6 keys to conducting a market opportunity analysis that works

Market opportunity analysis can unlock new revenue, product features, personas, and product messaging for your business. Find out how.

What is market opportunity analysis?

Good market research analysis is essential in identifying new business growth opportunities and understanding market demand. Market opportunity analysis can unlock new revenue, product features, personas, and product messaging for your larger business strategies.

If done well, this research method will leave your marketing and product marketing teams with a wealth of information to support overall business sales, and work toward winning a more significant market share for your business.

In this article, we’ll guide you through six key areas of a market opportunity analysis to consider, which will set you up to conduct an analysis that provides actionable business opportunities (and make you look good in the process!).

How to conduct a market opportunity analysis in 6 steps

Before we dive in, it’s worth noting that every market opportunity analysis is slightly different. It depends on the new business opportunities you’re hoping to uncover with this type of research project.

Before considering the market opportunity assessment points we’ve laid out in this article, set some internal goals for your market opportunity analysis.

- What do you hope to achieve by doing the analysis?

- Is there a particular question you need answers to?

Answer these questions first. Then you can explore the specific points you need to focus on to get you to the answers you need.

1. Track brand awareness and brand knowledge

First and foremost, identifying new market opportunities comes from understanding how your brand is perceived and recognized within that market.

Brand tracking can help your team get an idea of general brand sentiment, campaign effectiveness for anything you have running. It can help you understand how your brand lines up alongside competing brands.

A few metrics to measure when doing brand tracking:

- Brand sentiment & awareness

- Product awareness

- Logo recognition

- Campaign effectiveness

- Competitor recognition & sentiment

2. Conduct a competitive analysis

Competitive market analysis can help you understand why a competitor is even a competitor in the first place. Done well, it’ll help you tweak your product messaging and value proposition and evolve your product life cycles or features. It can also provide you with some growth benchmarks to pitch your efforts against.

Things to consider when planning a competitive market analysis:

📌 Pinpoint who your competitors are (direct & indirect) and the products they offer.

📲 Go through your competitor’s sales process: note pricing, tactics, and promotions they offer.

👀 Analyze your competitor’s distribution channels and engagement, including social media channels like LinkedIn, Instagram, Pinterest, and TikTok. Look at email, blogs, videos, podcasts, and anything else they use in their content marketing strategy.

🏃♀️ Run an SEO audit on your competitors; Moz has a great free tool for this called Link Explorer.

👍 Get an idea of the general brand sentiment using online reviews and questionnaires.

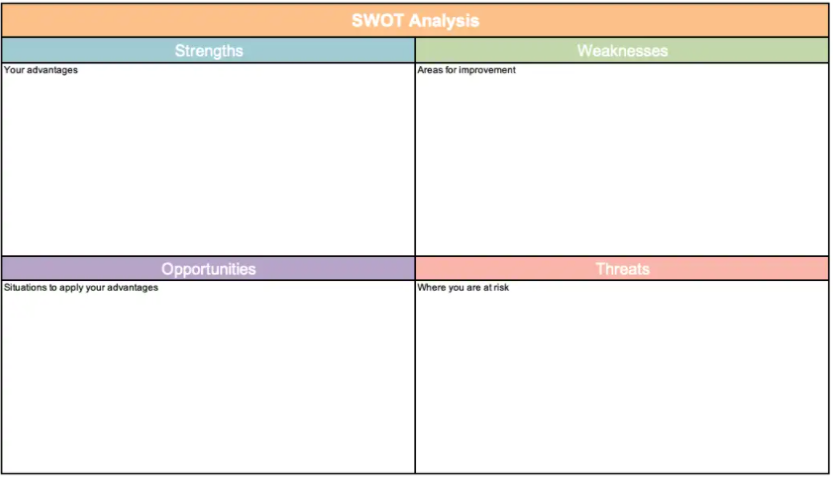

🔬 Use a SWOT analysis to accumulate your data.

At this point, you can also consider indirect competitors. Indirect competitors are those businesses that are not offering exactly what you’re offering but whose product may affect yours in another way.

For example, if your product were a photo-sharing app that integrates with messenger apps, your indirect competition would be those messenger apps (for more on this, take a look at our guide to competition mapping).

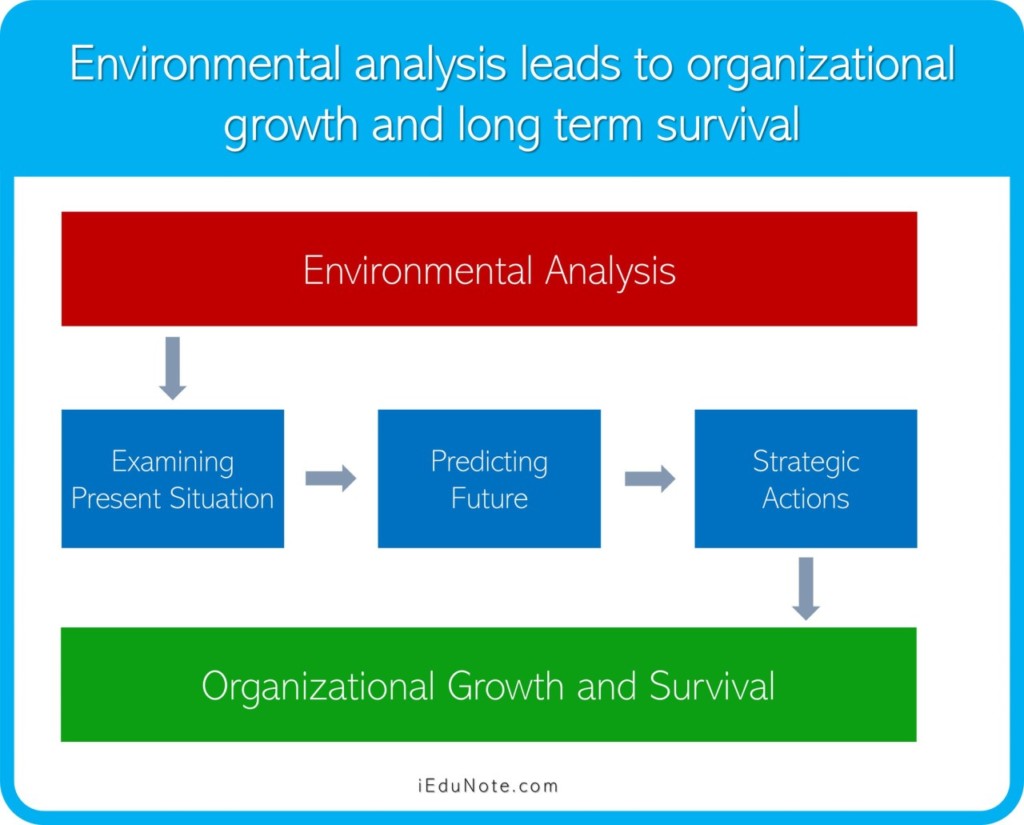

3. Consider an environment analysis

What is environment analysis?

You can execute an environment analysis in two ways. Internal and external.

Internal environment analysis

An internal environment analysis considers your immediate business environment and internal factors that affect work output, resources, and processes. It can be anything from new technology developments, culture shifts, or new roles/teams entering the business.

External environment analysis

An external environment analysis considers anything that affects your potential customers and how they interact with, view, and use your product.

An external environment analysis, again, can be advancements in technology. However, it can also be things like seasonality, pop culture, new laws, and so much more. Think about things that affect the product that you can’t control. How can your business adapt to them?

4. Identify new product opportunities

There are plenty of opportunities out there that a little international research can highlight for your team—at a low-risk. Rather than spending money on advertising campaigns, or pushing sales in markets that simply aren’t ready or in need of your product, first, consider asking that market if they would be interested in your product.

By conducting international research, perhaps you’ll identify new markets, languages, demographics, or personas that are a surprising fit for your product.

You’ll also be able to pinpoint new features or product upgrades that you can introduce to make your product more usable for a particular market segment. Talking of segments…

5. Work on consumer segmentation

If you’re hoping to build a global brand, there’s no doubt you will be selling to different target markets. That doesn’t mean you need to change your product depending on who you’re selling to. What it does mean is that you’ll need to change your messaging and your route to market.

Different categories of people will have different problems and place greater importance on specific product features.

How can you sell the same thing to everyone, but in a slightly different way? How can you know what resonates with a particular audience? This is where consumer profiling and market segmentation come in.

If you ask the right questions to the right people, your market opportunity analysis will allow you to segment your user base into personas, and identify the market potential on a case by case basis.

These personas will then help you build a tailored market strategy and sales funnels, as well as increase your conversion rates along the way. It’s not always about identifying new markets, but determining how to better sell to those you are already in.

6. Spend time on pricing, forecasting and sales

Last on the list for conducting a market opportunity analysis for business growth is doing a cost analysis. You should have a good idea of average price points from your competitor analysis; however, there are a few more things you’ll need to take into account.

First up, and probably the most obvious, is your margin. How much does your product cost to build and maintain? Take into account resources, time, business expenses, the works.

Once you have the average cost per product build and maintenance, you should align your profit margin to what’s competitive against competing brands and gives you enough profitability to work with for the future.

Secondly, you’ll need to take into account forecasting.

- What’s coming up that your business needs to prepare for?

- Are you working toward a new feature that will take a great deal more financial resources than your product does now?

Consider what’s in the product pipeline and the costs you’ll need to forecast for in the future.

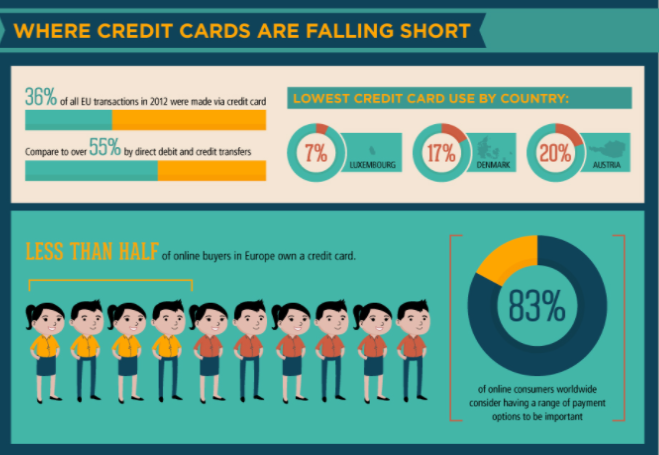

Lastly, sales. You’ll have an idea of how to sell—functionally—from your competitors. However, it’s good to find out how your customers are used to purchasing.

- Does your product need to be paid for in installments or on a monthly plan?

- Is it better off with a discounted yearly fee?

Dive deep into the details.

- Do your customers need invoices?

- Do they prefer to pay with PayPal, Apple Pay, debit card?

Figure out how you can make the process of buying your product as inclusive as possible for your customers and eradicate any barriers.

Make the process a regular practice

No matter what your business model is, a market opportunity analysis is an essential step to every successful business plan. It can give you that competitive advantage you need, help you meet existing and future customer needs, and spurr on critical decision-making.

It’s also not a one-trip pony. Think of this process like a case study or white paper, and repeat the process every 6-12 months to ensure you’re ahead of your game.

No doubt new competitors will crop up, as will better supply chains, technologies, and lots more that could affect your business. You’ll need to stay on your toes if you want to stay ahead.

And – crucially – the market opportunity analysis is useless if you don’t build initiatives into your marketing strategy based on the learnings. Prioritize each initiative in your business growth roadmap. What’s low risk and high reward? Start from there and work your way through them.

Tying it all together

What’s important to remember with any market opportunity analysis is that they’re carried out to be acted upon. It’s a huge amount of research to be doing only to have it sit as research. Read your data and translate it into actions your team can take to create a better brand, product, and business.

See what Attest can do for you

Speak to our team to understand how we can help you to get high quality insights from your target audiences, fast.

Book a demoTell us what you think of this article by leaving a comment on LinkedIn.

Or share it on: