23 Brand growth strategies you’ll want to steal

Discover what brands like Cadbury, Starling Bank and Enterprise are doing to grow revenues with these 23 brand growth strategy examples.

Does your brand growth strategy need a shake up? If you’re not sure what direction to head in next, it helps to see what others are up to.

That’s why we’ve gathered together 23 brand growth strategy examples highlighting the different tactics that brands like Cadbury, Gymshark and Lego are using to grow brand equity and revenues. And don’t miss these other top brands who’ve had great success from their brand tracking projects.

With case studies from across a range of sectors, including food and beverage brands, tech, consumer finance, fashion and gaming, you’ll find plenty of inspiration. Read on for ideas you can apply to your business (don’t worry, even the most original brands sometimes ‘borrow’ stuff!)

What is a brand growth strategy?

A brand growth strategy is a comprehensive plan for a company to increase brand equity and market share over time. To develop an effective brand growth strategy, you need to consider a variety of factors that can affect your brand’s success. For example, brand awareness, perception, association and consideration can all play a significant role in a user’s decision-making process when choosing a brand.

A company’s overall brand awareness strategy may include a combination of different strategies, such as market penetration, market development (entering a new market with an existing product), brand development, new product development and diversification. It all starts with using a brand awareness tracker to know where you’re at now, and assessing how your brand’s perception and awareness change over time. Then, by taking a strategic branded approach and considering all the factors that can impact your brand’s success, you can create a plan that sets them up for long-term growth and success.

How to measure brand awareness

Here’s what you need to know about measuring how aware consumers are about your brand—and use this to guide your brand strategy!

Get your copy now!23 brand growth strategies you can steal

Porsche brand growth strategy: finding a new audience

For the launch of their new electric vehicle – the Porsche 99X Electric Formula E race car – Porsche wanted to engage a brand new, hard to reach audience. The carmaker wanted to target 18 to 34-year-olds who weren’t already targeted by traditional TV and radio advertising.

Porsche teamed up with Twitch, the live-streaming platform for gamers, to create an interactive “play your own adventure” gameplay ad. It took viewers four hours to figure out the puzzles in the ad, where viewers controlled the IRL actions of two drivers in order to reveal (or “unlock”) the new car.

The experiment was a huge success, with almost a million people playing the game across the four hours it was live on Porsche’s Twitch channel. It was also the most viewed live stream globally and generated a storm of engagement in the platform’s chat.

Enterprise’s brand growth strategy: a savvy sponsorship

When car rental company Enterprise found trust levels around renting had fallen, they needed an influential brand with unrivalled access to their target audience to change this.

Enterprise partnered with Absolute Radio to sponsor the station’s 2019 Isle of Wight Festival coverage. The mission was to improve awareness of Enterprise as a rental car company and increase consideration of Enterprise for listeners’ next vehicle hire.

Research found that Absolute Radio’s audience of “Reluctant Adults” (people who balance responsibility with adventure) were 80% more likely than the UK average to have hired a vehicle in the last 12months.

Enterprise activated the sponsorship with a four-week “Road to the Isle of Wight Festival” content programme, bringing exclusive coverage through integrated talent involvement, audience engagement and online activity.

The sponsorship campaign succeeded in reaching over 6.8 million of Enterprise’s target audience, achieved a 47% conversion rate for the competition the brand was running and 155,906 video views on social posts. Consideration of Enterprise amongst heavy Absolute Radio listeners grew by 6% and perception of Enterprise as ‘trustworthy’ grew by 3%.

Shell’s brand growth strategy: using intent to purchase marketing

Consumer research carried out by Shell found that low interest in motor oil meant consumers spent very little time deciding which brand to buy. To combat this, Shell realised they needed to reach potential customers before they go to the store.

Working with Mediacom, Shell began mapping online data points for millions of consumers, which included an individual’s search behaviour, their contextual interests, in-market data and geographic data, in order to accurately predict when motorists would need to buy oil.

“We turned to applied advanced data science to predict when individuals would be in the market for motor oil. We defined high-value actions as signals of purchase intent, such as visiting the workshop locator page of Shell.com, or oil-change specialist workshop visits (using geolocation data),” Mediacom explained.

“We then mapped these hundreds of signals of purchase intent for the millions of individuals in Shell’s digital ecosystem. Predictive analytics and machine learning gave each individual an ‘intent to purchase’ (ITP) score from 1-10, based on their likelihood to purchase motor oil.”

With this insight to hand, Shell was able to focus their marketing investment on people with high purchase intent scores. This led to a record-breaking ROI of 4.44 for every marketing dollar spent in the US and 2.49 in China. Shell is now rolling out intent to purchase marketing across every global market.

Papa John’s brand growth strategy: supporting charity

Everyone knows you don’t give to receive… but supporting a charity can result in favourable exposure for a brand. It allows you to make a positive statement about your brand values, which consumers can buy into.

Papa John’s did this in an innovative way. Instead of paying a creative agency thousands of pounds to create its Christmas 2020 campaign, the pizza company produced a DIY ad in-house. The money saved by the brand was donated to Crisis and the Trussell Trust.

The stop-motion ad featured pizza boxes, which internal staff had written on with marker pen to explain the charity initiative. Not only was it an effective way to highlight two of the most prevalent issues faced by the UK; hunger and homelessness, it helped Papa John’s stand out in a sea of samey festive ads.

Bloom & Wild Brand growth strategy: expanding internationally

Bloom & Wild specialises in sending fresh flowers in letterbox-size boxes. The concept has seen the company blossom in the UK and Ireland, but looking for further growth, they started scoping out new international markets.

Bloom & Wild hoped to launch in France and Germany, but realised their core proposition – flowers through the letterbox – would need to be adapted because people in these markets don’t tend to have letterboxes.

The brand did not let that deter them, instead carrying out research (using the Attest platform), to uncover consumer preferences in France and Germany.

“We saw that prospects in Germany and France behaved in very different ways to our UK base and that different elements of our product resonated,” said Bloom & Wild’s Head of Business Intelligence, Mairead Masterson. “In the UK, the letterbox packaging is a core part of our proposition as it makes the experience easier for recipients, however in France and Germany people don’t tend to have letterboxes, so we needed to understand which of our other USPs were important to them.”

Bloom & Wild discovered that hand-tied flower bouquets were the preference, with minimal and eco-friendly packaging. They were also able to pinpoint specific photography styles that resonated in each market. The research was used to create tailored marketing campaigns, which helped the brand take root abroad.

Gymshark brand growth strategy: supporting consumers

When coronavirus closed gyms and sales of fitness clothing looked set to plummet, Gymshark saw an opportunity to support customers. The brand launched a series of initiatives, which were focused on building brand loyalty and engagement.

These included Gymshark Dailies; a daily email covering topics like home workouts, nutrition ideas and mental wellbeing activities, and Deload, a mental health platform.

“It’s helped us show that we actually really give a shit about our customers and it’s not just about selling leggings. We’ve been able to provide tools to empower them and adapt to this new normal through the things we’ve introduced like free content, education, ways for them to connect and even earn money through the PT initiative we’ve launched, offering an hourly rate to host online workouts,” says Lorna Phillips, Audience Insight Manager at Gymshark.

The initiatives were designed using consumer data gathered through Attest, which helped Gymshark understand their customers’ current priorities.

“We know that some of this might not be profitable for us, but we know that this is also what people really appreciate at the moment and that’s how we can build loyalty in the long term.”

Weber brand growth strategy: overhauling social media

Aiming to grow brand awareness in Europe, American barbeque brand Weber enlisted creative agency Because to rejuvenate their social channels.

But this came with an added level of complexity, because it was against the backdrop of a global pandemic. The aim was to develop a relevant and entertaining content strategy that was going to be genuinely helpful and engaging.

Because focused on developing a Weber-specific, conversational tone of voice and visual aesthetic to reflect the ambitions of the brand. As the agency began to plan social content, each channel’s features (such as Instagram’s interactive stickers) and algorithms were taken into consideration to maximise engagement opportunities.

“Then we started to create sizzling content from relevant tap-through recipes, to masterclass videos and live Q&As with Weber’s Master Griller, Dan Cooper. It was important we optimised the content beyond ‘likes’ – focusing on meaningful ideas that helped us build a relationship with our community, and at the same time genuinely helped the community get the most out of their Weber BBQ experience.”

Other initiatives included creating a hashtag to acknowledge fan-generated content, alongside a range of Weber emojis. Because has taken the brand into new formats and platforms including IGTV, Interactive Stories and Instagram and FB stores to drive sales. This resulted in a 25% uplift in followers in just six weeks and the brand’s best performing content to date.

FabFitFun brand growth strategy: influencer marketing

In a crowded subscription box marketplace, FabFitFun have used influencer marketing to stand out. The tactic, which aims to connect brand advocates with potential subscribers in organic, fun ways, has driven a 300% sales growth annually.

The brand’s first influencer partnership was with Giuliana Rancic, and they later teamed up with Joelle Fletcher, both of whom have more than two million followers on Instagram – more than FabFitFun themselves.

Michael Broukhim, the Co-CEO and Co-Founder of FabFitFun, said working with Giuliana Rancic helped the subscription box brand find an initial audience. Now they try to reach as many women as possible through social media, partnering with diverse influencers that have specific audiences.

“We do quite a bit of influencer marketing today working with different influencers in terms of doing unboxing events and things like that,” Broukhim told Single Grain, adding that FabFitFun uses Instagram, SnapChat, Twitter, Facebook, YouTube to get in front of as many eyeballs as possible.

“To the extent that you can get into the stream of where the eyeballs are in an organic and fun way, that’s the way you want to think about how to do your marketing or at least a really big part of it.”

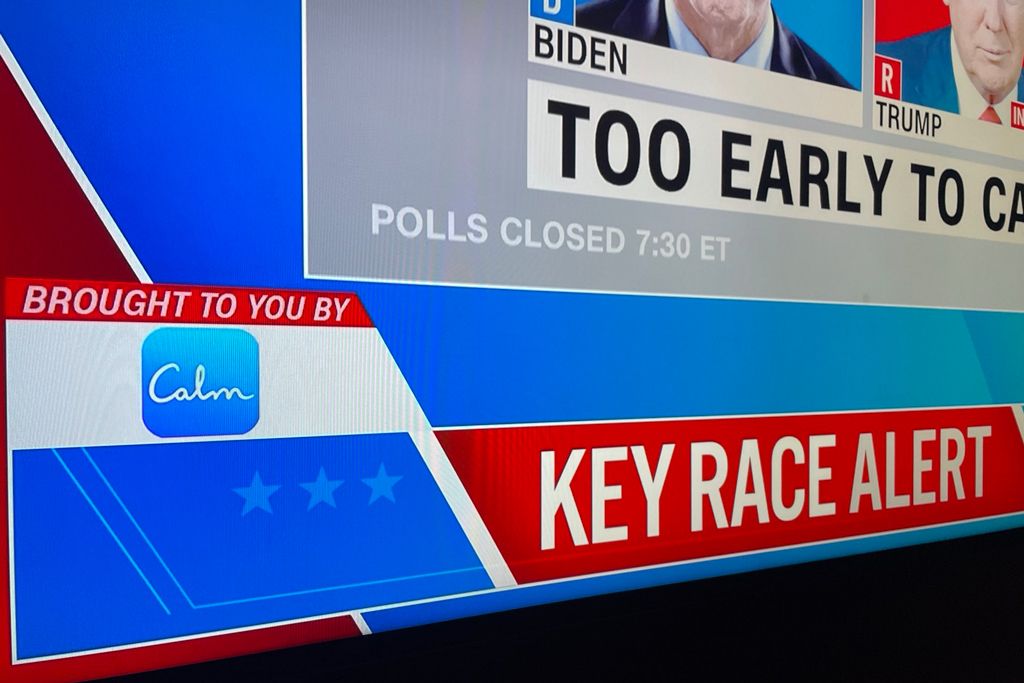

Calm brand growth strategy: running a PR stunt

Piggybacking on an event that’s already getting a lot of attention can put brands in the spotlight – especially if it’s done in a clever way. A great example of this is what Calm did during the 2020 US Presidential Election.

The meditation app sponsored CNN’s Key Race Alert coverage, reminding people to stop and breathe if the stress of the election got too much to handle. In addition to a logo for the app being shown during CNN’s coverage, Calm aired 30-second commercials featuring relaxing scenes, like rain or a beach.

To support the PR stunt, Calm offered 40% off premium membership, as well as free coping and calming tools to help stressed out Americans through its resource hub. The campaign not only reached thousands of CNN viewers, but also succeeded in securing a bunch of media coverage and saw Twitter mentions spike.

Crucially, it substantially boosted downloads of the app. On iPhone in the US, App Annie says Calm moved up 20 ranks from the day before Election Day to reach No. 79 overall across both apps and games. It also reached No. 1 in the Health & Fitness category.

Made.com brand growth strategy: discovery commerce

Traditional e-commerce sees people searching and finding products through a retailer’s website, but what if this could be reversed, with products finding people? Known as “discovery commerce”, this strategy has brought great results for online furniture retailer Made.com.

Made.com leveraged the Facebook Discovery Commerce System, which uses big data to understand how people are interacting with a retailer’s business, then uses sophisticated advertising tools to ensure the right products find the right people.

To understand the difference in performance between some of their top markets, specifically the UK and Germany, Made.com set out to run two simultaneous two-week conversion-lift studies. Made showed dynamic ads featuring relevant products in carousel and video formats across four placements, including Facebook news feed, Instagram feed, Facebook Stories and Instagram Stories.

Prospecting through broad audience targeting yielded the strongest results across both markets, with a 27% sales uplift in the UK and a 22% uplift in Germany. There was also a 30% decrease in cost per incremental conversion compared to retargeting audiences for the UK.

This study not only validated the importance of discovery commerce for Made.com but also allowed each market to better understand who it is targeting, helping it to refine their custom and lookalike audience lists to continue to reach new customers, Retail Week reported.

McDonald’s brand growth strategy: renewing brand purpose

You might expect a big multinational like McDonald’s to be clear on its brand purpose. But the fast food restaurant says it needed to translate its historic values “from Shakespearean to modern-day English”.

“We needed to clearly establish what our role is beyond the product we sell and what are the behaviours that let us fulfil that,” McDonald’s Vice-President of Global Communications, Michael Gonda, told Campaign.

McDonald’s “renewed purpose” is to feed and foster the communities it serves around the world. The purpose gives the brand a clear direction going forward and will guide both McDonald’s actions and communications.

“When we are working toward building trust, customers want to understand what are the values of that brand, what are the causes they support and do those align with mine? So we are taking a long, hard look at how we modernise our comms to more clearly and effectively communicate the value and causes we stand for.”

L’Oreal brand growth strategy: transforming customer service

After experiencing a 60% increase in e-commerce during the coronavirus pandemic, L’Oreal wanted to better meet the needs of customers shopping online.

The beauty brand has overhauled their approach to customer service by breaking down silos between various teams, including marketing, e-commerce and customer experience. As part of what they call their “100% responsiveness program”, L’Oreal ensures that each brand across markets has a consistent set of tools to engage with consumers in real time. This, says Céline Dumais, Global Chief Consumer Care and Experience Officer, enables them to be truly consumer centric.

“We’re aiming to blend all of the teams with different skills so you don’t have the old model, with a customer service person doing one thing and a community manager doing another with different tools,” she says. “It’s shifting from a case mindset to more of a conversation mindset.”

Getting all hands on deck to provide enhanced customer service for e-commerce customers has included the redeployment of bricks and mortar store workers. L’Oreal has been teaching their beauty advisors to transfer their skills online so that they can continue to support customers.

This evolution is supported by new products, such as a tool that allows consumers to digitally try on makeup using augmented reality. After discovering that Gen Z are socialising more on video calls, L’Oreal created 10 filters for Snapchat, Instagram and Google Duo that let people wear digital makeup looks.

Asos brand growth strategy: identifying “tribes”

Asos has accelerated growth through a customer segmentation exercise that allows them to tailor marketing to different niche audiences known as “style tribes”.

The fashion brand uses these consumer profiles to create YouTube content that drives sales. One such series is called ‘Sneakers In 60’, curating the most exciting new releases for its “sneaker-head” audience. Data reveals that the UK watch time of trainer videos on YouTube has increased by over 80% in the last year.

“Those kinds of franchises are fun and energetic, and they do stimulate sales,” Asos Brand Creative Director John Mooney told Marketing Week.

Another Asos YouTube series called ‘How To Style’ is hosted by a team of in-house influencers. These individuals represent a diverse range of “style tribes” and provide general fashion advice rather than prescribing specific items.

Asos tracks sales figures relating to each “tribe” to check which tactics work best and tailors its YouTube content accordingly. The brand has also identified a trend for “thrifting” and is creating content encouraging their audience to upcycle, which is designed to foster longer-term brand loyalty rather than immediate sales.

“It’s not just smart; it’s the way things are. Gen Z are heavily tuned into these conversations, and I think we’d be called out if we weren’t too.”

Lego brand growth strategy: pruning back

As organisations grow they can easily become unwieldy. This is precisely what happened at Lego. Chairman Jørgen Vig Knudstorp, said the complexity that had been added was making it harder for the brand to grow further. “As a result, we have pressed the reset button for the entire group,” he said.

Unfortunately for Lego’s employees, this did mean cutting about 8% of its global workforce. But Knudstorp said this pruning back would prepare the company to grow back stronger: “We will build a smaller and less complex organisation than we have today, which will simplify our business model in order to reach more children. It will also impact our costs. Finally, in some markets, the reset entails addressing a clean-up of inventories across the entire value chain.”

Having scaled back operations in the US and Europe, Lego was able to set its sights on new markets, like China. Lego’s brand growth strategy paid off and in 2018, the company returned to growth again, with profits and sales both increasing by 4%.

The Ferrara Candy Company brand growth strategy: mining data sources

The Ferrara Candy Company has been around for more than 100 years but their approach to marketing is refreshingly modern. With hopes of doubling their sales to $2 billion by 2020, the company has turned to data.

In addition to tracking sales of their products across 120,000 stores, the company’s marketing team is analysing data that shows sales by household, TV viewing by household, and exposure to ad campaigns to see how these factors impact on demand. “The objective is to drive real-time data,” Todd Siwak, CEO of the Ferrara Candy Company, told AdAge.

Household data is gathered through loyalty cards and consumer panels, while exposure data comes through various partners. When combined, it forms Ferrara’s sales lift tracker, which shows by household, five or more weeks after an ad campaign launch, whether products have been purchased for the first time. It also shows whether households exposed to ads spent more per purchase compared to households not exposed.

And by keeping tabs on sales of competing confectionery brands’ products, Ferrera can see how it stacks up against others in the category. This helps the company develop strategies for increasing sales growth of particular product lines. “You can start to build a business plan, which is what we did around Black Forest Organic,” said Siwak. “It also helps us to dimensionalise the size of a business.”

Taking things even more granular, Ferrara can access data sources including the weather in a particular locale, gas prices, local flu outbreaks and information relating to the display of products in grocery stores. What could enhanced data insight do for your marketing? (Read more about the intersection between data and creativity here).

S’well brand growth strategy: targeting young consumers

Since 2010, reusable water bottle company S’well has grown an army of loyal bottle-holders – and one of the key ways they’ve done this is by marketing to young people.

Founder Sarah Kauss worked alongside the New York mayor to gift 320,000 bottles to students across all five boroughs of the city. The idea behind the stunt is that it’s easier to change the behaviour of young people than adults. Embracing reusable bottles, the kids then encouraged their moms and dads to stop buying plastic disposables at the shop.

Campaign magazine called it one of S’well’s “savviest growth strategies”. “The move flipped around the classic parent-to-child filtration system of behaviour-change marketing,” they said.

According to CMO Josh Dean, this strategy helped sustainability be seen as cool and led to S’well being adopted by celebrity fans such as the Beckhams, Ellie Goulding and Julia Roberts.

And it’s put the brand in a prime position for pushing forwards with its mission for sustainability. S’well’s latest product is an insulated, reusable food container people can bring to takeaway food outlets to avoid single-use plastic containers. S’well plans to work with restaurant brands to provide discounts for anyone who fills up with their Eats bowl.

“We’re already at a point where, without the bottle, people feel like there’s something physically missing in their lives – and that’s an amazing place for a brand to be in,” said Dean. “But we have a responsibility and opportunity to move beyond the bottle.”

MoneySupermarket brand growth strategy: optimising customer experience

MoneySuperMarket believes a focus on customer experience will help them win market share in a sector that’s been focused on saving money.

The new brand growth strategy stems from consumer research the brand carried out in 2017 about people’s attitudes to money, and why they use price comparison sites. As you might expect, the research revealed that 79% of customers like to be in control of their money, and that price comparison plays an important role in that. But the most compelling bit is that customers felt comparing prices could be hard work online, and that there wasn’t enough tailoring of results.

“Customers expect more of technology-enabled brands than just filling in a form of 20 questions and then seeing results in price order,” Chief Customer Officer Darren Bentley told Marketing Week. “They expect more in terms of curation, individually tailored experiences, and higher levels of convenience alongside great value.”

Alongside a company-wide rebrand, new services that underpin MoneySuperMarket’s strategy include a credit monitoring app and a bill monitoring tool. Both make the user experience more personalised and relevant, and are designed to change the nature of MoneySuperMarket’s relationship with its customers.

“The relationship customers have had with MoneySuperMarket has been very transactional,” said Bentley. “It’s been come in, save money on car insurance/energy then come back to us in 12 or 18 months when you need to switch again.

“The hope is we are now in the background, helping you with your credit score and using that to make tailored recommendations and make it easier to stay on top of your money. Then we’re in an ongoing conversation.”

To learn more about carrying out research to uncover consumer wants and needs, check out our Complete Guide to Survey Creation.

Graze brand growth strategy: adding a distribution channel

Healthy snack brand Graze kicked off the subscription box revolution in 2008, but the market has come a long way since then. There are now a ton of D2C brands and endless options for subscription services, and this has made it tougher for Graze to compete.

The brand responded to this challenge by expanding from an exclusively direct-to-consumer model, into retail. Graze products are now available in supermarkets and high street stores. Adding a new distribution channel turned out to be a winning brand growth strategy – Graze has since been bought by Unilever.

Graze’s CMO, Pia Villa, told Marketing Week: “Retail we see as our channel to drive market penetration for the brand. Our launch into retail has not had any negative impact on our direct-to-consumer business, actually we’ve found it’s the reverse. Ultimately, retail is the majority of our business and is also the growth engine and strategy for the future as well.”

Villa adds that while Graze couldn’t have achieved their growth without retail, D2C remains an important channel for brand building and market research.

“Direct-to-consumer allows us to tap into a slightly younger, more millennial target group, which typically food brands find more difficult to connect with. We use it as a much quicker and cheaper market research tool by harnessing our community to test concepts. When we launch new ideas or packaging designs basically overnight we can get feedback from hundreds of thousands of people, so it’s an important source of intelligence for the retail business as well.”

Graze shows that distribution channels can complement one another rather than having to compete against each other. So, if your brand currently relies on retail, why not consider a subscription offering – or something else entirely?

Starling Bank brand growth strategy: focusing on brand building

To stop being “banking’s best kept secret” and become a household name, Starling Bank embarked on a brand building exercise – a growth strategy that recognises that brand awareness translates to increased sales (Attest even developed a brand awareness template to help marketers make the most of this!)

The challenger bank boasted 900,000 accounts but aimed to expand further through initiatives like their first ever ad. The ad shows starlings taking flight across the countryside, accompanied by a cover of Avicii’s ‘Feeling Good’. It highlights how the app links businesses and their customers.

Rachael Pollard, Chief Growth Officer at Starling Bank, told The Drum: “Our aim is to make Starling a household name, pursuing our mission to free the UK from cumbersome and outdated banking. As we fast approach one million customers, the time is right to accelerate our marketing strategy and stop being one of banking’s best-kept secrets.”

TV advertising is just one tactic for brand building. The best place to start? Experiment with your marketing and discover what has the biggest impact with brand tracking studies. Learn more with our Complete Guide to Brand Tracking.

Sainsbury’s brand growth strategy: forming a strategic partnership

You don’t have to be working against your competitors when looking to grow market share – Sainsbury’s and Asda announced they were teaming up to create the UK’s biggest supermarket group.

The idea behind the partnership is to allow both brands to benefit from increased economies of scale, allowing them to bring prices down for customers. Sainsbury’s and Asda said they would operate a “dual-brand strategy”, keeping both brand identities intact.

Asda CEO Roger Burnley said: “The combination of Asda and Sainsbury’s into a single retailing group will be great news for Asda customers, allowing us to deliver even lower prices in store and even greater choice.

“Asda will continue to be Asda, but by coming together with Sainsbury’s, supported by Walmart, we can further accelerate our existing strategy and make our offer even more compelling and competitive.”

Sainsbury’s said enhanced purchasing power following the merger would allow them to lower prices by approximately 10% on many of the products customers buy regularly. On Twitter, the brand said: “We’re creating a dynamic new player in UK retail – three well-known, trusted brands in Sainsbury’s, Asda & Argos. We plan to operate a dual-brand strategy in grocery, with the scale to invest in the areas that matter most to customers: price, quality and more flexible ways to shop.”

The bold growth strategy will help the supermarkets tackle competition from discount stores Lidl and Aldi, as well as the growing threat of Amazon in the grocery sector. But partnerships don’t just apply to mega brands like these; teaming up with a competitor could work equally successfully for less established brands, especially if you’re operating in a small market.

Cadbury brand growth strategy: producing original content

Think original content is just for the likes of Amazon and Netflix? Nuh-uh. Now, all sorts of brands are getting in on the act. Cadbury released a 22 minute-long film shot as part of its brand growth strategy for its Heroes range.

The film is the first in a series called ‘Families Reunited’, which focuses on real parents trying to reconnect with their distant teens by going on a “crash course” to understand their hobbies.

“It’s a brand often in the home where entertainment is: in the lounge, being shared. So, we thought we could make our own entertainment and find ways to share that with people,” Michael Moore, Senior Brand Manager at Mondelez, told The Drum.

He added that the brand would use video on demand, Facebook, Instagram and regular TV to direct people to the films. “We’re seeing that shift to people streaming content online so it does still fit with the habits that people are displaying already.”

In addition to the film series, Cadbury has also forged partnerships with Global Radio and Spotify to curate a branded playlist for families. The strategy shows how diversification into new areas, such as production of on-demand entertainment, can be used to promote growth of existing products.

Pizza Hut brand growth strategy: returning to its roots

You wouldn’t normally look back to go forwards, but sometimes a return to your roots can make sense for growth. This was the case for Pizza Hut, who had lost sight of what they stood for in North America.

“As we evolved, our tone changed and there really wasn’t a clear understanding of what we stood for,” Marianne Radley, Pizza Hut’s Chief Brand Officer, told The Drum. “We should never have lost sight of where we came from, and that’s the fact we were born in a restaurant, not a boardroom. That’s really a point of difference for us within the category.”

The brand decided to tap into consumer nostalgia by resurrecting its red-roof logo that ran between 1967 and 1999. It also adopted a bolder tone of voice to assert the brand’s position as an American icon.

“Pizza Hut is an American, iconic classic that’s ingrained in people’s hearts and minds,” said Radley. “We attest that to the fact we really were the original pizza company – the first national pizza chain – and we’re celebrating that with a little more of a confident and unapologetic tone.”

The strategy is backed by qualitative research conducted with more than 3,000 consumers that found people still consider Pizza Hut as “the OG of the pizza category.”

To reconnect with the original essence of Pizza Hut, the brand’s marketing team trawled through company archives, finding old menus, recipe cards and photos. It reminded them of the style the restaurant was once famed for: checked tablecloths, red glass tumblers and Tiffany-style lamps.

“It made us see that when the Carney brothers first founded the chain, their big thing was having more guts than brains. We thought to ourselves, we need to have more guts in what we’re doing and be more confident. I think we shied away from that over the years.”

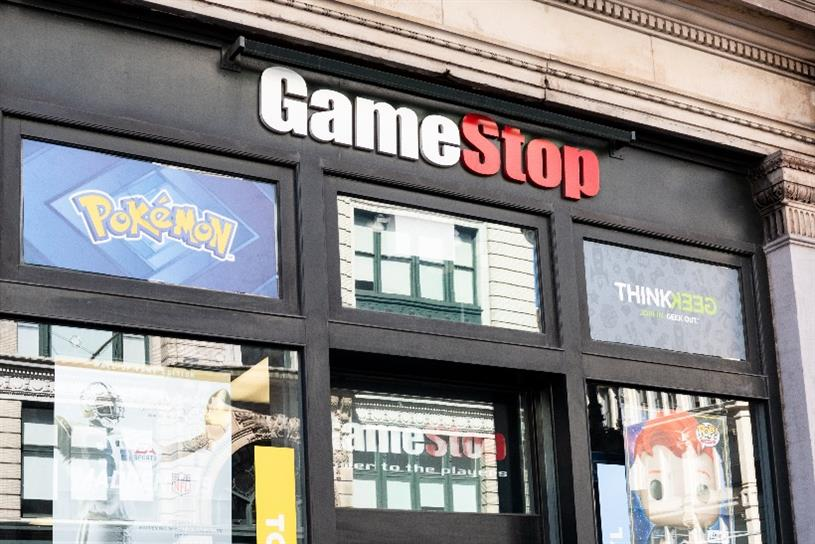

GameStop brand growth strategy: investing in bricks and mortar

Video gaming, by its very nature, is centred around digital experiences. But US gaming brand GameStop aimed to stimulate growth by investing in real-life bricks and mortar stores.

GameStop wanted to bring video game culture to life in every neighborhood and partnered with innovation design firm, R/GA, to create unique in-store experiences.

The new approach follows research that identified four major motivations people have for playing video games: immersion, achievement, creativity and community.

As a result, GameStop have developed and piloted new store concepts, such as locations that sell strictly retro gaming software and hardware, and stores that offer competitive sessions for homegrown e-Leagues.

“We’re on a journey to use our vast retail footprint to provide an engaging and well thought out experience that enhances our consumers’ gaming interests,” Frank Hamlin, Chief Customer Officer at GameStop, told Campaign.

“Among its many strengths is R/GA’s ability to leverage consumer insights and technology to reimagine the experience our consumers can have in our physical space. Our investment in this partnership is the next stage of our transformation and growth strategy.”

“Among its many strengths is R/GA’s ability to leverage consumer insights and technology to reimagine the experience our consumers can have in our physical space. Our investment in this partnership is the next stage of our transformation and growth strategy.”

And if you remember nothing else…

Keeping a close eye on what other brands are doing is one of the best ways to understand what your brand should be doing. While you should pay particular attention to your direct competitors’ brand growth strategy, don’t ignore growth tactics being used successfully elsewhere. There are many benefits of brand tracking, and when combined with the benefits of competitor tracking, there is potential to create a strong brand.

Borrowing ideas from unrelated industries and applying them to your own can result in the best innovation. To learn which of these brand growth strategies and what tools to use to build your brand strategy holds the most potential for your business, get the consumer insight you need. Speak to one of our experts.

Is your brand growing or shrinking??

Track your brand over time to find out how people perceive your brand, and use this to plan your marketing, product and sales strategies

Learn about Attest brand trackingFAQs about brand growth strategies

Even price can be part of your brand growth strategy, if you market it right. A great example of this is the skimming pricing strategy. This approach involves introducing a new product at a high price, then gradually reducing the price over time as production becomes more efficient and competition enters the market. This strategy has been used effectively by tech companies like Apple, who introduced the iPhone at a premium price and gradually lowered the cost of subsequent models as the technology improved.

A brand growth strategy is like a roadmap for companies to boost their brand’s popularity and their customer loyalty, leading to an increase in sales and market share. It all starts with understanding who your target audience is, what sets your brand apart from the competition, and how to craft a marketing and sales plan that leverages these insights to drive growth.

It’s more than popularity that reflects in sales numbers. Success shouldn’t just be viewed as how you’re performing in the moment, it’s about how you’re setting up your brand to remain successful in the future. With that in mind, a successful brand is one that connects with its target audience on an emotional level, delivering a consistent message across all touchpoints. A successful brand will have a clear, concise, and easily recognizable brand identity that sets it apart from the competition. Additionally, a successful brand will provide high-quality products or services that meet the needs and expectations of its customers. Strong customer relationships, effective marketing, and a commitment to continuous improvement are also key factors in the success of a brand.

Tell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: