A guide to understanding customer journeys

How do people discover your brand and why do they buy your products? Understanding customer journeys can unlock huge sales growth - learn how.

- Part 1: The considered purchase

- Phase one - Early exposure

- Phase two - Active evaluation

- Phase three - Moment of purchase

- Phase four - Ongoing exposure

- Part 2: The impulse purchase

- Understanding customer missions

- Customer journeys for website owners

- Phase one - Discovery/Entry

- Phase two - Consideration

- Phase three - Checkout

- Phase four - Post-purchase

- Conclusion

“Customer journey” is a term frequently used by marketing folk, but what does it really mean?

Essentially, the customer journey is every interaction a customer has in the run-up to purchasing your brand (or perhaps a competitor’s).

Why do customer journeys matter? Because if you don’t know what drives customers to make a purchase, how can you fine-tune your brand experience and marketing messages? Also, if you don’t know where customers start when researching a purchase, how can you be among the first to reach them?

Basically, if you don’t understand customer journeys, you’re planning in the dark.

You shouldn’t be relying on guesswork when selecting marketing and sales channels or allocating media and advertising spend – these decisions should be based on hard data.

The good news is, it’s easy to collect this data and get the brand intelligence you need to make decisions that lead to growth by going direct to consumers.

In this guide, we’re going to look at what you need to know and exactly how to obtain this intelligence, so you can win more customers, maximise your brand’s market share and grow revenues.

To begin, we examine the four-phase customer journey for one-off, larger or more considered purchases (FMCG will be dealt with in the second half of this guide).

Part 1: The considered purchase

Phase one – Early exposure

A customer journey actually starts long before a consumer even thinks about making a purchase. The exposure they’ve had to brands; what they’ve seen on the TV and in the press, what their friends, family and colleagues have said about brands and their previous experience with brands, will all be in their subconscious.

When a trigger occurs and the consumer becomes interested in making a purchase, their first port of call will be this existing knowledge.

Triggers may be things like a life event (such as getting married or having a baby), realising they have a problem they’d like to solve (they’re not fitting into their clothes and want to lose weight, or their dishwasher just broke).

Let’s say a person buys a house with a garden for the first time and now needs to buy a lawn mower; they may remember that their parents own a Black and Decker and perhaps they recall seeing adverts for Flymos with nice stripy lawns. Those accumulated impressions will shape the consumer’s initial brand consideration set.

The best way to understand which brands enjoy this prominence in your category is through unprompted brand recall, where respondents can provide open text responses. For example, you might ask, “When you think of lawnmowers, which brands come to mind?”

The response to this brand awareness question will help you understand the strength of your product or service at the first stage of the customer journey. If your brand is not in people’s minds at this stage, you will be at a disadvantage.

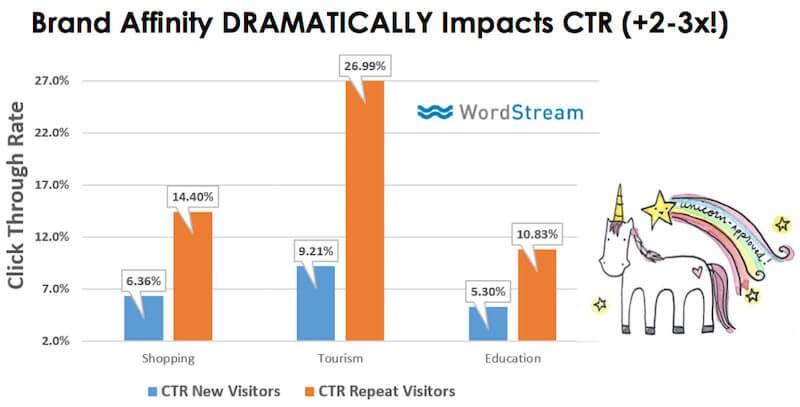

Larry Kim, founder of Wordstream says, “The propensity to click on your paid or organic search listings is often based on pre-existing brand affinity. Put simply: searchers are more likely to click on you if they’ve heard of you before.”

Credit: Wordstream

If awareness of your brand is low, you can work to improve it through advertising and PR. This can be expensive, so it’s crucial to repeat this research at regular intervals, enabling you to monitor your progress and ROI.

Phase two – Active evaluation

While not being included in the initial set of brands is a disadvantage, it’s not the end of the road. During phase two of the customer journey, consumers will actively start researching the marketplace, and they are more likely to be expanding their list of potential contenders than narrowing it, so this is where new brands can enter into consideration.

At this stage, marketing becomes very much consumer-driven – they come looking for you rather than vice versa – and it’s important to understand how that works in your category. Do they ask friends for recommendations, visit review sites or go straight to a retailer?

You need to be aware of the different touch points where a consumer may come into contact with your brand, and the weighting of each touch point towards a purchasing decision. To do this, you might ask survey respondents about how they begin their research. For example:

You’re considering buying a new laptop, where do you go to research products? (Tick all that apply)

- Search online to find reviews

- Look on retailer websites

- Read blogs and independent experts

- Ask for recommendations from friends and family

- Read industry magazines and brochures

- Go into a store and speak to a salesperson

- Other

Now you can go into more detail about the next steps in their evaluation process, and how much influence reviews and recommendations have on their decision. You might ask questions like:

Rank the following factors in order of importance when it comes to making a decision to purchase a laptop:

- The marketing copy reads well

- It has positive reviews

- It’s good value for money

- It’s a well-known brand

- It’s a brand I’ve bought before

Rank the following in terms of which would most influence your decision to purchase a laptop:

- It comes recommended by someone I know

- It comes recommended by a salesperson

- It comes recommended by an influencer

- It has positive customer reviews

- It has positive reviews by journalists and bloggers

If a laptop by an unfamiliar brand had positive reviews or came recommended, would you consider purchasing it?

- No, I only buy well-known brands

- Yes, I’m openminded to new brands

- Maybe, if it was competitively price

These types of questions help highlight areas of opportunity for new or challenger brands at various different touch points.

Perhaps you discover people like to receive advice from salespeople in-store when looking to purchase a new laptop and, as such, a sales incentive programme for retailers could help achieve cut-through? Or maybe people are much more swayed by reviews and you need to send your product to some influential reviewers to make an impact?

It’s also worth investigating how long this research period lasts and how intensive it is. The more consideration a consumer puts into making a purchase, the more opportunity that provides for brands to enter the consideration set.

Phase three – Moment of purchase

When a consumer’s research is complete, they finally select a brand to purchase, but that’s not the end the story. You need to find out how they actually make that purchase and the factors that influence where they buy from.

Perhaps they go in-store to demo a laptop, but then go online to find it at the cheapest price? To inform your channel management, you should ask questions like:

Where would you prefer to purchase a laptop:

- Online

- In-store

Rank in order of preference which retailers you would purchase a laptop from:

- Amazon

- eBay

- PC World

- Maplin

- Currys

- Argos

- Dixons

- Supermarket

- Other

Rank in order of importance the factors that would influence where you purchase a laptop from:

- Cheapest price

- Trusted retailer brand

- Good customer service

- Good returns policy

- Free delivery

- Time-slot delivery

- Next day delivery

- Availability of finance/payment plan

Knowing what customers look for when selecting a retailer to purchase a product from will enable you to select the most compelling messages to attract users to your brand and find more effective channel partners.

Phase four – Ongoing exposure

Once a purchase has been made, the customer journey is still not over. From this point onwards the consumer builds expectations based on their experience with the brand and any further interactions they have, such as contacting product support or signing up to a newsletter.

It not only informs their next purchase decision journey – it can inform that of their friends, family and colleagues, since they now become brand ambassadors or brand detractors. When someone asks them for laptop recommendations, will they suggest your brand or warn people away from it?

You can track consumers’ willingness to recommend your brand or that of your competitors by measuring Net Promoter Score (NPS).

To obtain an NPS you simply ask one question, “On a scale of 0 to 10, how likely are you to recommend this company’s product or service to a friend or a colleague?”

Based on their rating, customers are then classified as either brand detractors, passives or promoters.

The Net Promoter Score (NPS) is determined by subtracting the percentage of customers who are detractors from the percentage who are promoters, and if you’re using Attest, we calculate this automatically for you.

A NPS that continues to rise indicates increased customer loyalty and a higher likelihood you’ll enjoy the network effects of word-of-mouth referrals.

As customer journeys are often a circular process, a high NPS gives your brand a big head start when a consumer arrives once again at phase one.

To summarise

For larger, more considered purchases there are reasonably distinct phases to the customer journey, which include:

- Early Exposure

- Active Evolution

- Moment of Purchase

- Ongoing Exposure

Tracking your brand awareness, understanding the customer evaluation process, channel preferences and Net Promoter Score are all essential elements that you need to intimately understand in order to win at each stage and beat competitors.

Part 2: The impulse purchase

In the first half of this guide, we focused on the customer journey for larger, more considered purchases, where marketing becomes especially consumer-driven i.e. there’s usually a more protracted research phase, buying is not impulsive and brands need to ‘pull’ consumers into their world.

For brands in fast moving consumer goods (FMCG), fast fashion, fast food and discretionary entertainment, outreach to consumers remains key, since few people actively research purchases such as biscuits or beans, which fast food restaurant to choose or whether or not to buy a new £10 top they’ve seen in their Facebook feed.

Their decision to purchase will be based much more on the effectiveness of the messaging they have received from competing brands, as well as your own advertising, packaging and in-store Point of Sales (PoS).

To win market share for these kinds of purchases, brands can start by understanding what marketing people call “customer missions”.

Understanding customer missions

“Customer missions” are the various reasons people shop; their motivation for visiting a store and how that influences their behaviour. For the FMCG industry, there are four broad customer missions:

On-the-go: the shopper is looking to buy something for immediate use or consumption, i.e. a sandwich for lunch.

Top-up: the shopper needs something extra outside of their main shop, i.e. a bottle of wine as they’ve been invited to a friend’s house for dinner.

Main trolley: the shopper is buying food and other items for the week. It is a planned shop covering most categories.

Stock up: the shopper is buying in high volume to stock up i.e. bulk buying loo roll or dog food to cover for several weeks or months.

What type of mission are customers most frequently on when they buy your product? What types of shopper are you trying to target? Understanding this helps you work out the best positioning and merchandising for your brand in-store – and the types of stores you should be in.

However, you shouldn’t view your category in isolation – consumers seldom visit a purchasing channel for just one category. Additional insight that can help optimise your in-store performance is understanding how your category interacts with others in the context of the shopper’s overall shopping trip.

When an “on-the-go” shopper buys your brand of energy drink, for example, what else do they buy with it – chewing gum? Crisps? A magazine? This knowledge helps you boost sales through strategic category adjacency.

To find out customers’ primary mission when shopping for your category and to gain a deeper understanding of their motivations, you should conduct a combination of quantitative and qualitative research.

Quantitative research will be asking multiple choice questions such as:

Do you most frequently buy XYZ product as:

- Part of your main weekly shop

- As and when you need it

- On impulse

- A bulk purchase

Where do you most frequently purchase XYZ product?:

- At the supermarket

- At convenience stores

- At pharmacies/health & beauty stores

- At newsagents

- At petrol stations

- Speciality store

- Online

- Other

When you buy XYZ product outside of your main weekly shop, are you usually visiting the store specifically to buy this item?

- Yes, I go specifically to buy this product

- No, I usually buy it on impulse

When buying XYZ product outside of your main weekly shop, what else might you buy with it? Tick all that apply (the selection you provide will depend on the nature of your product, but for this example let’s look at toothpaste):

- Shampoo

- Shower gel

- Razors

- Makeup

- A snack

- A drink

- Nappies

- Feminine products

- Nothing

- Other (please state)

Once you have a better understanding of what brings your customer to a particular store, you can drill down into the details with qualitative questions.

For example, let’s say your quantitative research found that customers most frequently purchase your category when on-the-go, what are their motivations and primary considerations when they’re on this mission? Are they in a hurry? Are they concerned about making a healthy choice or not spending too much? Or are they looking for a little indulgence?

Ask consumers to tell their stories by enabling open text (qualitative) responses in order to give context to the data.

By gaining deeper insight into which consumption needs customers are trying to meet, you can make sure to meet those needs better than the competition, and work with retail partners to get rid of any bottlenecks that stall adoption.

Customer journeys for website owners

If your customers access your brand online rather than in a shop, gathering data on their journeys is even easier. Websites offer a wealth of data just waiting to be tapped; data that can provide vital intelligence for maximising your sales, especially when put into context with additional consumer research.

Phase one – Discovery/Entry

Think of your website like a house with a number of different paths leading up to it. The first step in understanding the online customer journey is knowing how people access your house – which path do they approach on?

You can use Google Analytics to view which channels drive most traffic, as well as where people land on your site after taking these routes.

Meanwhile, you can use tools like SimilarWeb to see which channels are driving traffic to your competitors. If your competitor is receiving much higher levels of search traffic than you are, for example, what are they doing differently? And how can you become more relevant in the eyes of search engines?

One way to find out is to ask consumers how they would search for your particular product or service. Allow a open text response so they can put it exactly in their own words. With this insight you can optimise your website copy, landing pages and PPC/Adwords campaigns to align with what customers are searching for.

It’s also worth noting that data from Google Analytics and tools like SimilarWeb won’t always show the full journey taken, but often focus on the ‘last click’ – the last place they were before landing on your site.

These journeys can be complex, and potentially last longer than a 30-day tracking cookie can follow, meaning you won’t always have 100% accurate data. We recommend you complement your aggregated digital data with direct consumer intelligence by asking shoppers about all the sources of information they tend to review before purchasing a product online. This will help give you a more rounded and complete view of phase one of the online customer journey.

Phase two – Consideration

When a customer lands on your site (remember this might not be on the homepage), they will very quickly make a decision if they want to stay and look around. Looking at data like bounce rate, pages per visit and average visit duration will help you understand how you’re performing.

To improve these statistics, it’s necessary to learn more about the different types of shoppers visiting your website. These are called “personas” and you can build them by surveying real consumers.

A great way to do this would be to look at Google Analytics > Demographics > Overview and look at the age, gender and other demographic details of your website audience (possibly look only at those who’ve completed a set goal, such as purchasing something or creating an account).

You can then use this information to focus your consumer research only on those high value consumer segments that you want to attract more of. With Attest, you can chose from a number of different demographics to build the ideal target audience.

Run a consumer profiling survey to learn more about their motivations, what their needs are and the information or encouragement they require to convert them into customers. You can ask questions like:

When shopping for clothes online, what concerns you most? Please rank the following:

- Affordability

- Product range

- Latest styles/fashionable

- Quality of product

- Security of site

- Speed of delivery

- Ease of returns

You can further segment these responses by age, gender, location, income bracket, employment and relationship status and much more. From this, you can build a picture of the key motivations for each shopper group, from cash-strapped students to working mothers.

And with this knowledge you can tailor your messaging and provide the right content to build confidence and ensure further engagement.

Phase three – Checkout

When a customer puts an item in a shopping cart you can still be a long way from completing a sale. Cart abandonment is a major problem for online retailers.

Baymard Institute looked at 37 separate studies on cart abandonment and found that 69% is the average documented online shopping cart abandonment rate, with $260 billion worth of lost orders which are recoverable solely through a better checkout flow and design.

You can check out your own cart abandonment rate in Google Analytics. To reduce this figure, you need to understand the various reasons why customers do not complete purchases.

You might ask consumers to tell you in their own words the biggest sticking points or things that put them off when purchasing from websites like yours or present them with multiple choices if you think you have a good idea of those factors already.

As well as the potential to lose customers, on the flip side, checkout also represents an opportunity to increase basket size. You can do this by strategically promoting other complementary products.

You can interrogate your sales data to see what items people often buy together, and ask consumers to tell you what products they’d most likely be interested in purchasing at checkout.

Phase four – Post-purchase

As with considered purchases, the customer journey continues long after they’ve made a purchase, in the form of the customer support you provide and the onwards communications you send. To make sure you get it right, you can poll consumers as to their preferences with questions such as:

How often should an XYZ brand email you about offers after you’ve purchased something from them?

- Daily

- Weekly

- Fortnightly

- Monthly

- Quarterly

- Yearly

- Never

Which channels do you prefer for customer support? (Choose all that apply)

- Live chat

- Phone

- Chat bot

- SMS

- Social media

You can combine this feedback with data such as newsletter unsubscribes to smooth out all the touch points on a consumer’s digital journey.

Don’t forget to also regularly check your NPS (as discussed in Part One) to see how likely your customers are to stay loyal to your brand post-purchase, and how likely they are to promote it.

If your customers are promoters and spread the word online, then you’ve got a good chance of generating viral growth, which is essentially free customer acquisition!

Conclusion

Whatever type of product you sell, and however you sell it, understanding customer journeys is essential if you want to master your market and grow your share of it.

When you know how people discover products, what motivates them to buy one brand instead of another, and why they keep coming back for more, you can influence their behaviour.

With the right insight into customer journeys, you can make sure customers don’t stray off the path or veer towards your competitors along the way. Crucially, this makes it more likely their final destination will be your brand.

You can get started understanding your customers today – sign up to survey your own contacts for free. Or why not take advantage of a free brand awareness survey to see how much share-of-mind your brand has among our audience of consumers?

Tell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: