Brand tracking helps you spot changes in your brand's health, awareness and perception—and gives you the insights to understand why these changes are happening.

Introduction to brand tracking

Brand tracking is a way to continuously track the development and progress of your brand or a competitors’ brand.

What is brand tracking?

You do this by consistently monitoring a number of key metrics, like Net Promoter Score (NPS) or levels of brand awareness and brand perception. These metrics help you assess how healthy your brand is.

What do we mean by a ‘healthy brand’? According to brand leaders, healthy brand is one that comes to mind when target consumers think about products in your category. It’s a brand they think highly of and would recommend to others.

By asking target consumers a core set of questions on a regular basis, you can determine whether your brand is becoming more or less healthy over time.

Most brands check in on their brand health once a month or once a quarter. This lets them link the shifts to specific campaigns or actions that moved the needle

What can brand tracking help you do?

You can use the insights you collect from brand tracking in loads of ways.

Help you direct your marketing strategy and spend

Spot downward (or upward) trends immediately and tackle them quickly

Measure the effectiveness of ad campaigns

Benchmark your brand against competitors

Keep an eye on your brand’s overall health

Track and inform your brand’s messaging and positioning

Discover your biggest brand advocates

What metrics does brand tracking give you?

You start your Brand tracking by defining a core set of questions to ask consumers.

The first survey you run is designed to take baseline measurements and repeated at regular intervals (often timed around specific actions like ad campaigns) to track changes.

Here are seven core metrics you can measure with brand tracking:

1. Unprompted awareness

What is it?

This helps you understand how deeply your brand is embedded in the consumer psyche. You might sometimes hear this referred to as unprompted recall.

How do you do it?

To gauge unprompted awareness, you ask survey respondents to give open text answers, meaning there is no predefined list to potentially influence their response.

Why should you do it?

Good unprompted awareness is what many brands dream of—it’s a sign that you’re a real leader in your category. It can be very hard for challenger brands to win share of mind from well-established incumbents, but small gains here can be super meaningful.

2. Prompted awareness

What is it?

This is when people recognise your brand name or logo from a list of similar brands. Even if your unprompted recall is low, prompted awareness—sometimes called prompted recall—can help put things into perspective.

How do you do it?

You ask consumers a question such as, ‘Which of the following snack brands have you heard of?’, then provide a list of brands that includes yours and some key competitors.

For prompted awareness questions, some people might say they’ve heard of brands when really they haven’t (this is often called overclaiming).

Here are a couple of simple ways you can avoid this:

👉 Add a message card to the beginning of the survey making it clear that there are no right or wrong answers and people should answer completely honestly.

👉 Put an unprompted awareness question before the prompted one. This should get respondents thinking about the brands they genuinely recall.

👉 Use a broad spread of brands for your prompted answers, including a couple that you know have high awareness.

Why should you do it?

Prompted awareness is a super important indicator of where your brand sits in your category and when placed alongside competitors.

3. Brand perception

What is it?

Brand perception describes insight into what consumers think about a brand or service, rather than what a brand says about itself.

How do you do it?

To learn your brand perception you could ask questions like ‘Which of the following feelings do you associate with [Your Brand]?’ Some brands also include their Net Promoter Score (NPS) question in their brand perception research.

Why should you do it?

Good brand perception projects add a lot of color to your overall brand tracking research. It often goes deeper than more traditional brand awareness research because it gives you a better sense of what consumers feel about your brand—this is super important for working out purchase intent.

4. Logo recognition

What is it?

Is your brand memorable? And how does it compare with your competitors? This is what you’ll find out with a logo recognition question.

How do you do it?

You show consumers a selection of brand logos in one category and ask them to select the ones they recognise.

Why should you do it?

This metric will tell you how memorable your branding is and how likely your products are to be recognised on the shelf alongside other brands.

5. Purchase intent

What is it?

People are aware of your brand—great! And they love your branding—fantastic! All of this is meaningless unless it translates into purchase intent—this is how likely they are to actually buy your product or service.

How do you do it?

Here you’ll ask something like Which of these brands, if any, would you consider purchasing from in the next 12 months?

Why should you do it?

Knowing whether or not positive feelings about your brand translate into sales is super important. If they do, then you’ll have figured out which customer segments are valuable to you. If they don’t, that tells you there are areas you can work on—you can dig into the reasons people don’t buy from you in some follow-up research.

6. Brand loyalty

What is it?

Are customers planning to stick with your brand in the future? That’s what you’ll try to figure out with brand loyalty research.

How do you do it?

This metric comes from combining purchase history with purchase intent. Looking at how likely those who have bought from you before are to buy from you again helps you start to measure brand loyalty

Why should you do it?

Getting customers to the checkout is one thing, getting them to come back to the checkout next time is a different ball game. Working out your brand loyalty helps you on your way to building commercially sustainable customer relationships.

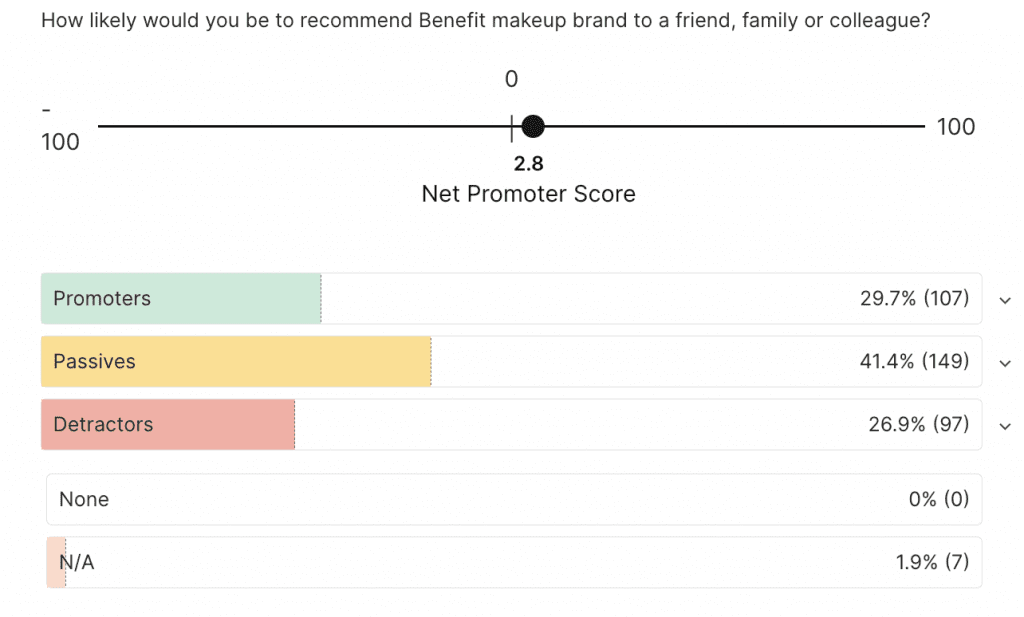

7. Net Promoter Score (NPS)

What is it?

NPS gives you a quick snapshot of the general sentiment towards your brand.

How do you do it?

You ask respondents a single question: On a scale of 0 to 10, how likely are you to recommend this brand to a friend. Based on their rating, customers are then classified as either brand detractors (those who rated from 0-6), passives (those who rated a 7 or 8) or promoters (those who rated a 9 or 10).

Your NPS is determined by subtracting the percentage of customers who are detractors from the percentage who are promoters. The results are expressed as a number, which can range from -100 to 100.

Why should you do it?

What qualifies as a ‘good’ NPS score varies according to industry. For example, the education sector has an impressive average of 71, while for financial services the average is 34. Regardless of the number you’re benchmarking against, any uplift in NPS is a good way to know if your marketing, product and sales strategies are having an impact.

Here’s a great example of an NPS question in the wild…

The Consumer Research Academy is brought to you by the Customer Research Team—our in-house research experts. Any research questions? Email or chat with the team.