Luxury brand index 2019 Q2

Please note: This is not the most recent brand index. If you’re right where you want to be, read on. If you’re looking for the latest data, click here for our most recent brand indexes.

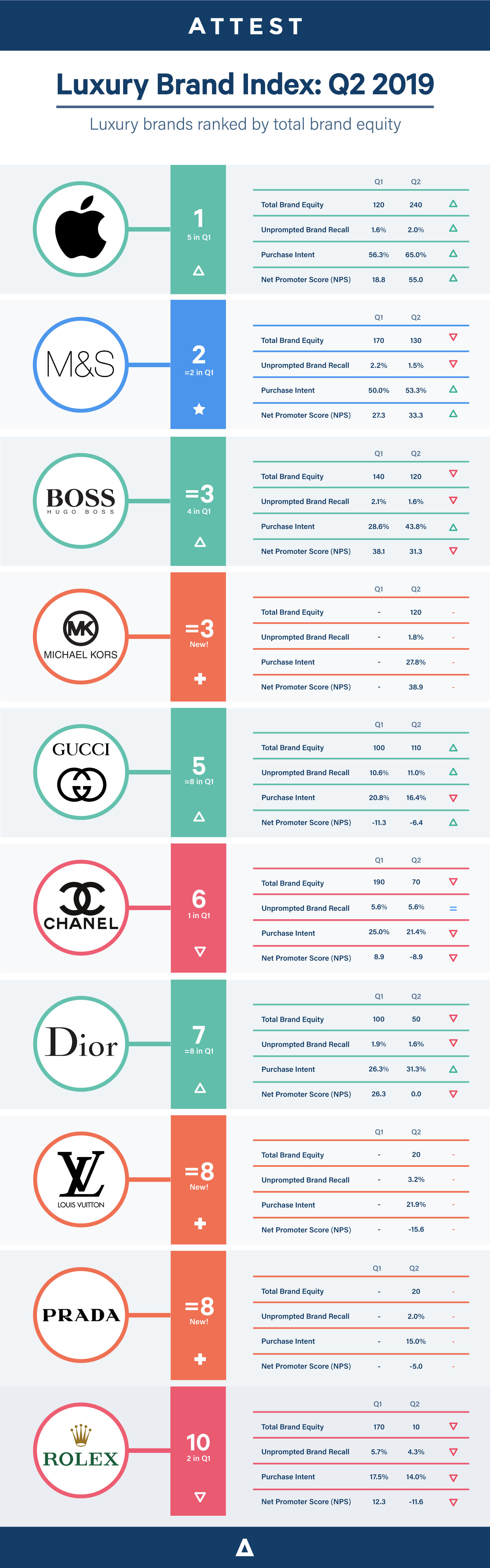

Every quarter we survey British consumers on their brand awareness and preferences in relation to the luxury industry. Our latest insights into this industry are detailed below. However, in Q1 of each year we dive even deeper into the data to create an in-depth report on the state of the industry.

To jump straight to our 2019 luxury brand index report, click below:

To compile this quarter’s luxury brand index below, we looked at three things:

- Percentage of unprompted brand recall within the luxury category

- How likely a person is to purchase each brand (purchase intent)

- How likely a person is to recommend each brand (Net Promoter Score)

Key changes in brand attributes

The luxury industry continues to shift the most of any sector that we explore in our brand indexes. It also continues to be the sector which has the hardest uphill battle to please consumers. With just two brands scoring over 50% Purchase Intent and only one brand scoring an NPS over 50, being a well-regarded luxury brand is hard to get right. With a fine balance between cost and quality being one of the toughest challenges these brands face, we look at eight category-specific attributes for the top 10 brands named.

Here are the main winners, losers and movers across those eight attributes this quarter:

- Last quarter, Harrods received the lowest weighted ranking in three attributes; setting trends, being good value and having a noticeable online presence. They did, however, also receive high scores for ethical practices and in-store customer experience. Being well-regarded for these two attributes makes it surprising, then, that Harrod’s weren’t recalled frequently enough to make the top 10 in Q2. Instead, M&S take Harrod’s crowns for ethical practices and in-store customer experience.

- This isn’t the end of M&S’s winning streak, either. The high street department store receives the highest weighted ranking for having memorable branding, for providing the best customer service and for offering the best quality products. In fact, M&S receives an almost perfect score of 98.3% for the quality of their products.

- The best value products, though, are produced by Apple. The only technology brand in the top 10 also takes the title as the brand with the best online presence and website.

- Despite taking the crown as the trendiest luxury brand in the market, Michael Kors receives the lowest weighted ranking in four of the eight attributes; for having memorable branding, good ethical practices, high levels of customer service and a noticeable online presence.

Key Takeaways

- This quarter welcomes a new Luxury Brand Index leader, jumping from 5th to 1st place in the leaderboard. Single-handedly representing luxury technologies, Apple storm to the top of the leaderboard. Although they receive just 2.0% of the Unprompted Brand Recall, their category-leading Purchase Intent score and NPS see their Total Brand Equity double between Q1 and Q2.

- Last quarter’s leader, Chanel, drops to 6th place in Q2. Though they were mentioned by the same amount of consumers in Q1 and Q2 – 5.6% – their falling Purchase Intent score, and an NPS that dips into minus figures this quarter, means their overall Total Brand Equity drops from 190 to just 70.

- Chanel doesn’t suffer the worst fate of all the brands in the leaderboard, though. It is, in fact, Rolex who drop the furthest, from 2nd place down to 10th. Significant drops in all three key metrics see their Total Brand Equity fall from 170 to 10. The luxury watchmaker will need to work hard to turn around consumer perception, and avoid falling from the leaderboard entirely in Q3.

- Three new brands enter the leaderboard this quarter; Michael Kors takes joint 3rd position overall, while Louis Vuitton and Prada both enter the top 10 in joint 8th positions with their negative Net Promoter Scores preventing them from reaching the upper half. These three push Armani, Harrods and Lindt from the top 10.

The full report

The report compiled in Q1 includes:

- The UK’s leading luxury brands for awareness, purchase intent and Net Promoter Score

- Overall brand strength and total brand equity index

- Industry averages and market dynamics

- Key takeaways for the UK luxury industry

The report is based on a nationally representative survey of 1000 people in the UK (aged 18+), surveyed in January 2019.

Brand index methodology

The Attest brand index is a platform agnostic measure of a brand’s total brand equity in the Alcohol sector, as determined by real consumers.

What does that mean?

When we say ‘platform agnostic’, we mean the results are not influenced by any particular method of obtaining them, like looking exclusively at social media mentions or at brand search terms. This reduces bias and gives us a much more accurate view of a brand’s strength in their category.

Learn more about why we think this is the best methodology for brand intelligence.

brand index data is gathered every quarter from a nationally representative survey to 1,000 UK consumers aged 18-65.

Tell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: