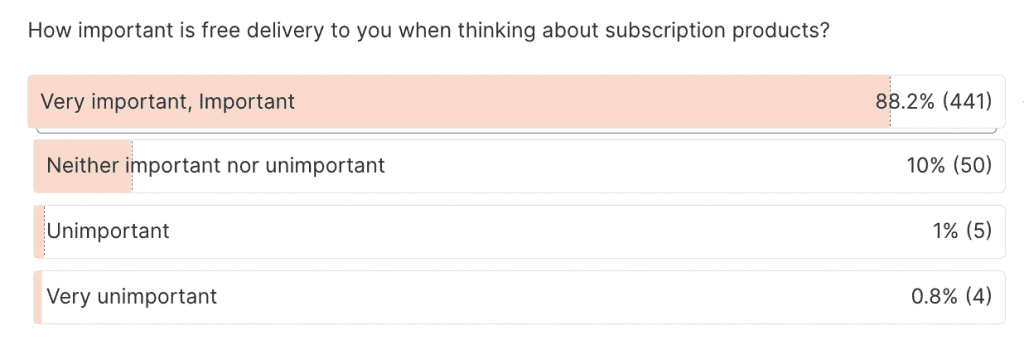

There are some interesting generational differences when we dig a little deeper. When we asked how important free delivery was to them, respondents aged 18-25 were least bothered—in the US, 78.8% in Generation Z said it was either very important or important, and this rose to 81.7% in the UK. American Boomers consider free delivery most important (94.1%) but—perhaps surprisingly—in the UK, Millennials score higher than any other generation at 93.4%.

The lesson here for D2C brands is that free delivery has broad appeal to all age groups in an increasingly cost-conscious world. By minimizing delivery charges brands have a better chance of being perceived as offering value for money.

UK consumers expect delivery baked-in to subscription price

We asked respondents how much they would be prepared to pay for delivery for different types of subscriptions. In the UK, the point at which most consumers would be put off signing up was between £2 and £3 across all categories, but cheap or free delivery was especially important for subscriptions to food & drink, hobby-related products, personal care/health products, and cosmetics. It seems that in the UK, consumers expect delivery to be bundled-up in the overall price of the D2C experience (and that any additional delivery charges are minimal).

In the US, respondents were more likely to accept higher delivery charges, with $5 proving to be the threshold. But there were still significant numbers of people willing to pay more than $5 for delivery. Food & drink commands the most at 18%, followed by personal care/health & fitness (14.4%), and clothing & shoes (14.2%).

On the other hand, only 7.6% of people would pay over $5 for the delivery of bags & jewlery, and 7.2% for kids’ products. Toiletries & cosmetics is another price-sensitive category, with 4.8% of people not prepared to pay for delivery at all. Understanding category sensitivity is valuable for D2C companies while living costs are rising and consumer willingness to pay may be falling.

Regional variations show that location matters

When you break down the results by region there are some notable variations. Those in the Western US and West Coast states rank free delivery as being even more important than value for money when considering a subscription service (60.5% vs 57.0%). However, respondents in the Northeastern states were most likely to declare free delivery as being ‘very important’ to them at 65.2% vs the national average of 60.4%.

US results:

UK results:

In the UK, free delivery is especially important to people in Wales (96.0%), Scotland (95.0%), the West Midlands (93.3%) and the North East of England (100%). Ignoring tired stereotypes; this is useful information about where D2C brands and companies cannot and should not make changes that pass-through delivery costs.

It’s evidently also important for D2C subscription brands to consider regional variations when expanding their service so they can balance the costs of the increased mileage against the varied expectation of free delivery.

If you want to delve deeper into the research then feel free (you’ll find the US Survey here and the UK Survey here) but if you want to find out how Attest can help you deliver what your customers really want then get in touch.

Tell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: