How to calculate market size potential in 3 easy steps

Got an awesome product you’re ready to bring to market? You’ll need to do your homework, and that means learning how to calculate your market size potential.

Conducting an in-depth market segmentation or sizing study can cost a lot of money and often requires research expertise. Here’s how to get a solid steer on your potential market size without saying goodbye to your (entire!) marketing budget. Hint: we can help!

How to quickly calculate market size potential

Calculating market size can help you create better marketing, sales, and development strategies for that specific market. How can you quickly calculate it though?

TL;DR—You’ll need to follow these simple three steps:

- Step 1: Define your audience and total addressable market (TAM)

- Step 2: Gather wider market size intel

- Step 3: Use the market size calculation formula

Quick market size calculation formula

And here’s the quick formula for calculating market size and value:

- Total potential customers x Average revenue per customer = Market size

What is market size?

Market size is the number of individuals in a certain market who are potential customers of your product or service. Depending on your distribution strategy, you’ll probably also want to look at the number of potential sellers of your product or service.

When measuring market size there are two ways to approach it: top down and bottom up.

Let’s look at each:

Top-down market sizing

The top down market sizing approach focuses on seeing what the current market is like and applying what you find to your business.

For example, let’s say you sell your services to creative agencies and there are 100 creative agencies across the UK, however you currently only sell to eight of these agencies.

You can calculate that your average sale among the eight creative agencies that you work with is £5,000. This would mean that your top down market size is £500,000.

However, this number is likely unrealistic and it won’t really tell you much. After all, not all the agencies will decide to work with you, nor will you sustain the same selling average.

Bottom-up market sizing

For the bottom up approach you look at your own segment data, and then you look at secondary research to understand what’s expected to happen to those segments.

Although the bottom up approach can be more time consuming and will require you to better study and analyse your market, at the end it results in a more realistic and trustworthy number.

For example, let’s say 60% of your marketing agency business goes to big corporations, and 40% goes to small and medium-sized companies.

Your secondary market research might say that big corporations are relying less on agency work because they’re hiring in-house teams. And if you also know there’s an increase in the number of new startups entering your market, then you can act accordingly and focus on providing better solutions to SMBs.

These two ways to calculate market size help you understand the size of the opportunity in any given market. That said, it’s also important to consider other factors such as the indirect competition.

Find out how big your market really is

Calculate your market size, its pain points, attitudes and price sensitivity with quality consumer insights from Attest.

Calculate market sizeLet’s understand why market size is important.

Why should you calculate market size?

If you create a business plan that doesn’t cover market size, you’re likely to be sent packing by any potential investor.

Without market size data you can’t create a viable business plan, it’s the only thing that gives you an idea of the potential value of your product or service. Market size is essential even if you’re not seeking third-party funding.

Let’s say you have the patent to a revolutionary new software tool; it’s easy to assume everyone will want it.

So you might say: “my market is all American adults,” but this is naive and not backed with evidence. You’ll never sell your product to all American adults, no matter how great the product is!

There will be a certain type of person who really does want to buy your tool and your job is to nail down who that person is—and then work out how many of those individuals like them there are in the market.

This might sound difficult, but thanks to the wealth of data tools available nowadays, it’s easier than you think.

How to use your market size calculation

Before we cover how to calculate your market size, it’s important to know how you’ll be able to use this number.

Market size helps business owners answer the following questions:

- What’s the potential revenue from this particular market?

- Is the market big enough? Will it be worth it to invest time and money in?

- Is this a growing market? Will there be opportunities after three, five, or ten years?

These are key questions when trying to start or maintain any business. Now, without further ado, let’s take a look at how to calculate market size.

How to calculate market size

Calculating your market size shouldn’t be complicated. In fact, it can be done in three simple steps:

Step 1: Define your target audience and Total Addressable Market (TAM)

Your target customers are the people for whom your product or service solves a specific problem.

Identifying who these people are is a lot easier if you’re already active in one market.

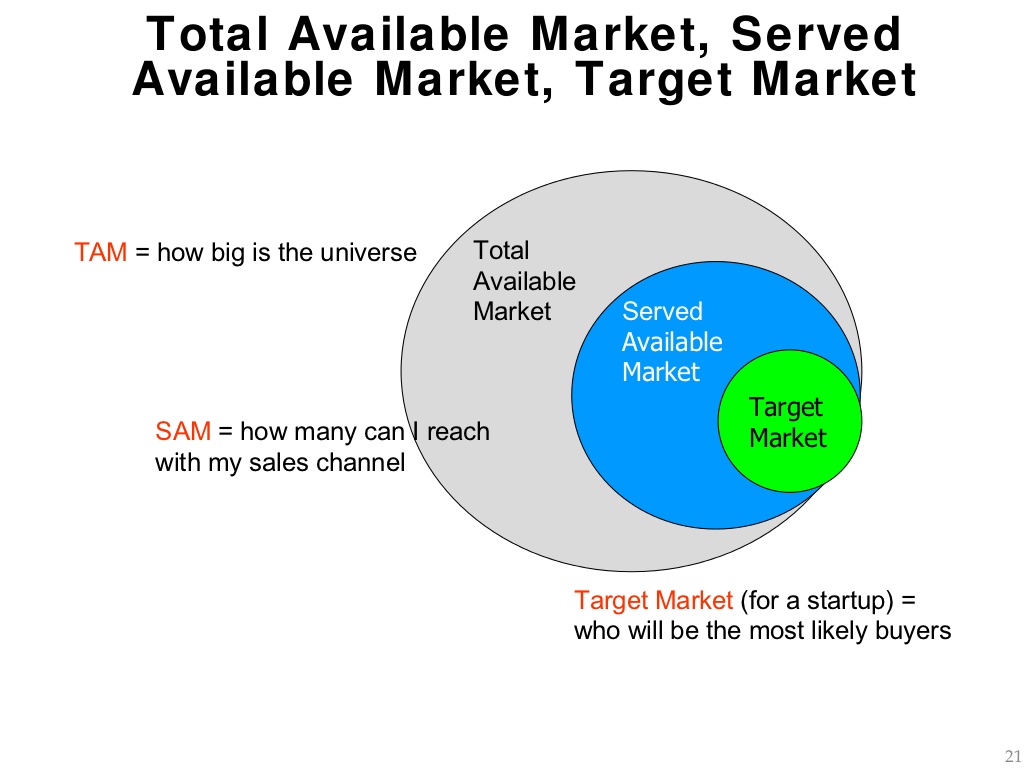

There are three ways to group your target audience’s market: TAM, SAM, and SOM – worry not, we’ll go through what each of these mean.

Total addressable market (TAM)

TAM is the total demand there is for a product like yours.

If you’re creating an energy drink, your TAM will be estimating everyone that might consume your product: students, drivers, athletes, the lot.

Serviceable available market (SAM)

SAM is the people in the TAM that could feasibly reach your product.

Let’s say you’ll only sell it at a specific supermarket that’s only available in the southern cities of England, those within your TAM that are also in the southern cities of England will be your SAM.

Serviceable obtainable market (SOM)

SOM is the smallest subset of the available market that you’ll want to capture through your marketing and sales efforts.

These are those customers that are in your SAM, but are currently not being served, or are unhappy with the existing market offerings, or those that would actually be willing to try a new version of the product they already use.

Using existing data

Examine the profiles of your existing customers – what do you know about them?

In addition to looking at demographic information like age, gender, geographical location and socio-economic background, engage in a conversation with your customers to find out why they buy your product and why they buy your brand specifically.

Using new data

If you’re starting from scratch with a new product or service, you’ll need to come up with some hypotheses to test.

For example, let’s say you’ve invented a wearable device that automatically tracks how many calories you’ve consumed. You can probably assume it will be of interest to men and women trying to live a healthier lifestyle, as well as sportspeople who need control over their diets and workout routine.

There could be further demand from employers or health insurance providers who want to incentivise people to maintain a healthy diet.

You can gather initial data from a bit of desk research – for example, this government-published statistic tells us that 64% of adults in the UK are overweight.

But don’t stop there, now’s the time to delve a bit further by carrying out some consumer research.

Through a market research and brand tracking tool like Attest, you can access more 150+ million people in 59 countries, which means you can test real demand with a subset of your target audience.

For example, you could find out:

- How many people are actively trying to live a healthier lifestyle?

- Why is a healthier lifestyle important to them?

- What are their pain points when trying to do this?

- What products do they currently use to help them improve their health?

- Would they be interested in your product?

- How likely would they be to buy it?

- How much would they be willing to spend if they are interested?

To further define your target customer, you can then analyse their demographics (these are built-in to the Attest platform) and look for trends.

Perhaps you see that professional women, living in London and the south east, aged between 30 to 50 are showing the highest purchase intent. You can then create profiles of your prime potential customers.

Once you’ve got a good indication of who your product or service is relevant to, a larger market segmentation exercise makes sense. It’ll help you prioritise your efforts and understand the true potential size of the market.

Step 2: Gather wider market size intel

To get the full picture, you’ll want to enhance your findings by gathering further information on your industry.

Most industries have formal associations which compile and track industry size data.

You can find out, for example, how much the industry is worth, how much is spent annually on specific product types and average retail prices.

It’s worth spending some time working out which industry your product or service actually sits in. Knowing your industry helps you understand who your competition is.

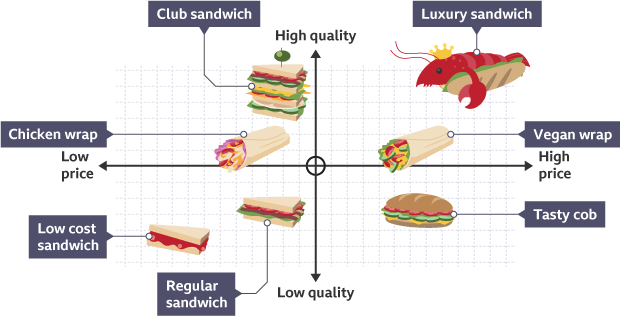

To get more clarity on who your competitors are, try drawing up a market map. Market mapping involves arranging competing products on an axis according to their positioning.

For example, whether they are high or low-cost or whether they are complex or basic (see the below example.)

In an ideal world, market mapping will highlight that your product falls into a unique niche.

For example, your product could be the highest quality product being offered at a low price point.

This immediately gives you a point of difference, giving investors a compelling reason to believe you’ll be able to steal market share.

Use consumer research

You can use your consumer research to back up your market positioning, like social enterprise Divine Chocolate did.

The chocolate bar maker identified that some consumers were prepared to pay a premium price for very high-quality chocolate made from Fairtrade cocoa. It saw that there was little competition in this space and successfully claimed the position.

If you do find a gap in the market, it’s important to be sure why others aren’t filling it.

It may be that the demand from consumers just isn’t there, so be sure to combine your study of the market with actual feedback from consumers.

Discover the potential value of your product or service

Get the market size data you need to carry out your marketing strategies with confidence.

Find out your market sizeRun brand perception research

Brand perception is about what your consumers think and feel about your brand.

Not just as an opinion, but as a deeper subconscious sentiment that they have developed after interacting with your brand, your products, your international marketing and messaging, and yes, even your competition.

Brand perception is not what you want customers to feel towards your brand.

It’s about what the customers believe you stand for. Ideally, these two would be the same, but in reality it’s hard to influence your customers so directly; that’s why you need to research your brand perception – and also that of your competitors.

Brand perception can affect the type of customers you attract, your price point, and the partnerships you can build with other brands. So, make sure you measure your brand’s reputation and perception.

Use market research surveys

The best way to gather market-wide information is through market research surveys using market research services.

These tools will help you collect important information from various demographics, and types of customers.

Market research used to be done face-to-face or through lengthy, cumbersome calls.

Today you can have great insights, data ready for reporting, and a global reach with online market research surveys. They help you take the guesswork out of market research while keeping your process scalable and inclusive.

Once you’ve narrowed down your target market size and customers, and you’ve studied the market at length, you’re ready to calculate market size.

Step 3: Use the market size calculation formula

Here’s that quick formula again:

- Total potential customers x Average revenue per customer = Market size

Your market research will give you a lot of information that you’ll need to analyse and understand. Let’s look at how to plug this information in a formula for estimating market size.

For example, let’s say you produce chocolate. You plan to be stocked in independent food stores. But you find there are few of these types of outlets in the Midlands – a location where you see high purchase intent.

This will affect these consumers’ ability to buy and will reduce your potential sales.

You have to take factors like this into consideration and look at the ‘available market.’ The available market is those who have both interest and the ability to buy – this is your number of target customers.

Once you have this figure, you need to multiply it by the quantity of your product an average buyer will purchase in a given time period, like a year.

In the case of our fictional calorie counting device, this is likely to be a one-off purchase, but if it’s a consumable you’re selling, purchase frequency will be far higher.

Use your industry data and consumer brand research to estimate this figure – and be realistic!

How to project your market size

Market size is the maximum total number of sales or customers your business can see, often measured over the course of a specific period of time – often a year.

Knowing what your potential market size is will help you when gauging your next business steps, whether or not an investment in a new product is worth it, or what growth is to be expected.

The next step in calculating market size is to engage in a bit of future-gazing. Is your market likely to grow or shrink in the future?

You can look at historical data to analyse the market’s performance – is it on an upward trajectory?

Now, think about your customer base — is that likely to get bigger? If we go back to the example of the calorie tracker, there’s plenty of available data to show that the overweight population is growing.

Will there be more prospective customers in your market in the next few years? If you can show your marketplace isn’t static and is instead evolving, there’s greater reason to believe in a successful future for your product.

When presenting market size and market value statistics for your business, try to make one, two and three-year projections.

Don’t forget to factor in your anticipated roll-out to other geographic areas over time or improved distribution plan.

You also need to consider your own impact on the industry. What’s your disruptive potential? Most startups are coming to market with an innovative product or service and this can dramatically change the landscape.

Think of the way digital cameras virtually destroyed the market for film cameras – and film developing – or the effect Amazon’s Kindle had on regular bookstores.

On the other hand, are there other companies’ products or services on the horizon that threaten the industry as you know it?

Do as much research as possible by looking at patents being filed, reading industry media and setting up Google alerts for relevant keywords to keep abreast of things in development.

How to calculate market size: an example

Let’s say your product is a face wash for people with acne – you can reasonably expect people to get through one tube of it per month.

If there are 500,000 target customers in your market, this means the total volume of market demand for acne face wash is 500,000 x 12 (months a year) = 6 million a year. If the average price of acne face wash is £10 a tube, then market value is 6 million x £10 = £60 million.

Another calculation you can do is estimating the percentage of market share you will be able to command.

For example, if you know the face wash and cleanser industry as a whole is worth £1 billion annually, you can realistically expect to capture between 1% to 5%. In terms of value, that equates to between £10 million and £50 million.

Summing up your market sizing exercise

Now you’ve learned how to determine market potential (Total potential customers x Average revenue per customer = Market size).

Now, you can add this information into your pitch deck so potential investors can see what the estimated earnings can be.

Bear in mind that most VCs and angel investors would like to know they’re investing in a market with a large potential size (typically, at least £1 billion).

If your numbers are smaller than this, don’t be tempted to over-inflate them. Be honest and explain why you believe in the market’s potential… or why it’s important to bring your product to market. For example, it’s going to make the world a better place.

Investors’ investment philosophies differ, so there’s every chance you can find your match with the right research in hand.

Understand your market size to ensure success

Make smart decisions for your brand with Attest’s combination of cutting-edge tech, human research expertise and a quality global audience of 150+ million in 59 countries.

Open the market sizing templateMarket Size FAQ

To calculate market size you need to follow three simple steps:

Step 1: Define your target audience and total addressable market (TAM)

Step 2: Use consumer, brand perception, and market research to gather wide market size intel to find out which gaps in the market there are, the current and future competitors, and what consumers think of your brand.

Step 3: Use the market size calculation formula (number of target users x purchases expected in a given period of time = market size or volume) to better understand your target market potential.

This is the market size calculation: Total potential customers x Average revenue per customer = Market size.

Here’s an example of a market size calculation: let’s say your product is a face wash for people with acne. You estimate that people will get through one tube per month. If you have 500,000 target customers, this means that the total volume of market demand for acne face wash is 500,000 x 12, because there are 12 months in a year. This is equal to 6 million a year.

Now, to calculate market value you take the 6 million and multiply it by the average price of your product: 6 million x £10 = £60 million. That’s your potential market size and value.

A good market size will depend on your industry and product. However, investors will normally be looking for a market potential size of at least £1 billion. Don’t get discouraged if you didn’t find that’s your potential market, there are other factors to consider when entering a market.

Tell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: